Extended Viewer

Is Dispersion in Small Caps Linked to Selection Opportunities?

In principle, high dispersion in stock returns should create opportunities for active managers. One measure of stock dispersion is cross-sectional volatility (CSV). CSV is defined as the standard deviation of returns across stocks in a specific universe over a defined period. CSV has been viewed as a proxy for active managers’ potential to add value through their stock-selection process. For example, when stock-return dispersion, measured by CSV, has been low, stock prices have behaved similarly and offered fewer opportunities for active managers to outperform the market.

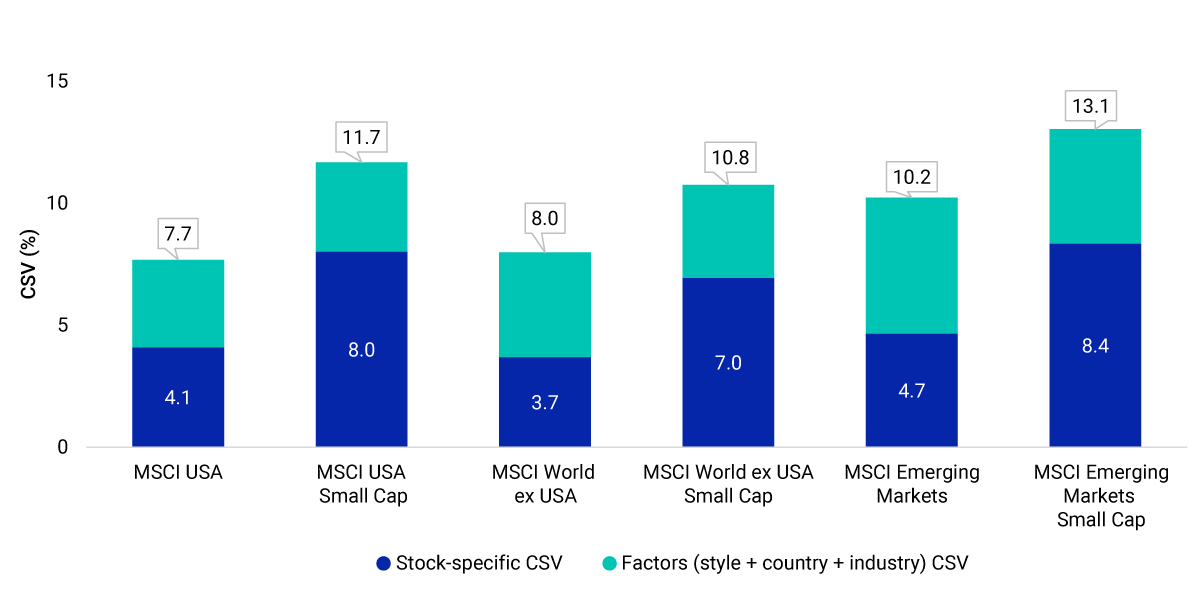

Our analysis, from 2002 through the third quarter of 2023, shows that across regions, as represented by the MSCI USA, MSCI World ex USA and MSCI Emerging Markets Indexes, CSV was higher in small caps compared to the larger-cap stocks in the parent indexes. Our finding indicates greater potential for active managers’ stock-selection strategies to bear fruit in small-cap stocks versus the large-cap and midcap segments of the equity markets.

We refined our assessment by stripping out systematic factors, such as style, country and industry, from the CSV calculation to derive a stock-specific CSV. The contribution of stock-specific CSV as a percentage can proxy the potential added value from security selection alone. In each region, we observed that stock-specific CSV has been higher for small caps than midcaps and large caps, indicating potentially more stock-selection opportunities for active managers within the small-cap segment.

Stock-specific CSV can proxy potential for added value from stock selection

Related content

Small Caps’ Big Story in China

The China A shares market has grown rapidly, along with the number of small-cap stocks. We compare a market-cap-coverage approach to index construction vs. a fixed-number approach and find the former more consistently captured small-size exposure.

Explore moreMind the Gap in Small- and Large-Cap Valuations

Unusually low small-cap valuations have prompted a role reversal between small caps and their larger-cap peers. Since 2021, they have had a lower forward P/E than large caps and, based on P/B, been consistently cheaper than the cheapest larger caps.

Learn moreSmall Caps Have Been a Big Story After Recessions

Some investors are already evaluating opportunities offered by a post-slowdown world. One of these opportunities is small-cap stocks, which have historically outperformed large caps, especially after recessions.

Read more