Hero - MSCI High Dividend Low Volatility Indexes

MSCI High Dividend Low Volatility Indexes

Social Sharing

Intro - MSCI High Dividend Low Volatility Indexes

What are the MSCI High Dividend Low Volatility Indexes?

MSCI High Dividend Low Volatility (HDLV) indexes are designed to contain a fixed number of liquid securities with sustainable and persistent high dividend yield, while aiming to keep volatility of the indexes low.

Why should you consider MSCI High Dividend Low Volatility Indexes?

Price return versions of HDLV indexes could be used for structured products, as high dividends and low volatility may allow for more attractive pricing. Total return versions may offer improved risk-adjusted return vs benchmark, through increased dividend pay-outs and lowered risk (as measured by volatility).

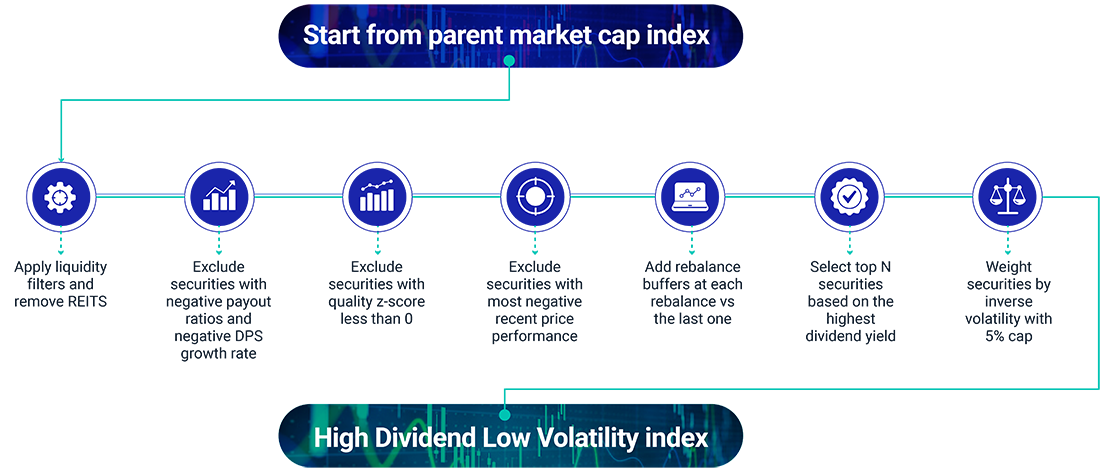

How are the MSCI High Dividend Low Volatility Indexes constructed?

For each region / country, simplified construction process can be illustrated as follows.

Larger global indexes (e.g. world, ACWI) are constructed by combining regional indexes as described above.

MSCI High Dividend Low Volatility Indexes offerings:

Related content - MSCI High Dividend Low Volatility Indexes

Related content

Methodology Book

MSCI High Dividend Low Volatility Indexes are designed to represent the performance of a fixed number of securities with high dividend yield and Quality characteristics.

Download(PDF, 271 KB)

Markets in Focus: Investors Look to Capture Big Market Shifts

Global equities and bonds declined in 2022 against a surge in inflation, waning economic growth and monetary tightening. We highlight how factor indexes, country allocation and thematic investing can help investors capture opportunities with greater precision.

Read more