When investors buy overseas real estate, they inevitably take on foreign-exchange exposure. Normally, currencies do not fluctuate wildly, but forex volatility can escalate — often spurred by political events. The June 2016 Brexit referendum and September 1992 Black Wednesday selloff (as the market reaction to the U.K.’s withdrawal from the European Exchange Rate Mechanism is known) are two major historical U.K. events that put currency risk in stark relief. The resulting currency-market dislocations resulted in near-term losses for some investors, but also created attractive opportunities for investors to buy real estate exposure in the U.K. market using non-GBP currencies, as shown in the exhibits below.1

EFFECTS OF THE BREXIT REFERENDUM AND BLACK WEDNESDAY

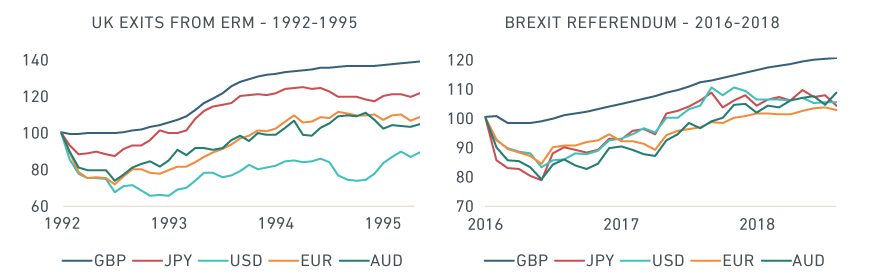

To demonstrate the degree of currency risk faced by these cross-border property investors, we examined the total returns of a hypothetical GBP-denominated portfolio tracking the MSCI UK Monthly Property Index (as a proxy for the market) in the periods before and after both events. We then compared the returns for the GBP-denominated portfolio to portfolios tracking the same MSCI UK Monthly Property Index denominated in four non-GBP currencies during the same period.

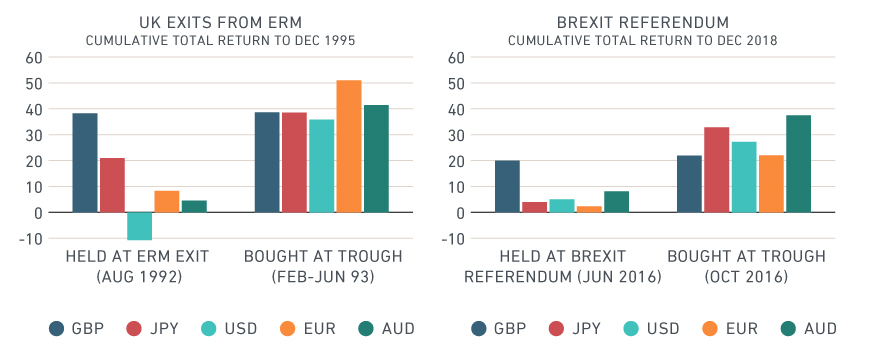

Our analysis shows that currency risk led to opportunities during both events: In the immediate aftermath of the Brexit referendum and Black Wednesday, the values of these four non-GBP-denominated U.K. property portfolios shifted rapidly downward, especially when compared to the GBP-denominated portfolio, due to currency swings that appear to have had no direct relation to underlying real estate values. However, in general, the values of these same four non-GBP-denominated U.K. property portfolios outpaced the GBP-denominated portfolio in the years after both events.

FASTER HISTORICAL RECOVERIES IN GBP TERMS

After both major market-moving events, the GBP-denominated index’s total returns recovered quickly following the initial shock. But the same index denominated in one of the four non-U.K. currencies failed to bounce back, as the GBP continued to depreciate significantly against the other currencies.

For example, from shortly before the Brexit referendum in May 2016 until December 2018, the GBP-denominated MSCI UK Monthly Property Index would have returned a cumulative 20%. By contrast, the euro-denominated index, over the same period, would have returned only 2.26%.

The same pattern held for Black Wednesday. A GBP-denominated index would have returned 38.23% from August 1992 until December 1995, whereas a USD-denominated index would have lost 10.79% over the same period — all due to currency exposure during a period of USD strength relative to the GBP.

UK PROPERTIES’ IMMEDIATE RECOVERY IN GBP

STRONGER EVENTUAL RECOVERIES IN NON-GBP TERMS

Of course, currency exposure cuts both ways for cross-border real estate investors — depending on their choice of currency denomination and investment timing.

For example, from the October 2016 post-Brexit-referendum trough until December 2018, the portfolios denominated in the Australian dollar (AUD) and Japanese yen (JPY) would have returned 37.48% and 32.8%, respectively (versus 21.93% for the GBP-denominated portfolio over the same stretch of time). Black Wednesday presented a similar pattern: The GBP-denominated portfolio saw a cumulative total return of 38.65% from the March 1993 trough to December 1995, whereas the euro- and AUD-denominated portfolios returned 50.94% and 41.44% over the same period.

UK CRISES CREATED OPPORTUNITIES IN NON-GBP-DENOMINATED CURRENCIES

The Brexit referendum, Black Wednesday and other hard-to-predict geopolitical events can have a major impact on currencies. And with the currency risk that comes with cross-border property investing, real estate portfolios can fluctuate in value like faster-moving, more liquid asset classes. Such volatility can offer both risks and opportunities.

1 This report contains analysis of historical data, which includes hypothetical, backtested or simulated performance results. There are frequently material differences between backtested or simulated performance results and actual results subsequently achieved by any investment strategy. Past performance — whether actual, backtested or simulated — is no indication or guarantee of future performance. None of the information or analysis herein is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision or asset allocation and should not be relied on as such.

Further Reading

Global real estate: To hedge or not to hedge

Measuring real estate capital growth isn’t rocket science, is it?