The year 2023 was an especially tough one for real estate. Declines in asset valuations, which had begun in the second half of 2022 in many markets, proliferated across a broader range of markets through the rest of 2023. Transaction volume also continued to fall through the year, with dealmaking often paralyzed by the standoff between potential buyers and sellers on pricing.

Investors will be hoping for a better 2024, where we find a floor in pricing that will return the market to more-normal levels of activity. When and how that happens remain to be seen. It may be through increased distress forcing sellers onto the market. Or we might eventually see interest rates start to fall, returning confidence to potential buyers. Whatever the details of exactly when and how we reach that point, the sudden market movements we’ve seen over the last 12 to 18 months have shifted the playing field. Investors are reassessing their real-estate allocations and strategies to mitigate significant risks but also exploit opportunities posed by this market dislocation.

The heady mix of various structural and cyclical trends buffeting the market creates an investment landscape characterized by great diversity in risk exposures and hence expected returns. In this blog post we present some of the trends that we see, to help investors navigate this challenging environment through 2024.

1/ Distress starts to bite as loans mature

Distressed sales have represented just a small fraction of the U.S. market in 2023, at a 1.7% share of investment, despite steady growth in distress levels since 2022. Still, there is reason to believe that more forced capital events, including sales of distressed assets, could be on the way.

The wave of loans facing maturity, and the timing of when these loans come due, could lead to additional forced selling. The most problematic loans are those originated at record-high property prices and record-low mortgage rates, which is the case for many of the loans originated in 2021 and 2022. Many of the loans from these vintages had shorter-term durations: For instance, of the 2021 loans that remained outstanding at the start of Q4 2023, 67% are slated to come due by 2027. As these loans mature, some investors will struggle to rebalance their capital structures in an environment of higher interest rates and lower valuations.

More-conservative lending terms will likely force such capital events: Commercial loan-to-value ratios (LTVs) for 7- to 10-year fixed-rate products averaged 57% in 2023, down two percentage points from 2021; LTVs for multifamily assets have declined more. With more than USD 2 trillion in loans set to mature through 2027, as the cost of capital reverts to a more historically typical level and lenders continue to tightly manage risk, additional opportunities will be revealed for investors looking to pick up assets on the cheap.

Still, because of the structure of the financing market in the years since the 2008 global financial crisis (GFC), this down cycle may afford more flexibility for lenders and borrowers than in the aftermath of that calamity. Then, rebalancing often took the form of foreclosures by purchasers of loans and sales out of distressed situations by the special servicers. Today, there are investors looking to new vehicles for rebalancing.

Looming US loan maturities

2/ Mind the gap: Buyers and sellers need to meet

The current illiquidity in many global transaction markets is largely due to the pricing uncertainty caused by the sharp rise in interest rates following years of benign rates. There is less agreement between buyers and sellers on where properties should be priced, meaning that fewer deals have been completed.

The scale of the price gap that needs to be bridged to bring market liquidity back to its long-run average, as shown by the MSCI Price Expectations Gap, has grown significantly for some of the major European and North American office markets. (This analysis shows that offices are, on average, faring worse than industrial or residential property.)

The price gulf for offices in the German A-cities has grown to -36% in Q3 2023 from -7.5% a year prior, which comes on top of a 14% drop in transaction prices over the same period. This indicates that buyers would require an even larger discount than that currently on offer to come back into the market. A similar dynamic is on display in San Francisco, where the gap has grown to -27% on top of a substantial drop in transaction prices.

For greater liquidity to return to the transaction market, there has to be greater agreement on where property should be priced, which requires some more clarity on the trajectory for interest rates. If investors expect that, with inflation falling, central banks are largely done with the tightening cycle, this may allow buyers and sellers to move closer together. In the meantime, mind the gap.

Difference in buyers’ and sellers’ pricing views has widened

3/ Office performance may trigger a double dip

The turbulent last few years in commercial real estate has made calling the bottom of the investment cycle even more difficult than usual. A double dip in property performance after the initial interest-rate-led declines of late 2022, cannot be ruled out due to factors including higher-for-longer rates and weakening global economic growth.[1] Weakening tenant demand in the office sector is also a key factor.

The biggest influence on the swings in property performance is capital growth, which in turn is driven by pricing. One signal on pricing is provided by the MSCI Price Expectations Gap. This analysis indicates that of 143 market segments measured in Q3 2023, 99 will need further price reductions to restore liquidity to long-run averages. Such adjustments, in turn, could trigger further valuation drops.

Furthermore, the biggest reductions appear necessary in office properties, with an average gap of just under 17% across all office markets covered. A closer look at some of MSCI’s quarterly indexes shows that several markets, such as Australia and Ireland, are heavily weighted toward the office sector, so if these price reductions occur, they could trigger a negative impact on capital growth once transactions start happening.

First dips in property performance already experienced

4/ Investors grapple with a rapidly shifting risk/return landscape

Global real estate investing has undergone a notable shift over the past year and a half, and changes in the economic and financing landscapes have altered investors’ perceptions of value across and within asset classes. This change is especially true for real estate, which is influenced more directly by debt-financing and interest-rate impacts, as well as by the broader, indirect impact of rising risk-free-rate benchmarks against which all asset classes are priced. Investors are also reassessing capital allocations within real estate due to evolving risk and opportunity dynamics. These are driven by the varied way evolving cash-flow expectations and asset repricing have hit differently across various dimensions of the market. Risk — from core to opportunistic strategies — is one key dimension.

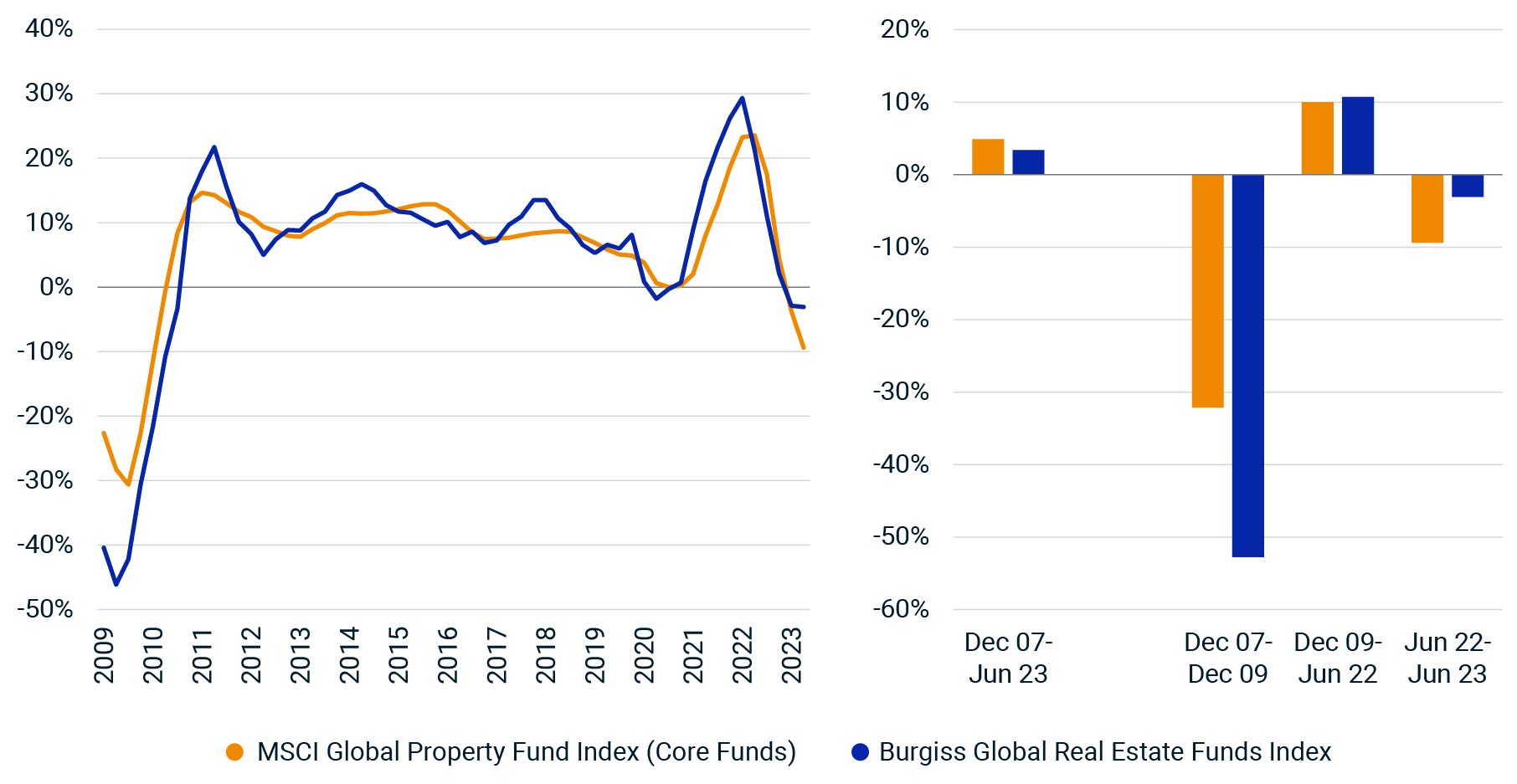

Against this backdrop, it’s valuable to view the return characteristics of core, open-end funds versus closed-end funds, which are heavily dominated by value-add and opportunistic strategies. From December 2007 to June 2023 the Burgiss Global Real Estate Funds Index marginally underperformed the MSCI Global Property Fund Index (Core Funds) by 150 basis points (bps) per year, though this was mainly driven by significant underperformance during the GFC. Over the intervening period up to June 2022, the Burgiss index outperformed the MSCI index by 70 bps per year and in the latest downturn (12 months to June 2023) posted returns of -3.1%, vs. -9.4% from the MSCI index.

Core investments have lagged so far in the current downturn

5/ Climate change casts a long shadow

The specter of climate change has cast an increasingly ominous shadow over the planet in recent decades. In 2023, several notable climate records were broken and scientists expect the year to be the warmest on record.[2] For real estate investors, these changing weather patterns may impact their portfolios in several ways, including physical damage and transition costs. The MSCI Climate Value-at-Risk Model estimates that up to 5.5% of the MSCI Global Annual Property Index could be vulnerable to transition risk and 3.0% could be vulnerable to physical risk over the coming decades.[3]

Another, more immediate way in which climate change could affect investors is through insurance costs. If extreme weather becomes more frequent and more severe, as climate models predict, these costs will likely have to increase and we may already be seeing evidence of this trend. Data from the MSCI U.S. Quarterly Property Index shows that insurance costs as a percentage of income receivable more than doubled to 2.3% from 1.0% over the five years through September 2023. These increasing costs have been attributed to the growing number, and increased severity, of extreme weather events, as well as higher reinsurance rates.[4] Costs are particularly high in states like Florida and California, where the MSCI Climate Value-at-Risk Model estimates properties face above-average risk linked to physical climate change.

US insurance costs have increased, particularly in high-risk states