- U.S. auto-loan asset-backed securities are under stress due to COVID-19, according to April remittance reports with the first post-lockdown updates. New 30-day delinquencies increased, and the number of nominally current loans that stopped amortizing increased in March.

- The April remittance reflected only a partial impact from the economic distress in March since the earliest state-level lockdown launched on March 19. Investors might wish to monitor the May remittance for signs of higher impact — which may be cushioned by government policies.

- April remittance reports show a potential V-shaped recovery for Chinese consumer ABS. New-delinquency rates have dropped toward pre-crisis levels. Prepayment rates have bounced back. Roll rates to serious-delinquency status remained elevated.

Beyond COVID-19’s steep human toll, the pandemic’s disruption of economic life has led to widespread loss of income and impaired some borrowers’ ability to repay loans. What could the impact be for investors in consumer asset-backed securities (ABS) in the U.S. and China?

In the US, Unseasonably High Delinquencies

More than 33 million Americans have filed unemployment claims since the coronavirus hit the U.S.1 We analyzed the April remittance data, which gave us the first direct reading of U.S. consumer ABS under distress.

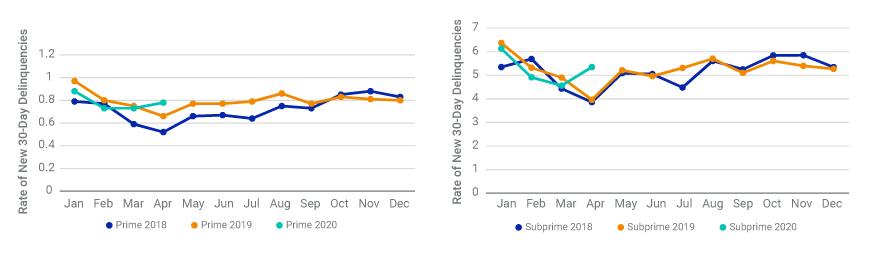

The exhibit below shows the rates of new 30-day delinquencies for each calendar month from January 2018 through April 2020, for prime and subprime auto loans bundled in ABS. The month of April has historically tended to have the lowest level of new 30-day delinquencies, likely due to consumers’ tax refunds, which add to borrowers’ cash flow.2

In April 2020, however, new 30-day delinquencies were higher than the previous month’s level. While 2020’s tax-filing deadline moved from April 15 to July 15 due to the coronavirus, the borrowers expecting tax refunds were more likely to have filed tax returns earlier — i.e., before the pandemic hit the U.S. — and received the benefits of the tax refunds. If we expect the same tax benefits for April 2020 as in April 2019 and 2018, then the new 30-day delinquencies for subprime- and prime-auto-loan ABS are about 35% higher than expected, before considering the effect of the coronavirus.

April 2020’s New 30-day Delinquencies in Recent Context

Source: Intex Solutions, MSCI

More Loans Suspended Amortization

The nominally “current” (i.e., nondelinquent) auto loans also recently showed signs of distress. Responding to the economic crisis, auto lenders offered payment-deferral programs,3 which aim to help borrowers stay current, although finance charges will continue to accrue to balances.4 In March, more than USD 4 billion in securitized auto loans were reportedly granted extensions due to hardship.5

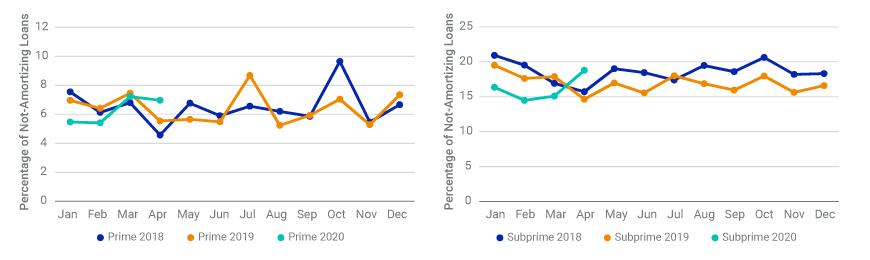

The exhibit below shows that, among current loans, a certain percentage pay less than the required amount to amortize, so that loan balances on the whole were not decreasing. Compared with April 2018 and 2019, the percentage of “not-amortizing loans” increased from 15.19% to 18.8% for subprime loans, and 5.06% to 6.97% for prime loans. This suspension of payments could reveal borrowers’ hardship — and may indicate higher default risks, especially for subprime borrowers, whose balances might accrue faster due to their higher interest rates.

The April 2020 remittance data reflects borrowers’ behavior in March. The early-lockdown states — for example, California and Washington, which instituted lockdowns on March 19 and March 24, respectively — were impacted toward the end of March. If subsequent months’ remittance reports reflect the current economic stress, the performance of consumer ABS might show a much bigger impact than the 35% increase in new-delinquency rates and the large increase in not-amortizing loans among the nominally current loans, as discussed previously. On the other hand, the cash infusion from the CARES Act and state unemployment benefits may cushion against some of the deterioration. The May remittance report, which will reflect borrowers’ behavior in April, could yield a clearer picture.

Some ‘Current’ Loans Were Not Amortizing

Source: Intex Solutions, MSCI

Have Chinese ABS Recovered?

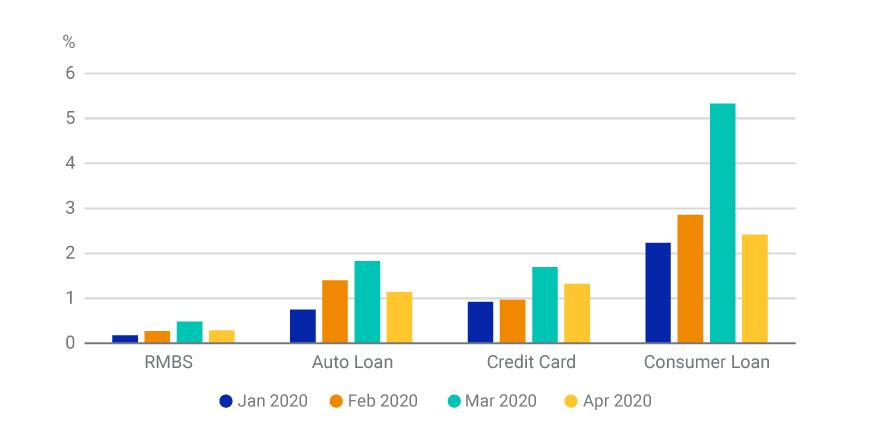

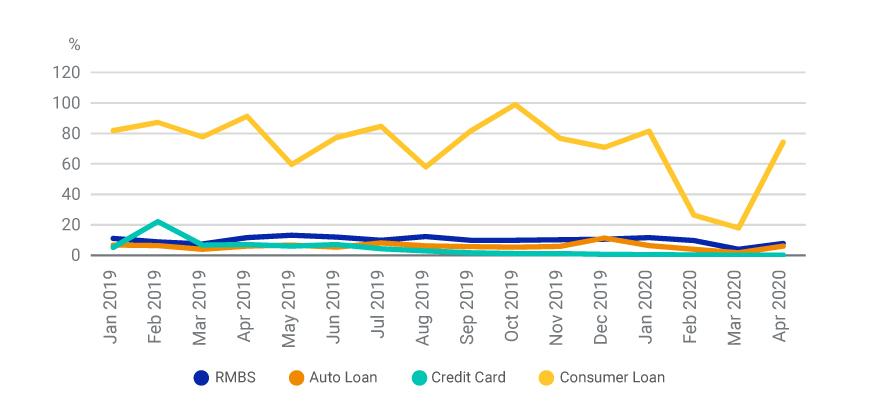

April remittance reports for Chinese consumer ABS suggest a V-shaped recovery is possible. The exhibit below shows new-delinquency rates for the previous four remittance cycles, across residential mortgage-backed securities (RMBS), auto ABS, card ABS and noncollateralized consumer loans (NCCL). While March new-delinquency rates (representing February behavior) increased dramatically at the height of the coronavirus-induced economic distress, the April performance improved, moving toward the pre-crisis levels of January 2020.

After a COVID-19 Rise, Early Delinquencies Fell in Chinese Consumer ABS

Source: CNABS

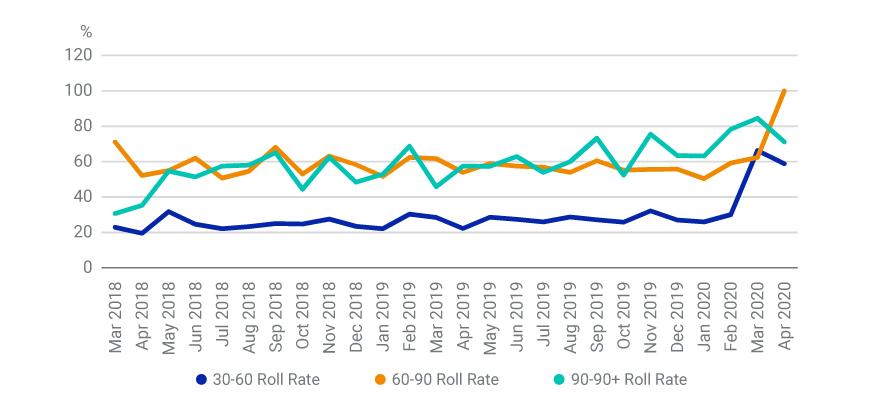

Delinquency roll rates (those rolling from delinquencies of 30 to 60 days, 60 to 90 days and 90 to 90+ days) were still at elevated levels. The exhibit below shows that the RMBS 60-90 roll rate in April nearly reached 100%, while the 30-60 and 90-90+ roll rates were almost as high as March’s levels. This suggests people who were already behind on payments were not getting much relief in April. Whether or not these delinquent borrowers will eventually roll toward default depends on continued economic improvement, in our model.

In Chinese RMBS, a Sharp Rise in 60-to-90-Day Delinquency Rolls

Source: CNABS

As we wrote previously, prepayment rates for Chinese ABS dropped sharply in March, indicating that borrowers' willingness to hold cash outweighed debt repayment. But prepayment rebounded for April, potentially signaling borrowers’ overall confidence in economic recovery. Note that borrowers prioritized prepayment for NCCL, perhaps because of their high interest rates.

Prepayment Rebounded in High-Interest Chinese ABS

Source: CNABS

Chinese and US ABS on Their COVID-19 Paths

In April, Chinese consumer ABS showed rapid improvement after 1 1/2 months of coronavirus-related economic stress. Further improvement may depend on restoring the foreign trade and global supply chains disrupted by COVID-19’s spread around the world. Whether there will be a similar V-shaped recovery for U.S. ABS performance hinges on the speed of economic reopening in the U.S., according to our model.

1Bayly, L. “Another 3 million Americans filed jobless claims last week, bringing total to 33 million since coronavirus hit.” NBC News, May 7, 2020.

2Zhang, J. and Yang, Y. 2019. “MSCI US Auto Loan Collateral Model Insight.” MSCI Model Insight.

3Tarpley, L.G. “31 lenders that may help you with auto loan and lease payments in response to COVID-19.” Business Insider, April 17, 2020.

4“A message for our Ally community about coronavirus (COVID-19).” Ally Bank, May 4, 2020.

5Fest, G. “S&P: Auto loan extensions exceeded $4B in March.” American Banker, May 4, 2020.

Further Reading

How coronavirus could hurt Chinese consumer ABS

Trade deal broadened access to China’s nonperforming loans

A default wave for Chinese consumer ABS?

Are Subprime Auto Loans at a Tipping Point?

MSCI US Auto Loan Collateral Model (client access only)

MSCI US Credit Card ABS Collateral Model (client access only)

MSCI China ABS Collateral Model (client access only)

Could coronavirus lead to default contagion in CLOs?