- Deglobalization has been on the rise, accelerated by the COVID-19 pandemic. If deglobalization persists, it may require a rethink of existing asset-allocation strategies and bring new opportunities for equity investors.

- Well-diversified global portfolios, quality and minimum-volatility strategies and innovation-oriented themes have benefited from such opportunities.

- Deglobalization could mean more inflation volatility and a worsening trade-off between growth and inflation. Value has historically outperformed in high-inflation periods; low volatility in moderate- and high-inflation ones.

Investors are already well aware of how COVID-19 led to closed borders, economic shutdowns and trillions of dollars of fiscal and monetary stimulus. But there’s also been a longer-term shift at play: one toward deglobalization, in the form of rising nationalism, trade wars and geopolitical tensions. Now, investors may look to adapt as these forces collide and potentially forge rising global inflation.

While much has been made of global supply-chain disruptions driving scarcity and higher prices, we can’t ignore that pro-globalization trends likely helped keep inflation at bay for several decades, as lower-cost producers increased supply for advanced economies. If the trend toward deglobalization continues, it could cause a supply-side shock. In addition to shortages, the lack of global competition and a long-term reduction in trade could add to inflation pressure, as well as slower innovation cycles and lower long-term GDP growth.1

In the face of these events, business cycles and long-term economic growth prospects across countries may decouple. And if it persists, it may have implications for asset-allocation strategies, as investors work to understand and respond to market shifts.

Implication 1: Greater global diversification and specific country selection

Dispersion in growth rates across countries has narrowed for the past 30 years.2 Deglobalization is likely to break that trend, and differences in growth rates between countries may widen again, as noted in the International Monetary Fund’s October 2021 World Economic Outlook. Coupled with deglobalization’s potentially negative impact on growth rates overall, this could lead to a market environment of lower returns, higher volatility, lower correlations and growing dispersion among markets.

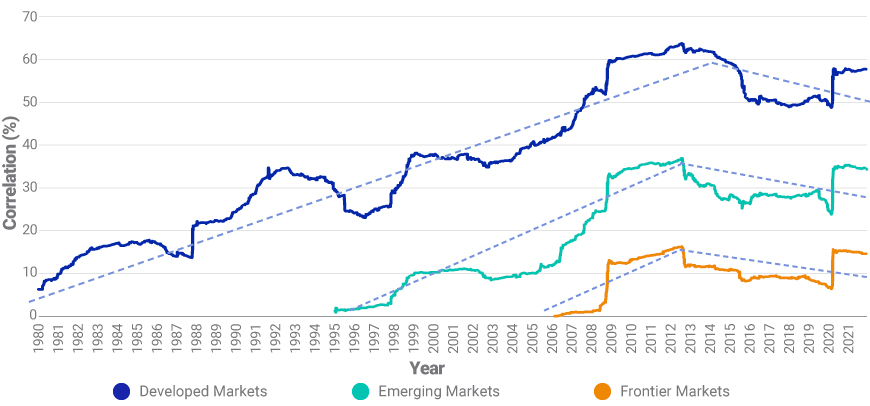

A reduction in correlations would make it even more important to diversify investments, both globally and across asset classes. There is evidence that correlations between developed equity markets have been trending lower since 2015, as seen in the exhibit below. As a result, internationally diversified portfolios’ risk-reward trade-offs have become more attractive.

Correlations between markets have declined in recent years

Pairwise average correlations for developed, emerging and frontier markets, 48-month rolling window

Deglobalization may also mean that national markets are less vulnerable to external shocks, but this would come at the cost of increased vulnerability to domestic economic conditions. Trade flows could become more regional in nature as supply chains shorten, and, in general, cross-border trade and investment would be lower. Thus, institutional investors may choose to make country bets, in addition to being exposed to the diversified global equity universe.

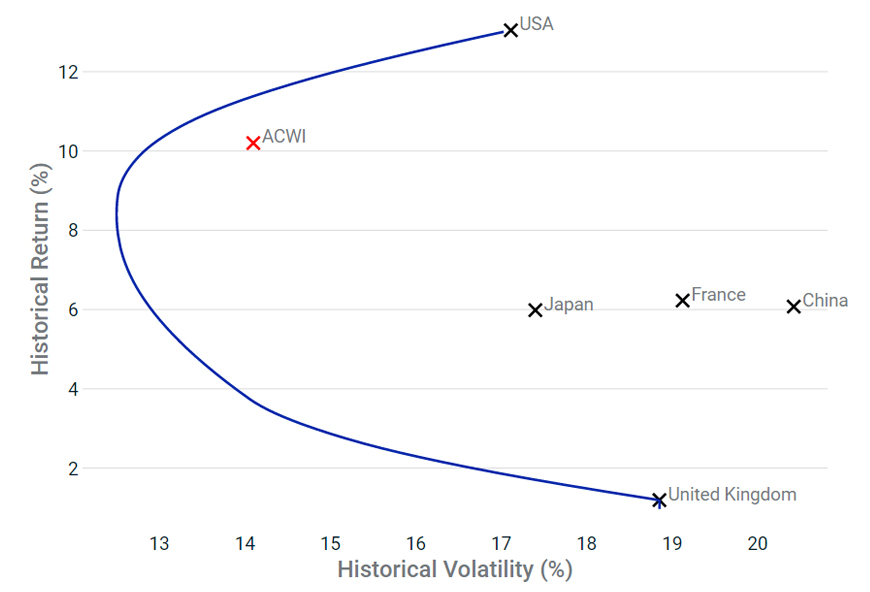

The exhibit below illustrates the efficient frontier constructed by allocating to the top five countries in the MSCI ACWI Index, by average active weight, for the period from January 2014 to November 2020, as well as a global allocation proxied by the MSCI ACWI Index. Two conclusions stand out:

- A global allocation was close to frontier, providing significant international diversification benefits for most investors during that period.

- Investors who had the flexibility of making individual country allocations could have reduced risk further, relative to individual countries and the global equity market.

International diversification and country allocations

Efficient frontier with country allocations. Data from Jan. 1, 2014, to Nov. 30, 2021. Gross returns in USD. The five countries on average accounted for 74% of the weight in the MSCI ACWI Index.

Implication 2: Focusing on high quality, low volatility and innovation

When the cost of capital rises, companies with higher leverage have faced headwinds, historically. Many companies depend on their ability to source goods from lower-cost, and often international, suppliers to keep margins healthy. Less cross-border trade could hamper this effort, and reduced cross-border capital flows could impact access to credit for certain regions.

Conversely, higher-quality companies — those with durable business models and sustainable competitive advantages — could remain more resilient in a deglobalization scenario. In the past, as markets experienced greater volatility, low-volatility strategies became more attractive. Historically, minimum-volatility strategies declined less than the market during times of crises and market downturns.3

With less reliance on global supply chains, national economies may require a higher level of automation to achieve greater domestic production, as cheap emerging-market labor is replaced by more expensive and skilled developed-market labor, supported by robots and other new technologies. Manufacturing may need to become highly automated and highly customizable to customer needs.

Selected index performance representing quality, minimum volatility and innovation

Risk and return profile of the MSCI ACWI, MSCI ACWI Quality, MSCI ACWI Minimum Volatility and MSCI ACWI Innovation Indexes, from Jan. 1, 2014, to Nov. 30, 2021. Gross returns in USD

Implication 3: Factor tilts stemming from the inflation environment

A shift from global to national/local output gaps and resource constraints, plus lower productivity and growth trends, ultimately may help raise the rate of inflation. At the same time, this transition is potentially deflationary, as it could trigger a new wave of bank deleveraging and tests of credit/fiscal sustainability. In combination, this could mean greater inflation volatility and a worsening trade-off between growth and inflation.

The impact of inflation on equity portfolios depends on the underlying causes. Our previous work using scenario analysis indicated that stagflation and disinflation could be the most negative scenarios for equity markets overall. Historically, growth delivered positive active returns in low-inflation environments, and negative active returns in moderate-to-high-inflation environments. On the other hand, value stocks with high cash flows have outperformed in high-inflation environments. Low volatility delivered stronger performance in both moderate- and high-inflation environments, as corporate cash flows might have been positively exposed to inflation. Quality and momentum were less sensitive to inflation and outperformed in all scenarios.

As the world recovers from the long-term effects of the pandemic and several structural changes, deglobalization is one of the many things top-of-mind for investors globally. Investors may wish to consider the implications and insights discussed here, as they choose to reallocate portfolios and position themselves for a potential new paradigm.

The authors thank Raman Aylur Subramanian and Raina Oberoi for their contributions to this post.

1History provides guidance about how trade tensions can impact the broader economy. As the U.S. entered the Great Depression in 1930, Congress passed the Smoot-Hawley Tariff Act, which raised tariffs on more than 20,000 imported goods and caused a significant drop in U.S. imports and exports. Some economists believe that Smoot-Hawley deepened and extended the depression.

2Dees, Stephane, and Zorell, Nico. “Business Cycle Synchronisation: Disentangling Trade and Financial Linkages.” European Central Bank, April 2011.

3The MSCI Minimum Volatility Indexes outpaced their respective broad market-cap-weighted parent indexes through the downturns of the 2008 global financial crisis and over the subsequent periods of continued volatility. See, “Minimum Volatility Indexing, The Long-Term View.” MSCI, July 2013.