- The U.S. market for offices has slowed, with sellers hesitant to take a loss and buyers sitting on the sidelines.

- Bringing volume back to long-term-average levels would require a drop in prices to pique buyer interest, our analysis shows.

- To return to normal levels relative to corporate bonds, office cap rates may need to go up 140 basis points.

The Pension Real Estate Association (PREA) and Urban Land Institute conferences in late October brought together capital sources and investment managers active in commercial real estate. The mood I gathered in conversations with market participants was cautious optimism, despite signs of economic challenges ahead. In discussions about where the market is headed, the big question was not whether prices for U.S. commercial property would decline, but rather, how much values would decline and how soon.

Challenges and caution

Even with pending economic challenges, it is hard to feel bad when one has not lost money yet. People at the PREA gathering in Washington, D.C., had to feel great as the MSCI/PREA U.S. ACOE Quarterly Property Fund Index was up 22% year-over-year in the second quarter of 2022. With those kinds of returns, somebody is earning a promoted interest, and the mood was positive. Still, there was that same combination of caution with a party atmosphere at the PREA conference in Los Angeles in February of 2020, on the cusp of the COVID-19 crisis.

Several factors are pointing to price declines in the quarters ahead. The MSCI US REIT Index already declined 30% from the end of 2021 to the end of September, as investors quickly updated estimates of the net asset value of these companies in response to the changing interest-rate environment. Pricing for real assets has only just started to show signs of decline, with the RCA CPPI for offices in central business districts down at a 2% annualized rate in the third quarter relative to the second.

Deal volume was the first shoe to drop in the market for U.S. commercial properties. From a third-quarter high of USD 218 billion in 2021, activity fell to USD 172 billion in the third quarter this year. Potential buyers and current owners have simply moved too far apart on price expectations. The downshift in deal activity for offices was more intense, with deal volume for the third quarter 33% below the level a year earlier. If buyers and sellers of offices are too far apart on prices to get the market to clear, how much would prices need to decline before deal activity could close again at normal levels?

A disconnect on prices

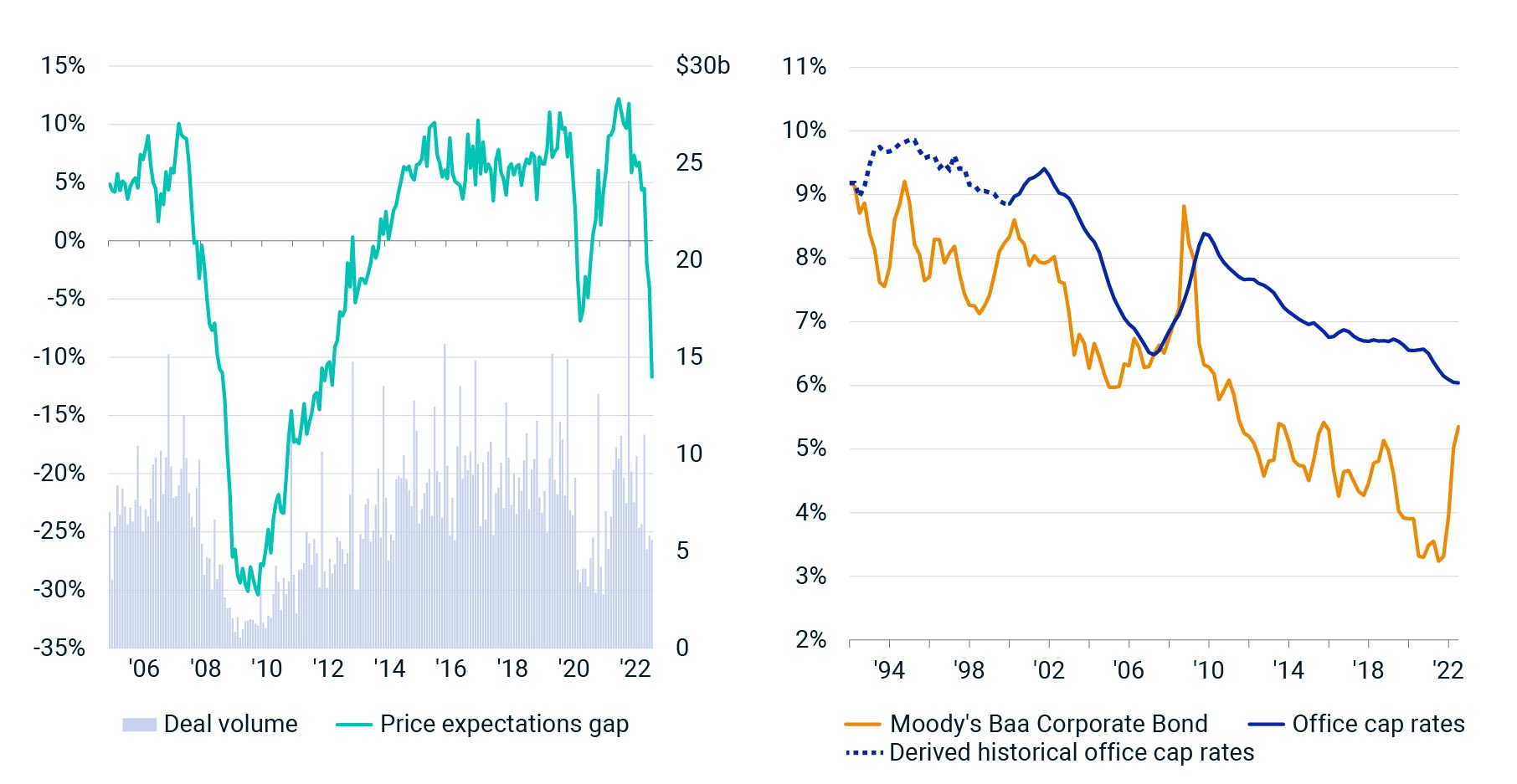

Following the methodology employed in a paper by Dorinth van Dijk, David Geltner and Alex van de Minne,1 the chart on the left shows that sellers needed to lower their price expectations for offices by 12% in September in order to raise deal volume to long-run average levels. (The deal volume shown in the chart represents individual asset sales to eliminate the noise of one-time events.)

Deal volume rises and falls as buyers and sellers each have a reservation price where they are willing to transact, with activity falling when those reservation prices move far apart. We calculate this disconnect on price expectations using a Bayesian, structural-time-series approach to determine the price adjustments necessary today to keep deal volume constant given historical trends in the supply and demand for real estate investments.

Two approaches to the outlook for prices of US office properties

Sources: Bank of St. Louis's FRED database, NCREIF, MSCI

Still, this measure is just a point in time and does not suggest that a mere 12% reduction in prices is going to get every building to sell. In the coming months, it could fall or climb as investor preferences change. The demand elements that go into this analysis suggest that buyers have already adjusted their price expectations downward by 18% since the start of the year, a decline that matches other data in the market.

Visiting with appraisal professionals over the last four months, I have always asked: “Have you started to mark asset values down?” Inevitably the answer is no. These experts note that they have not seen enough sales comparables to say with confidence that prices should move. There are other indicators that could be examined, however.

Cost of debt

A paper I worked on2 noted a relationship between the cost of corporate debt and cap rates. If corporate-bond rates are rising as investors become fearful that corporations may not pay back their debt as agreed, over time that same fear bleeds over into the assessment of a tenant’s probability of default on a lease. As shown in the chart on the right, over time as the Moody’s Seasoned Baa Corporate Bond Yield moves, cap rates tend to follow, with adjustments to transaction cap rates on a four-quarter lag.

The corporate-bond yield jumped from a low of 3.24% in the second quarter of 2021 to 5.35% by the third quarter of 2022. A rough calculation of the average spread between this measure of corporate bonds and our cap-rate measure stood at 205 basis points (bps) from 2012 to 2019. Cap rates for offices hit 6.0% in the third quarter; and if these measures were to move to the pre-pandemic relationship in the coming months, it would imply a cap rate of 7.4% or so, assuming no further changes in investor perceptions of risk in corporations. A 140-bp move in office cap rates would imply an 18% decline in office properties’ value at these levels, assuming no changes in income.

Getting the information flow

My public-market colleagues at MSCI have noted with some curiosity that the information flow in commercial real estate sometimes hinges on conversations at social events and the happenstance of whom one meets at conferences. The opacity of information in a market for a comparatively illiquid asset can make this sort of intelligence gathering necessary. Following such conversations among market participants about what buyers and sellers will and will not do may determine price adjustments in the private markets that were seen in the public markets months ago.

The author would like to thank Willem Vlaming for his contribution to this post.

1Van Dijk, Dorinth W., Geltner, David M., and van de Minne, Alex M. “The Dynamics of Liquidity in Commercial Property Markets: Revisiting Supply and Demand Indexes in Real Estate.” 2022. Journal of Real Estate Finance and Economics 64: 327-360.

2Chervachidze, Serguei, Costello, James, and Wheaton, William C. 2009. “The Secular and Cyclic Determinants of Capitalization Rates: The Role of Property Fundamentals, Macroeconomic Factors, and ‘Structural Changes.’” Journal of Portfolio Management 35 no. 5: 50-69.

3RCA Hedonic Series cap rates.

Further Reading

Price Growth for US Property Ebbed, Deal Volume Fell

Rent-Growth Expectations Shaped Returns for US Industrial Real Estate