MSCI Global Intel header

MSCI Real Estate

Global Intel

Unique data, Real insight

Unique data, Real insight

Real estate is going mainstream. Over the last two decades, it’s moved from alternative to a growing and significant proportion of allocation. Real estate is different. Some investors may use it to perform a very specific role within a diversified portfolio. It’s also opaque, especially in private real estate. As a result institutional investors may find it increasingly important to use the very best data to inform their investment strategy, allocation choices and performance decisions. And, for multi asset investors, it may also be increasingly important to use tools that analyse relative to other asset classes.

MSCI Global Intel is designed to provide insights into real estate data that are consistent and comparable, robust and tailorable, constantly evolving and objective. It is one of the most extensive private real estate databases in the world designed to provide you with a unique level of transparency.

MSCI Global Intel: unique data, real insight.

Request more information

MSCI Global Intel video

MSCI Global Intel

Watch the video to learn more about Global Intel

Global Intel parallax 1

Unique data, Real insight in action

Unique data, Real insight in action

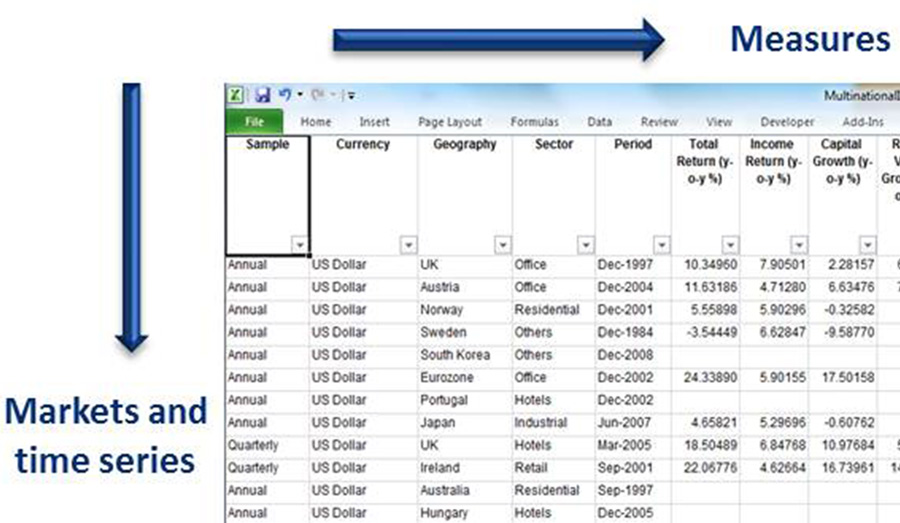

Getting a return from private real estate often demands understanding the complex intersection of a range of different risk factors. MSCI Global Intel measures the total return and the different elements that drive it. It does so using a globally consistent database, it’s comparable and provides a robust series of features and benefits. It’s a unique database, providing real insight of real assets.

Consistent and comparable – we have a consistent database and a consistent methodology across all the markets we operate in. MSCI Global Intel encompasses 80 comparable measures globally, providing like-for-like comparisons across different geographies and property types. In an asset class defined by its very different standards, practices, valuation policies of different markets across the world, this can be a significant resource for clients. We’ve standardised our measurement definitions, to allow you to compare like-for like when carrying out a global analysis. Whether you want to determine how your portfolio is positioned from market to market, or you’re trying to understand how you’re performing relative to the market as a whole (or to other asset classes), or you want to attribute your historical performance to future trends, MSCI Global Intel is designed to help you.

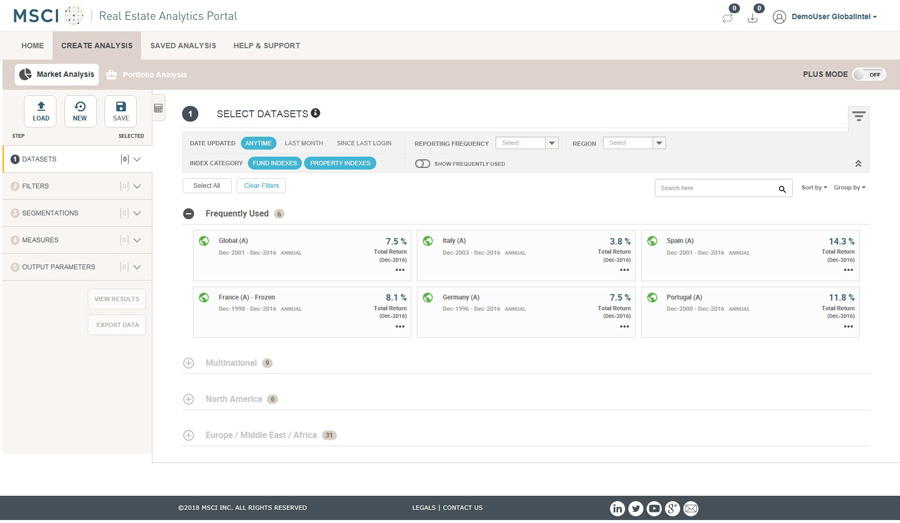

Robust and tailorable – our database spans $2 trillion of private real estate assets, across more than 30 countries, over 18.5 years (on average1). It is built on the key indicators of its underlying assets of real, settled private real estate investments. It is not survey-created, reliant on goodwill or a by-product of another service, but collected from the actual performance of assets. The information is reviewed by our specialists and delivered through our platform. It is one of the most extensive private real estate databases in the world. We preserve the specific characteristics of different markets across the world, whilst maintaining underlying consistency. You can review multiple segmentations or custom build something that meets your needs. It allows you to not only understand what’s happened in the market, but also why. You can create an analysis to test an assumption, refresh it, adapt it and save different versions of it, so you can spend more time learning from it and adding value.

Constantly evolving and objective – the world that you operate in doesn’t stand still and nor do we. We are constantly evolving and innovating to incorporate advancing technology and meet the needs of a changing landscape with data collated from actual performance of assets.

Unique transparency – in the opaque asset class of private real estate, MSCI Global Intel aims to provide insights that are consistent and comparable, robust and tailorable, constantly evolving and objective.

Download the MSCI Global Intel factsheet

Download the MSCI Global Intel measures guide

1 Based on 2018 year-end figures of msci real estate

Global Intel Parallax 2

Unique data, Real insight whoever you are

Unique data, Real insight whoever you are

We have a client oriented mind-set, and we’ll work with you to understand how MSCI Global Intel can help you meet your needs and continue to.

Institutional investors often need to make informed allocation decisions, understand risk and monitor performance. Whether using your own platform or ours, we can help. From a regulatory perspective, we can help you in your efforts to place a value on risk.

Asset managers often want to inform their allocation selection, to create the desired return, against the relevant risk profile on behalf of their clients. Our extensive and objective data can help you plan for different scenarios and build your business case.

Banks typically seek to understand the value and risk of the asset for which they are providing the senior lending. Our data is tailored to segment and evaluate the market in a variety of ways.

Custodians may need to inform portfolio performance measurement and monitoring. Our unique database may be used for benchmarking and providing market figures for comparative data and relative performance.

Investment consultants may use our databases to cross-check their own data, inform their monitoring process and advise on and validate investment decisions.

Global intel content separator

Unique data, Real insight for your needs

Unique data, Real insight for your needs

Subscription provides access to our unique database and a wide range of services. You’ll also have a dedicated client services representative who will work to understand your needs and help you to get the most out of your chosen level of subscription.

Click on the headings to learn more about the three levels of analytics:

MSCI

MULTINATIONAL

INTEL

MSCI

MULTINATIONAL

INTELMSCI GLOBAL

INTELMSCI GLOBAL

INTEL PLUS

Real estate country and regional indexes and sector data with access to headline performance, market fundamental and investment metrics.

A granular dataset of more than 1,000 direct property indexes and 16 fund indexes tracking property type, location and asset-specific characteristics.

Ability to query MSCI Global Intel’s unique dataset using filters such as property type, location and asset-specific characteristics allowing for standard and highly customised segmentations.

Subscription levels in more detail

Subscription levels in more detail

|

|

MSCI Multinational Intel |

MSCI Global Intel |

MSCI Global Intel PLUS |

|---|---|---|---|

|

DATASET |

|

|

|

|

Direct Property Indexes |

44 | 1,000+ | 3,000+ |

|

Fund Indexes |

|

16 | 16 |

|

Lease data |

|

|

|

|

MARKET DEPTH |

|||

|

Countries |

32 | 32 | 32 |

|

Cities |

|

95 | 240+ |

|

Property Types |

6 | 120 | 120 |

|

Sample Filters |

3 | 3 | 7 |

|

Dynamic Segmentations |

|

|

|

|

ANALYSIS |

|||

|

Global Measures |

22 | 65 | 65 |

|

Local Measures |

|

25 | 25 |

|

Return Percentiles |

3 | 3 | 20 |

|

Currencies |

8 Local + Hedged | 8 Local + Hedged | 19 Local + Hedged |

|

PLATFORM |

|||

|

Analytics Portal |

Basic | Standard | Dynamic |

|

Data files over FTP/HTTPS |

|

|

|

Global Intel parallax 3

Global Intel Data Delivery - interactive asset

Global Intel Data Delivery

Global intel content separator 2

Global Intel additional resources

Additional resources

-

Blog: Have appraisers been too bullish on retail real estate?

Jul 30, 2019 Will Robson - Executive Director & Head of Real Estate Solutions ResearchMedia commentary has fixated on the shuttering of shops, while retail-focused REITs are priced at substantial discounts to the value of their assets. Have appraisers of retail real estate been excessively bullish?

Read the blog -

Research Paper: Valuations and sale price report

Jun 28, 2019 Hariharan G G - Vice President, Index Management Research | Girish Walvekar - Senior Associate, Index Management ResearchThis paper explores the following questions: How much do sale prices differ from previous valuations? Are differences random, or were sale prices consistently above or below the latest valuations?

Read the paper -

Research Paper: Global real estate performance in 2018

Jul 3, 2019 Bryan Reid - Vice President, Global Real Estate ResearchGlobally, income yields on private real estate assets remained at record lows in 2018, while technological disruption had a growing impact on retail and industrial property performance. Our annual report details the consequences for real estate returns, at a global and national level.

Read the paper -

Blog: Brexit, Black Wednesday and Real Estate's Currency Risk

Feb 25, 2019 Niel Harmse - Senior Associate, Global Real Estate ResearchInvestors who buy overseas real estate inevitably take on foreign-exchange exposure. Currency volatility can put currency risk in stark relief but also create attractive investment opportunities.

Read the blog

Resource Center - Global Intel

RESOURCE CENTER

Interested in Real Estate?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.