- As 10-year Treasury yields hit a low of 0.52% in August of 2020, yield-hungry investors had to look beyond the bond market. Non-traded private REITs proved to be an attractive vehicle to many of these investors.

- While asset values trended up from Q4 2021 to Q3 2022, the price component of the MSCI USA IMI Core Residential Real Estate Index had a 28% cumulative decline, with a further 0.2% decline from September to November.

- Media has focused on the announcement of capital gates at some high-profile non-traded private REITs. But negative news of redemption queues for these groups may be just the tip of the iceberg.

As recently as early 2022, many investment managers wanted their own non-traded-REIT structure. Groups with so-called net-asset-value (NAV) REITs in particular had enviable capital pipelines, with an ability to raise billions each month. While the combination of the tax benefits of ownership with regular appraisals and lower fees than other vehicles suitable for private investors remain, the future may not look as bright for these groups, as talk of redemption queues has grown in recent weeks. The challenges faced by these groups, though, are not unique, as the impact of stresses in the credit markets have hit investors in all private vehicles for commercial real estate.

It is a side effect

The medicine of low interest rates and easy money helped cushion the economic shock of the worst parts of the COVID-19 pandemic. Medicine can have side effects, however; and as 10-year Treasury yields hit a low of 0.52% in August of 2020, yield-hungry investors had to look beyond the bond market. Non-traded private REITs proved to be an attractive vehicle to many of these investors.

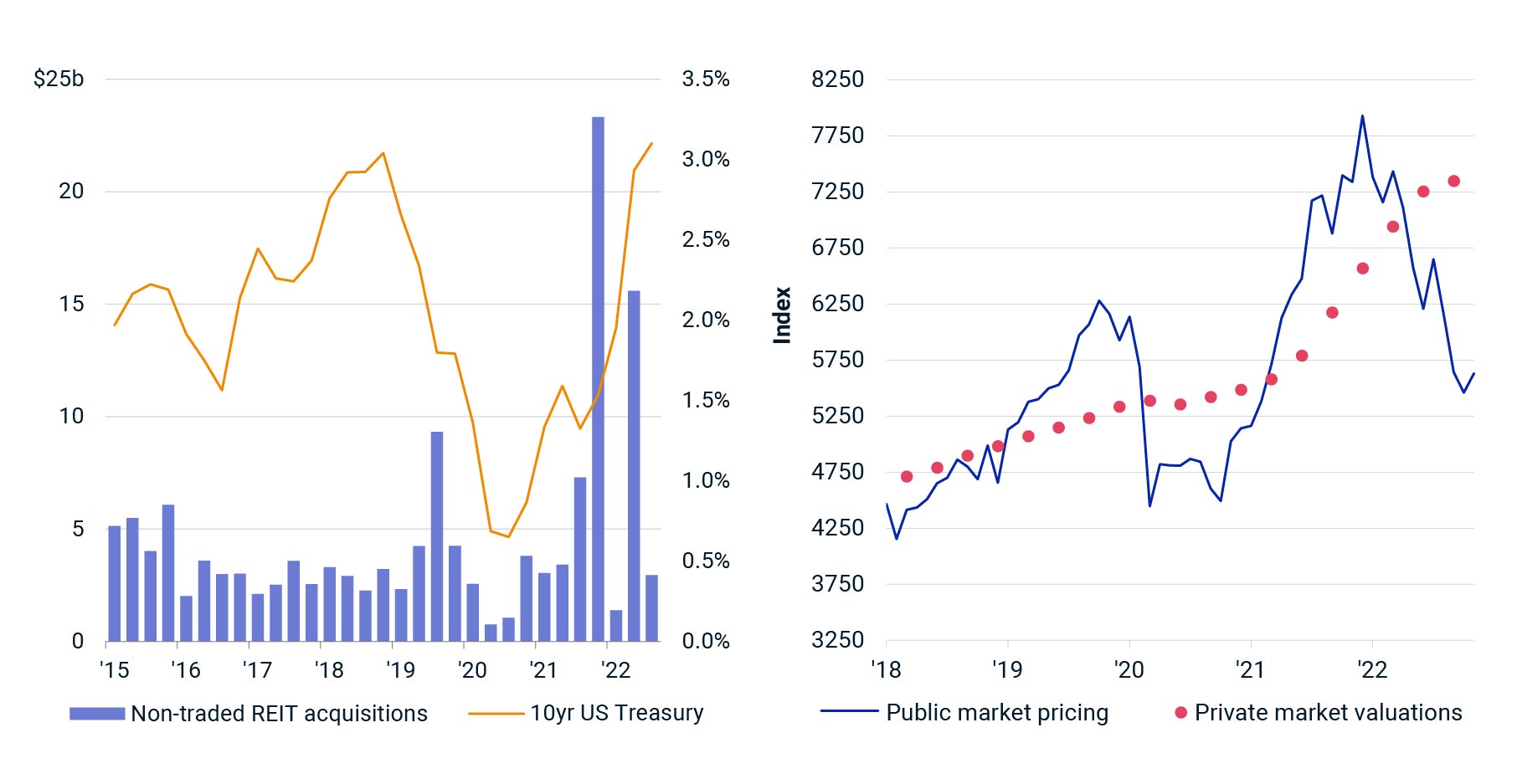

Non-traded private REITs accelerated the purchase of assets into 2020 given the capital that these groups had raised. In the five years before the pandemic, non-traded private REITs deployed an average of USD 3.7 billion per quarter in U.S. commercial real estate. Since the second half of 2020, this figure stood at USD 6.9 billion.

Acquisition trends for non-traded private REITs and public apartment REITs’ prices vs. appraised values

Public market pricing is represented by the MSCI USA IMI Core Residential Real Estate Index, and private market valuations by the MSCI U.S. Quarterly Property Index.

As mentioned above, raising capital was easier when investors were hungry for yield opportunities, and lower mortgage costs provided a leverage boost. As 10-year Treasury yields hover above the 3.5% level here in December 2022, investor expectations have started to change — but these changes have not yet been realized in appraisal values.

Appraisal methodology is the bigger problem

Appraisal methodologies in the U.S. are inherently backward-looking, with valuation professionals turning to sale comparables to help guide decisions. The MSCI U.S. Quarterly Property Index rolls up all these appraised values. Looking at the trend in asset values for residential only from the fourth quarter of 2021 to the third quarter of 2022, there was a cumulative 12% appreciation gain. A focus on residential is important as many non-traded private REITs are heavily exposed to apartments.

By contrast, the price component of the MSCI USA IMI Core Residential Real Estate Index has posted a 28% cumulative decline over the same time frame. The exhibit above shows the monthly trend for public REITs, made possible by the fact that price action is measured by the public markets on a daily basis. Public-REIT pricing continued to decline after the third quarter of 2022 with a further 0.2% cumulative decline in share price from September to November of that year.

Public-REIT pricing fell for the apartment sector, as investors marked down the value of these companies due to the higher cost of debt and lower leverage available as the credit markets became more challenging. Granted, public REITs often use more debt than private-market real estate, but seeing that trend in public REITs, investors in private real estate vehicles have become concerned that the next shoe will drop for them as well.

Market participants should not be focused on the news any individual firm, but rather the trend in price expectations and how that trend may change market behaviors. Valuations of all private real estate assets are being challenged with rising mortgage costs and a reduction in offered loans-to-value. In light of this change in expectations, some investors have looked to protect their downside risks and move capital out of vehicles where price declines were expected but not yet realized. The business press has been focused on the announcement of capital gates at some high-profile non-traded private REITs that have simply been transparent about the issues faced. The real story, however, may be that the negative news of redemption queues for these groups represents just the tip of the iceberg.

Further Reading

US Property Prices Fell in October from September

Global Real Estate Returns Turned Negative

A Correction in US Commercial Real Estate