Deglobalization is the trend of reducing global interconnectedness and integrating more closely with local and regional economic systems. The developed economies, especially the U.S. and EU, have sought in recent years to diversify their trade partners, bringing their supply chains closer to home. Government policy is also formalizing this course. As companies realign their supply chains, shedding old and finding new links, opportunities are being created.

In previous blog posts, we analyzed how deglobalization has added to inflation woes and the investment implications of nearshoring, friendshoring and reshoring. In this blog post, we explore how investors can identify potential beneficiaries of global supply-chain realignment. Using MSCI Economic Exposure data, we illustrate our approach based on exposure to the U.S. economy. The same analysis could be applied from the viewpoint of other regions and countries.

A company’s ‘shoring’ strategy influences likely beneficiaries

Industry-level opportunities

Certain industries are more susceptible to the effects of deglobalization. Although some companies in these industries may experience negative repercussions, others are positioned to benefit.

One way to assess the impact on an industry is by evaluating governments’ public-policy tools. For example, under the umbrella of so-called Bidenomics,[1] supply-chain resilience is being prioritized over immediate cost-cutting concerns.[2] Similar efforts are underway in the EU, with the bloc’s adoption of the European Economic Security Strategy[3] and legislation such as the European Chips Act.[4] Corporate management could interpret these directives as encouragement to move their companies’ supply chains closer, or back, to their home countries or regions.

Another approach is to analyze an industry’s economic exposures. We use MSCI Economic Exposure data to aggregate the economic exposures of Global Industry Classification Standard (GICS®)[5] sectors. We can illustrate this process using the U.S. and China, which has historically been the U.S.’s largest trading partner but has recently been surpassed by Mexico.[6]

For this exercise, we identify the industries in the MSCI China All Shares Investable Market Index (IMI) with the highest exposure to the U.S. economy.

Industries with highest US economic exposure in the MSCI China All Shares IMI

Firms in these industries would likely be the most vulnerable to U.S.-initiated supply-chain realignment efforts.[7] Our analysis shows that the semiconductor, semiconductor-equipment, biotechnology and chemical industries could experience the greatest impact from U.S. companies’ shifts to nearshoring, friendshoring and reshoring. Several of the industries overlap with those mentioned in President Biden’s executive order.

A simulated-index approach to identify probable beneficiaries

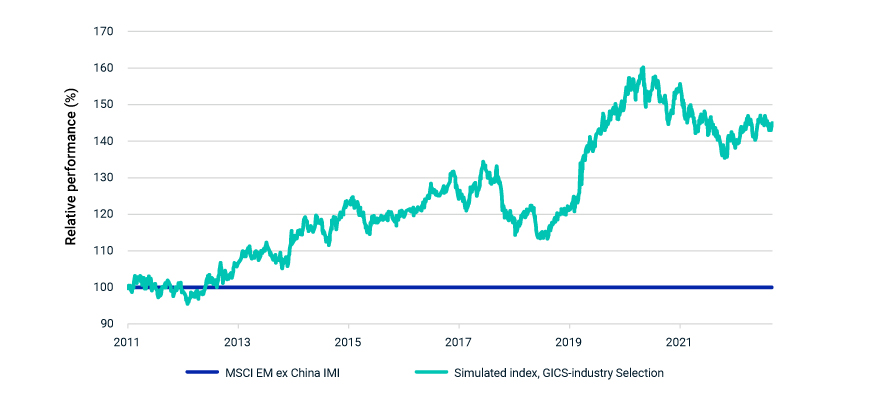

Using the preceding GICS-based industry-selection process, we constructed a simulated index of probable beneficiaries of supply-chain relocation to the emerging markets (EM) ex China. We selected companies in industries with the highest U.S. economic exposure. Our rationale is that if U.S. companies diversify their supply chains away from these industries in China, the same industries in EM ex China could benefit.

We excluded some of the industries identified in our analysis because their name indicated a services orientation and, thus, were less likely to be candidates for supply-chain realignment.From June 2011 through August 2023, the simulated index outperformed the MSCI Emerging Markets Investable Market Index by 45% on a cumulative basis.

The simulated index of likely shoring beneficiaries outperformed

Our approach could be refined by applying one or more of the following filters, as we assume that supply-chain relocation would impact manufacturing-based companies more than service-based companies:

- Business-revenue information to gauge a company’s revenues from manufacturing activities.

- Analysis of a company’s real assets (plant and equipment) to determine if its location offers a logistical advantage in a supply-chain realignment, making it a strong candidate as a supply-chain partner.

Thematic or structural opportunity?

Developed economies’ interest in building stronger trade ties closer to home and with economic and political allies appears to be intensifying. As the move to rewire supply chains gains momentum, a practical analysis of how companies could be impacted by deglobalization should uncover likely beneficiaries. We have illustrated potential ways to evaluate the impact on industries and companies as well as an indexed approach that considers both thematic and structural opportunities.