Social Sharing

Extended Viewer

Style Factors for Private Real Estate–Beyond Property Type and Location

Oct 24, 2023

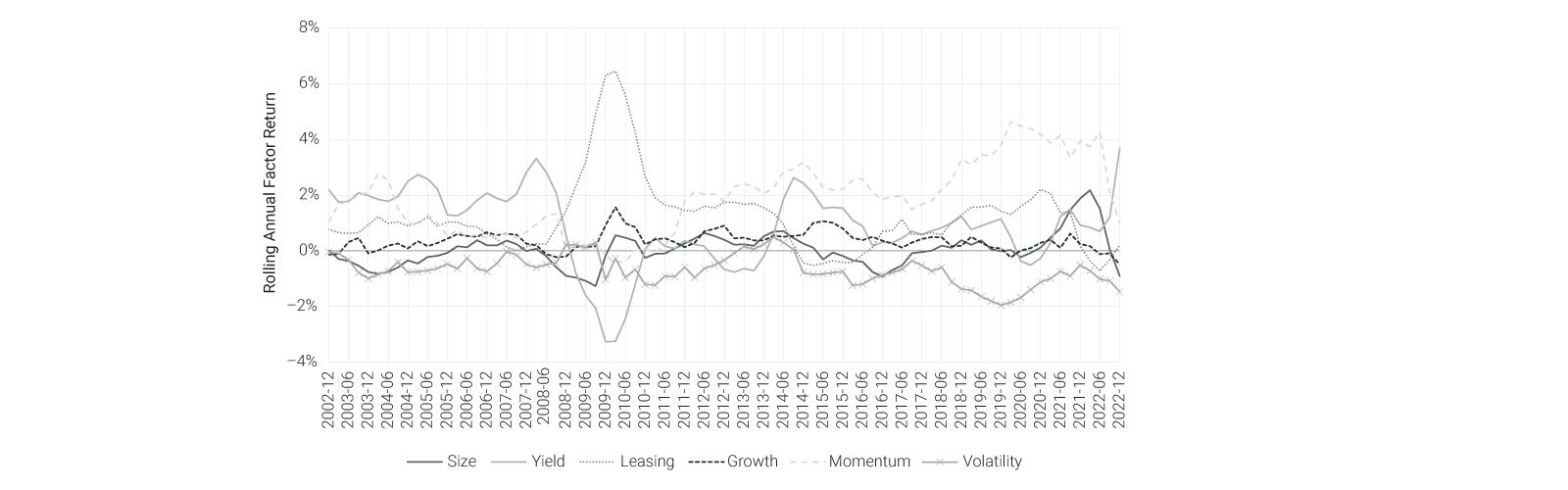

Traditional property-type and geography segmentations play an important role in private real estate but are limited in how much performance variation they can explain. In testing, six potential style factors — size, yield, leasing, growth, momentum, and volatility — in a cross-sectional multifactor model showed promising results. The development of style factors for private real estate could be a useful addition to the toolkit of investors in the asset class. Republished with permission from the Journal of Portfolio Management, from: Bryan Reid, Fritz Louw, and Will Robson. 2023. “Style Factors for Private Real Estate—Beyond Property Type and Location.” Journal of Portfolio Management 49, no. 10 (October 2023).

Style-factor returns

Download report

Research authors

- Bryan Reid, Executive Director, MSCI Research

- Fritz Louw, Senior Associate, MSCI Research

- Will Robson, Executive Director, MSCI Research

Related content

Performance: The Financial Crisis vs. Now

As U.K. real estate experiences a pricing correction at record pace, it’s natural to make comparisons to the 2008 global financial crisis. We draw on factors in private real estate to better understand current conditions and give us clues to what may happen next.

Read the blog postPrivate Real Estate Valuation and Sale Price Comparison 2022

Investment performance is measured using transaction prices in most asset classes. But real estate is illiquid and heterogeneous, so valuations and sales prices can differ. Our annual report compares valuations and sale prices in global real estate.

Read the paperReal Estate Market Size 2022

We estimate the size of the professionally managed global real-estate market in 2022, explaining the changes in this investment universe since 2021. We find that while the size of the global market declined, the dominance of the U.S. increased.

Read more