Hero - PSI

Portfolio Sustainability Insights

See the bigger picture. Manage your transition. Find Opportunities

Intro - PSI

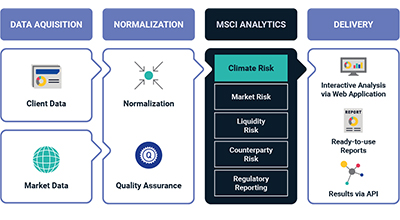

Sharpen your view of climate risk and get the support you need in a rapidly changing world. Backed by MSCI's decades of experience shaping sustainable finance, MSCI Portfolio Sustainability Insights (PSI) was built to empower compliance, sustainability and risk leaders at every stage of their climate journey. PSI makes it easy to capture an integrated, enterprise view of climate risk exposure, view progress against TCFD/ISSB regulations, and align with regulatory and disclosure requirements more efficiently.

Key benefits - PSI

Key benefits

Align with Evolving Regulatory Requirements

Leverage extensive solutions to navigate the complexities of climate-focused regulations and TCFD/ISSB reporting requirements. Align with the latest TCFD/ISSB standards, supported by continuous updates as regulations evolve.

Efficiently Track and Manage Progress

Utilize intuitive dashboards to monitor historical and forward time series data, benchmarks, and issuer targets. Effortlessly track your portfolio's climate transition journey and align with global standards and TCFD requirements.

Data-Driven Results: Where and How You Want It

Leverage MSCI’s curated data model to access your results directly in Snowflake or any downstream integration tool to maintain your own processes. Quickly pull information into your own enterprise data warehouse or proprietary systems at scale.

Centralize your climate data

Integrate diverse data sources across managers, strategies, and asset classes into a unified platform. Gain an enterprise-wide view of your climate exposure to assess your organization's standing and align portfolios with net-zero targets.

How - PSI

How Can Portfolio Sustainability Insights Help You?

PSI doesn't just track your Portfolio’s Footprinting and Climate risk -- it helps you understand where your emissions and climate risk are coming from. PSI empowers you to dissect data and drill down by metrics like issuer, asset class, sector, and more. Gain visibility to assess and analyse climate risk so you can identify opportunities. PSI allows you to see exposures through many different levels, including:

-

Carbon Footprinting

View a portfolio's exposure to financed carbon emissions and financed carbon intensity broken down by scope and asset type. Uncover carbon-intensive hotspots in portfolios to take action and minimize exposure to riskier assets, reducing portfolio climate impact.

-

Financed Emissions Attribution

See to what extent changes in a portfolio's carbon footprint are due to companies' real world decarbonization efforts, a portfolio manager's investment decisions, or changes in companies' financing.

-

Position Analytics

Drill down to gain visibility across position level and issuer sector analytics for financed emissions, carbon transitions, and fossil fuel and green revenue across sectors.

-

Total Portfolio Footprinting

Understand and baseline your financed carbon emissions associated with your investments, so you can monitor progress and communicate with stakeholders.

- Covering 4m+ Securities*

- 18K+ Corporate Issuers*

- 60k+ Private Companies*

- Equities and Fixed Income

-

Climate Related Risk and Transition Risks and Opportunities

View a multi-asset class view of a portfolio's exposure to climate-related risks and opportunities. Explore physical and transition risks using MSCI's forward-looking Climate Value-at-Risk model and a range of climate scenarios.

-

Enhanced user experience

Provisions a single interface to visualize risk across dimensions and across time including limits monitoring.

Accessible via MSCI ONE, or data delivered via Snowflake and APIs to store internally and use in internal analysis, we're making climate data and insights more accessible to your entire organization.

Contact - PSI

Related content - PSI

Related content

Climate Investing

MSCI offers a suite of tools to help institutional investors benchmark, measure and manage portfolio exposure to climate risk, identify low carbon investment opportunities, and support investors seeking to set a net-zero target.

Learn moreThe MSCI Net-Zero Tracker

Our periodic report on progress by listed companies to curb climate risk and close the gap between current climate ambition and a net-zero economy.

Read moreNavigating the Climate Transition

Sharpen your view of the risks and opportunities of the climate transition with our latest research-based insights.

Explore moreFootnotes - Portfolio Sustainability Insights

- * As of June 2024.

- Screens shown for illustration purposes only and not to be used for business purposes.