Hero banner - Direct Indexing

Direct Indexing

Built to simplify investing and catalyze growth

Social Sharing

Intro - Direct Indexing

Equipping wealth and asset managers with ability to deliver personalized indexes and portfolios at scale

Our direct indexing tools and capabilities are designed to help you satisfy your clients' unique needs, whether related to reducing carbon emissions of their portfolios or customizing their tax objectives. And we allow you to decide how much support you want based on your goals and desired level of detail.

Contact - Direct Indexing

How does it work - Direct Indexing

How does it work?

-

What you gain

- Scalable customization and means to simplify investment experience

- More control over your response to your client's unique investment aspirations and outcomes

-

How your clients benefit

- Greater transparency, choice and tax optimization opportunities in your offerings

- Ability to express personal ESG and climate views you tailor for them

Explore this top-down investment approach that capitalizes on opportunities created by macroeconomic, geopolitical and technological trends.

With direct indexing, you enable your clients to directly own individual securities as part of an index-linked separately-managed account that you tailor for specific outcomes. At MSCI, we can deliver client-designed indexes that use criteria you set to incorporate your clients’ needs. You also can leverage our full toolkit of standard indexes, optimization tools, risk models and reporting.

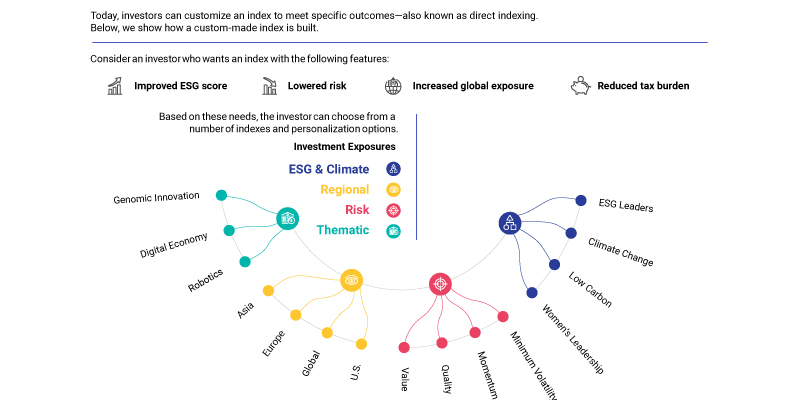

You can provide personalized advice to an investor interested in, for instance, improved environmental, social and governance (ESG) scores, lowered risk, increased global exposure and reduced tax burden by using several MSCI capabilities such as our indexes, optimization and ESG solutions.

Featured content - Direct Indexing

Featured content

Breaking Down the Direct Indexing Investment Process

In this paper we focus on aspects of the wealth manager’s implementation of direct indexing as well as options for tax optimization and the use of fractional vs. whole shares.

Why MSCI - Direct Indexing

Why MSCI?

You can use our solution to strengthen your direct indexing capabilities to help you attract and retain assets. We want you to gain a deeper understanding of how you think about your clients and assess their investment needs, ultimately accelerating your growth by becoming a more sophisticated adviser that can offer personalized portfolios.

With the operational capacity to calculate over 273,000 daily indexes,1 MSCI possesses the core infrastructure to support a client’s personalized requests. MSCI’s direct indexing solutions leverage data from MSCI ESG Research, with hundreds of global ESG and climate research analysts.2

For wealth managers and asset managers who want to offer more choice, we deliver portfolio construction tools to enable you to tailor your client’s exposures to specific tax objectives and implement unique portfolio requests.

Advisers can use the MSCI EAFE Expanded ADR Index, covering over-the-counter and listed securities equal to over 70% of the market capitalization of the standard MSCI EAFE index, to create a personalized international portfolio of US securities for US investors.

MSCI also:

-

Has been integrating ESG content into MSCI indexes since 1990, when we launched the MSCI KLD 400 Social Index, the world’s first socially responsible investing index.

-

Retains an ESG research team that includes experts across country, sector, factor, ESG, climate and thematic indexing.

-

Seeks to empower portfolio managers with a solution to help them achieve economically meaningful results for their clients.

-

Offers products powered by a leading multi-factor model.

Contact - Direct Indexing bottom

Related content - Direct Indexing

Related content

Indexes

From foundational broad market to customized outcome indexes, our time-tested, globally consistent solutions power indexed strategies and products for investors.

Learn moreThematic Investing

Characterized as a top-down investment approach that capitalizes on opportunities created by macroeconomic, geopolitical and technological trends.

Explore moreFootnotes - Direct Indexing

1As of May 31, 2022. *Index count at a variant level, includes one currency per variant.

2As of March 31, 2022.