Hero 2 - Private Capital Indexes

Intro - Private Capital Indexes 2024

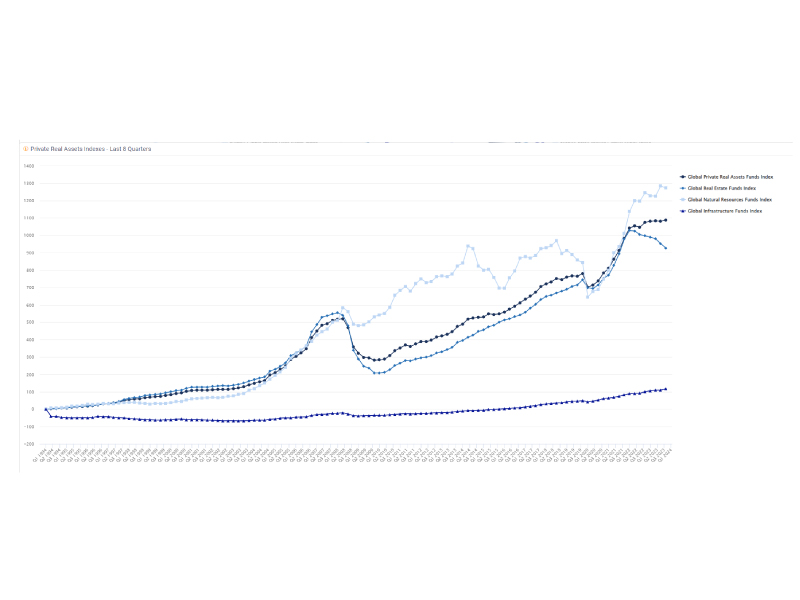

Indexes designed to help you make more informed, more confident decisions

MSCI Private Capital Indexes are designed to cut through the complexity of private assets, and to provide clear, precise, and unified performance insights. Our indexes span the spectrum of private asset classes, powered by MSCI's transparent, standardized methodology and our extensive, research-quality dataset.

Numbers - Private Capital Indexes 2024

-

200+indexes

-

15k+funds

-

$13tn+AUM1

Videos - Private Capital Indexes

Navigating private markets with MSCI

Navigating private markets with MSCI

Setting the standard in private asset benchmarking

MSCI’s broad private assets coverage

Bringing transparency to private markets

Why speed matters in private markets

Private markets need independent insights

-

Navigating private markets with MSCI

How can investors navigate the growing complexity of private markets? MSCI’s breadth and depth of data, sourced directly from LPs, provides the clarity needed to assess risks and make informed decisions.

Transcript (PDF, 18 KB)

-

Setting the standard in private asset benchmarking

Private asset benchmarking is critical for investors. As private markets continue to grow, learn how MSCI’s innovative indexes provide the clarity investors need to navigate rising challenges and drive informed decision-making.

Transcript (PDF, 18 KB)

-

MSCI’s broad private assets coverage

How can investors better navigate private markets? MSCI’s analytics—built on data representing over USD 11 trillion in capitalization—deliver the standards and insights essential to understanding these complex markets with confidence.

Transcript (PDF, 18 KB)

-

Bringing transparency to private markets

When making asset allocation decisions, access to unbiased insights is essential. Find out how MSCI’s impartial, high-quality data and analytics can bring clarity and set a new standard in private markets – helping you make confident investment decisions.

Transcript (PDF, 18 KB)

-

Why speed matters in private markets

In private markets, rapid growth and fierce competition mean that timely access to data is essential. Learn how MSCI’s commitment to speed and accuracy can help investors stay ahead.

Transcript (PDF, 18 KB)

-

Private markets need independent insights

Mastering private market data can unlock long-term competitive advantages, but it requires a trusted, independent source. Discover how MSCI can provide the high-quality insights investors rely on to navigate complex private markets.

Transcript (PDF, 18 KB)

Benefits - Private Capital Indexes

Commitment to quality

Transparent, standardized, and rigorous, we aim for consistency and reliability.

MSCI's transparent and standardized methodology is designed to allow clients to understand how benchmarks are constructed, and therefore to enhance confidence in performance evaluations.

Some of the world’s largest pools of capital leverage our benchmarks across the spectrum of geographies, industries, and private assets strategies.2

Breadth of coverage

Our range of indexes are designed to cater to the full spectrum of your private asset allocations.

- Investment data encompassing over $11 trillion in capitalization and more than 13,000 funds, including over 130 closed-end fund indexes covering private equity, debt, natural resources, and venture capital.

- More than 80 performance indexes spanning direct real estate investment, REITs, listed real estate, real estate funds, and real estate debt.

Tailored to private capital

You need an index provider with the industry expertise necessary to create relevant benchmarks

We enable precise benchmarking because our indexes are designed to reflect the unique characteristics of each private asset class. Our indexes ensure relevant comparisons tailored to your specific market segments and strategies.

Download brochureContact - Private Capital Indexes

Use cases intro - Private Capital Indexes 2024

Use cases

Use cases - Private Capital Indexes 2024

Limited Partners

Limited Partners

General Partners

Our indexes are designed to help:

- Inform your asset allocation to asset classes and individual managers

- Compare your performance against the broader market and against peer groups

- Assist in meeting obligations based on the strategic goals of stakeholders

We meet you across the range of asset classes relevant to your strategies.

Our indexes are designed to help:

- Present your track record for fundraising

- Assess the risk-return characteristics of your own investments against the universe of peer funds and strategies

- Ease the data management and scale needed for your benchmarks

Related content - Private Capital Indexes 2024

Related content

Footnotes - Private Capital Indexes 2024

- 1 As of September 30, 2023.

- 2 Eight of the ten largest private equity investors globally use our data and services as of December 2023.

- 3 As of June 19, 2024.