- U.S.-listed index and equity options were traded at record volumes in the first quarter of 2023, with maturities of less than a month accounting for 26% of total volume.

- Dispersion in sector performance and pressure on option market makers may have helped dampen market volatility, despite the banking crisis.

- We estimated the amount of futures needed to be bought (sold) for a 1% down (up) move in the U.S. equity market to be USD 16.5 billion based on April 2023 expirations.

2020 was an inflection point for the options market. Trading of U.S.-listed options rose significantly in volume during the global pandemic, and volumes have remained elevated ever since; they have more than doubled in 2022 as compared to 2019, as shown in the exhibit below. Additionally, over the last four years, investors gradually gravitated toward options with shorter maturities, from monthly, to weekly and now to daily options. Even more striking: Volumes in options with maturities of less than one day have doubled from 12.5% in 2019 to 24% in 2022. The gravitation toward short-dated options could reflect higher demand from yield-seeking investors (option sellers), given that short-dated options decay faster than longer-dated options, as well as intraday traders. This led some to wonder whether this could lead to greater volatilty in equity markets.

Investors gravitated in high volume toward short-dated options in the US

All U.S.- listed index and equity options from Jan. 1, 1996, to April 28, 2023. Source: OptionMetrics

Wide gap between equity and Treasury-rate volatility during the first quarter

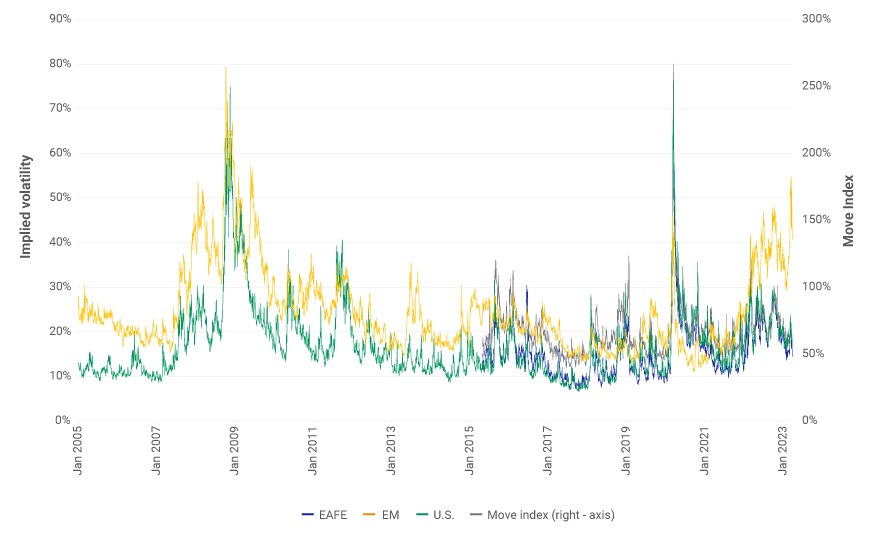

Along with the continued rise of short-dated options, 2023 witnessed the fall of Silicon Valley Bank and Signature Bank and UBS Group AG’s takeover of Credit Suisse Group AG. This contributed to the highest level of U.S. interest-rate volatility since the 2008 global financial crisis (when it was around 200%). Despite the increased uncertainty around the banking crisis, volatility implied by equity-option prices remained relatively subdued in the U.S., as well as in emerging markets and the EAFE region.

Dislocation between equity and Treasury-rate volatility

Implied volatility is based on the implied volatility of one-month 50-delta call and put options. Options linked to the MSCI EAFE and Emerging Market Indexes and the S&P 500 have been used for the EAFE, EM and U.S. calculations. Source: OptionMetrics. ICE Data Indices, LLC; used with permission.

One of the reasons behind suppressed equity volatility could be the technology sector’s outperformance, which offset negative returns from other sectors, such as financials, energy and health care.

A second reason could be the fact that short-dated options have high gamma exposure, meaning market makers would be more sensitive to market moves and buy and sell futures more often to remain delta-neutral. To understand the impact of short-dated options on market makers’ hedging activity, consider the following positions:

- If market makers are long gamma, to remain delta-neutral, they would consider selling (buying) futures when the market rises (falls). In effect, this could dampen realized volatility.

- If market makers are short gamma, to remain delta-neutral, they would consider buying (selling) futures when the market rises (falls). In effect, this could amplify realized volatility.

If we assume investors are short calls (i.e., market makers are long gamma) and long puts (i.e., market makers are short gamma), then based on April 2023 expirations for U.S. options, market makers would need to buy (sell) USD 16.5 billion for each 1% down (up) move in the index. In theory, buying pressure during market declines and selling pressure during market rallies may have had the effect of dampening volatility.

Total net gamma for US options

Based on options linked to the S&P 500, as of April 3, 2023. Relative strike calculated as strike price divided by spot price. Source: Cboe

Keeping your options open

While no two market events are identical, investors looking to evaluate the potential effects of a rise in short-term options may find it helpful to consider that such a rise has not always led to greater volatility in global equity markets.

Further Reading

Did the Trend Toward Short-Dated Options Extend Across Regions?

Evaluating Options in Different Macro and Volatility Regimes