- Equity markets have been volatile, given an inflation surge, growth uncertainty and war in Ukraine. Some investors have looked to option strategies to manage volatility and/or target alternative risk/return profiles.

- We evaluate the historical performance of systematic options-overlay strategies on equities: “buy-write,” “put-write” (with Treasurys) and “put-protection” strategies, in various macro and volatility regimes.

- In “stagflation,” buy-write and put-protection outperformed their respective benchmark indexes. In “heating up” periods, put-write with Treasurys outperformed a Treasury allocation (from March 31, 2006, to Jan. 31, 2022).

Over the past few months, developed- and emerging-market economies have witnessed a rise in inflation and slower growth. Inflation for developed markets stood at 7.2%, as of Jan. 31, 2022, a level last observed in 1991, and emerging markets’ inflation, as of the same date, was 6.3%, the highest level in the last five years (with significant variation within Emerging Markets with China Inflation growth being 0.9% whereas for Brazil, inflation growth being 10.4%).1 Additionally, the exogenous shock from Russia’s invasion of Ukraine added to market volatility in EAFE and emerging markets. Based on the equity-derivatives market, one-month at-the-money implied volatility for options linked to the MSCI EAFE and the MSCI Emerging Markets (EM) Indexes reached around 24% and 28%, respectively; and one-month realized volatility was 23% and 21%, respectively, as of Feb. 28, 2022, as seen in the exhibit below.

One-month implied and realized volatility for options linked to the MSCI EAFE and MSCI EM Indexes

Data from Jan. 29,1990, to Feb. 28, 2022. Implied volatility is based on the average implied volatility of one-month 50-delta call and put options. Source: OptionMetrics

In previous volatile markets, some investors have looked to options strategies to manage volatility and/or target alternative risk/return profiles. In this blog post, we evaluate historical performance of systematic options-overlay strategies across various macro and volatilty regimes. To do so, we looked at a range of options-based strategies, outlined in the exhibit below.

Options strategies linked to MSCI EAFE and EM Indexes

*Out of the money. Due to the lack of sufficient historical data for options linked to the MSCI EAFE and MSCI EM Indexes, we used options linked to the iShares MSCI EAFE ETF and iShares MSCI Emerging Markets ETF, from March 31, 2006, to Aug. 17, 2018, and then used options linked to the MSCI indexes.

Options-strategy performance conditioned on macro environment

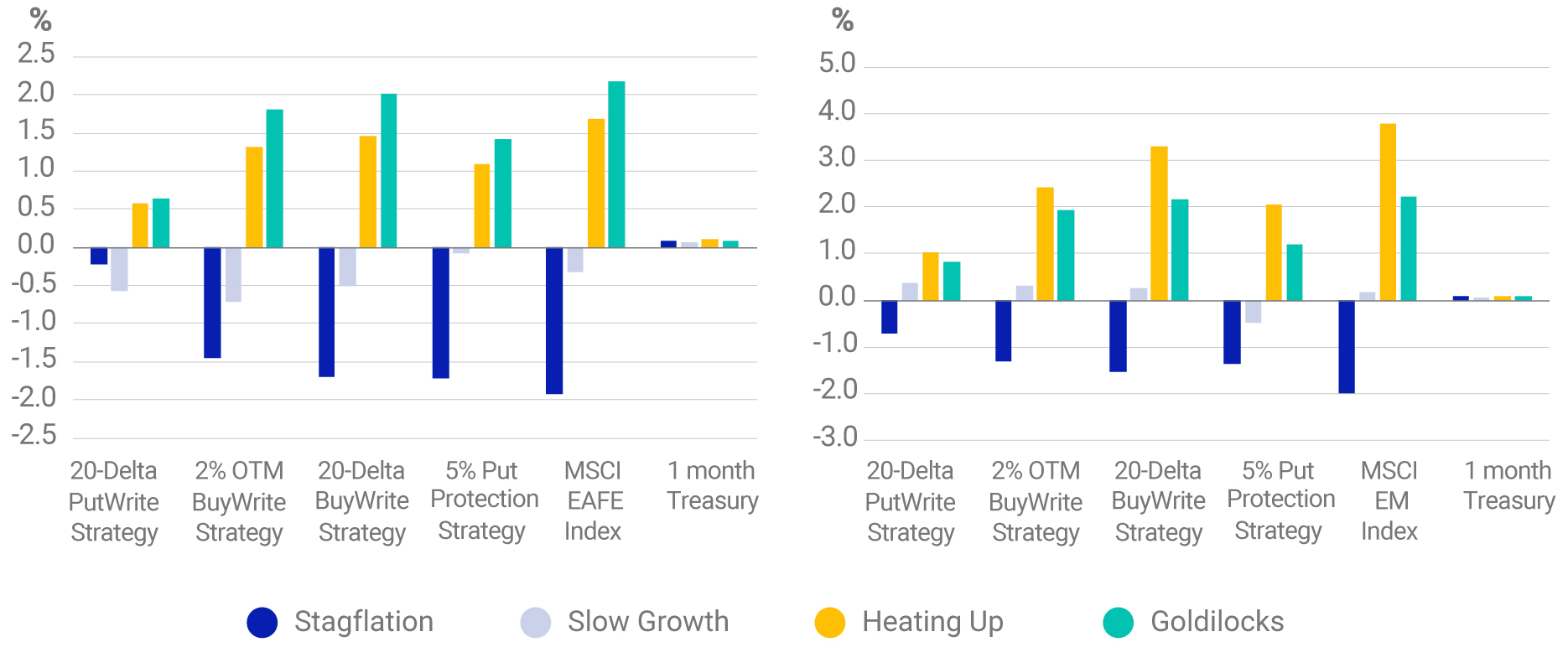

As shown in the exhibit below, the options strategies linked to the MSCI EAFE Index we analyzed had negative average monthly returns during the “stagflation” and “slow growth” periods between March 31, 2006, and Jan. 31, 2022, and positive returns in “heating up” and “goldilocks” scenarios.2 Options linked to the index provided downside protection in the “stagflation” and “slow growth” scenarios, offsetting the returns to the underlying equity index.

Strategies based on options linked to the MSCI EM Index also provided negative returns in the stagflation periods and slightly positive returns during slow growth. Options linked to the index provided downside protection in the stagflation periods and enhanced returns in slow growth.

Average monthly returns for options-linked strategies based on MSCI EAFE and MSCI EM Indexes

Data from March 31, 2006, to Jan. 31, 2022. Source: Cboe, Organization for Economic Cooperation and Development

Options-strategy performance conditioned on market volatility

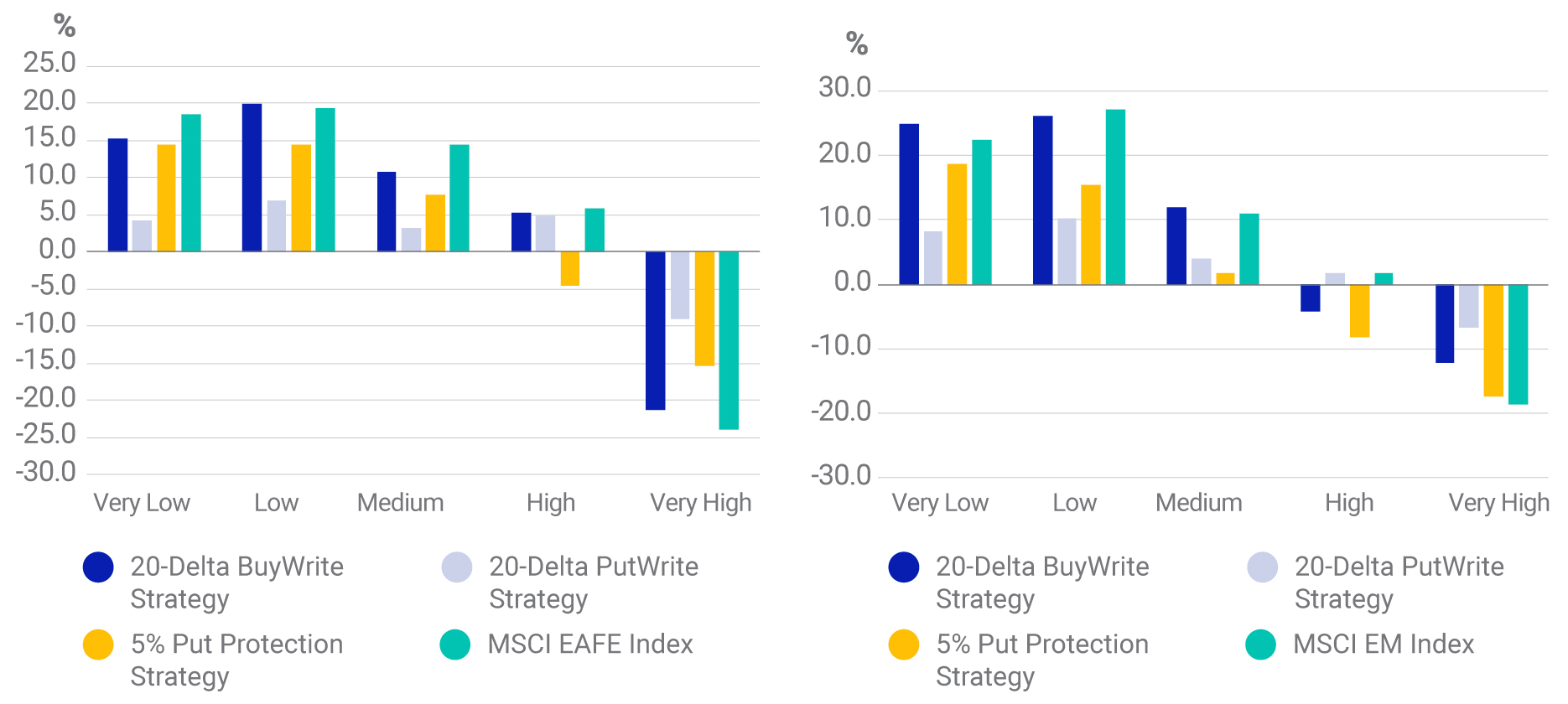

We next compared the performance of the same option-linked strategies in different volatility environments. The volatility quintiles were calculated based on the annualized monthly historical volatility for the MSCI EAFE and MSCI EM Indexes.

Annualized returns for options-linked strategies based on MSCI EAFE and MSCI EM Indexes

The buckets for strategies linked to the MSCI EAFE Index were generated using thresholds based on historical realized volatility data: [0,9.4,11.5,14.3,18.5,83.2]. The buckets for strategies linked to the MSCI EM Index were generated using thresholds based on historical realized volatility data: [0,10.5,12.8,15.2,19.7,95.2]. Data from March 31, 2006, to Jan. 31, 2022. Source: Cboe

As illustrated in the exhibit above, we saw similar trends for options linked to both indexes. In a “very high” volatility environment, the three options strategies outperformed their benchmark index. In the “very low” and “low” volatility environments, buy-write strategies and the underlying equity indexes outperformed other strategies over the period of study, perhaps due to the range-bound nature of equities during this period.

Weighing the options

Systematic options-overlay strategies have displayed differentiated risk profiles in a range of macroeconomic and volatility environments over the period of analysis. This may be useful as investors determine how to navigate today’s higher equity-market volatility.

1OECD inflation and OECD CLI have been used as a proxy for EAFE countries whereas an equal weighted BRICs inflation and an equal weighted BRICs CLI is used as a proxy for EM countries.

2Macro regimes were defined using estimates for inflation as well as the Organization for Economic Cooperation and Development’s composite leading indicator. We calculated and named the four regimes as follows: “stagflation” (falling growth, rising inflation); “heating up” (rising growth, rising inflation); “slow growth” (falling growth, falling inflation); and “goldilocks” (rising growth, falling inflation). We observe the following proportion of months for the respective scenarios: stagflation (EAFE — 26%, EM — 33%); heating up (EAFE — 24%, EM — 9%); slow growth (EAFE — 16%, EM — 17%); and goldilocks (EAFE — 35%, EM — 41%),

Further Reading

Hotter Inflation Set Some Styles and Sectors on Fire