- As a long-term asset class with fixed asset locations, private real estate may be especially vulnerable to both physical and transition risks from climate change.

- Real estate portfolios may be exposed to a variety of physical risks that could impact values. Our analysis found that different potential risks may require different mitigation strategies.

- As the world moves towards a low-carbon economy, transition risk may also play an increasingly important role with investors facing potential costs from emission-reduction requirements.

Many assets investors own can only figuratively be underwater when a company becomes insolvent or a stock loses all its value. But for real estate, with long-life fixed assets, there is — literally — a real possibility a building might one day be underwater because of climate change. Given this, investors in real estate may benefit from a better understanding of potential physical and transition risks.

Using the MSCI Real Estate Climate Value-at-Risk (Climate VaR) model we demonstrate how the nature and magnitude of physical risks may differ across assets and portfolios; and highlight the importance of considering transition risk.1

The Different Types of Climate Risk

In general, climate risk considerations in real estate can be divided into two categories, physical risk and transition risk (also known as regulatory risk). Physical risks are related to the damage to buildings from extreme weather events caused by climate change. These changing weather patterns could cause both chronic (steady long-term) and acute (severe short-term) effects that can vary depending on geographic location and could increase the costs faced by investors. Transition risks could arise from efforts to address climate change and the transition to a low-carbon economy. They are based on the carbon intensity of the assets and estimate the potential costs of meeting carbon-reduction targets.

Both physical and transition risk can be assessed under different scenarios. When combined they can provide an estimate of how much of the capital value in a real estate portfolio may be at risk due to climate change. However, investors may still need to drill down into the specific hazard exposures and how financially significant any associated costs could be to fully understand the investment implications of climate risk.

Not all Physical Risks are the Same

We used the MSCI Real Estate Climate VaR model and a sample of 671 assets from the MSCI U.S. Annual Property Index to evaluate two particularly impactful physical risks: Coastal flooding and tropical storms. All the assets sampled were from either the New York City, North New Jersey, Long Island (NY, NNJ, LI) metropolitan area or the Miami-Fort Lauderdale-Pompano Beach (South Florida) metropolitan area. Each were run under the model’s default assumptions.2

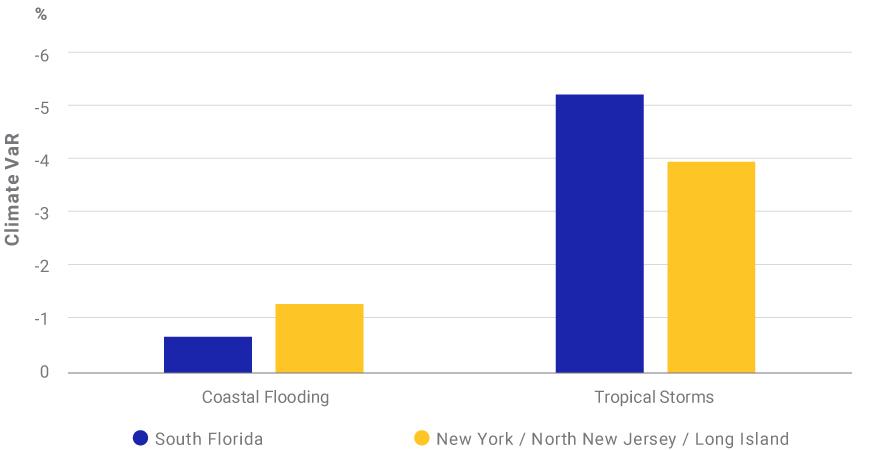

The results suggested that, for this sample of institutionally owned assets, the total Climate VaR due to coastal flooding was lower than for tropical storms in both regions. However, there was some difference in the relative size of these two types of physical risks. In this sample, the Climate VaR from coastal flooding was lower in South Florida than in NY, NNJ, LI (-0.7% vs. -1.3%), but the Climate VaR from tropical storm exposure was higher (-5.3% vs. -4.0%).

The Magnitude and Relative Importance of Physical Risks can Differ

Source: MSCI Real Estate Climate Value-at-Risk model run on a sample of assets from the MSCI U.S. Annual Property Index. Index data as of December 2019 and model run as of July 3, 2020.

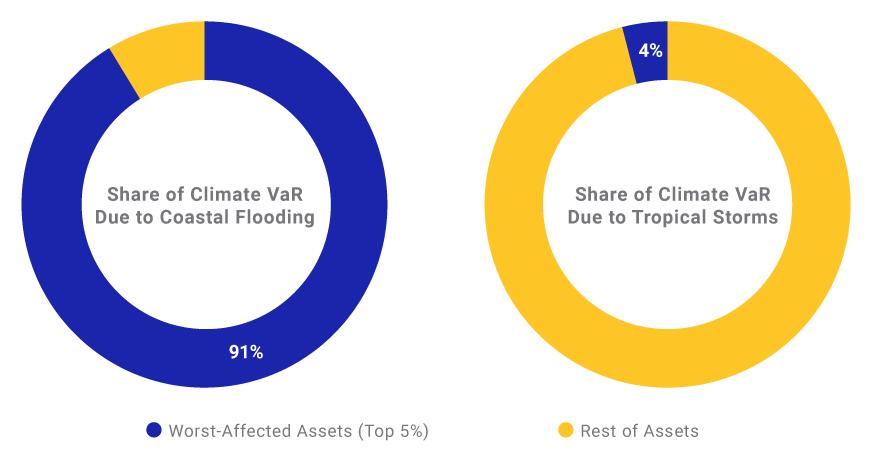

Another distinction was how the different physical risks were distributed across the asset sample. For coastal flooding, we observed that only a handful of assets with the highest exposure were responsible for nearly all (91%) of the estimated Climate VaR. By contrast, the Climate VaR caused by exposure to tropical storms was more evenly distributed across the sample, as illustrated in the chart below.

Physical Climate Risks may not be Evenly Spread Across all Assets

Source: MSCI Real Estate Climate Value-at-Risk model run on a sample of assets from the MSCI U.S. Annual Property Index. Index data as of December 2019 and model run as of July 3, 2020.

This is unsurprising given that there can be considerable variation in the elevation of individual assets even within a relatively small geographic area, and this can largely drive how much coastal flooding risk they are exposed to. The relatively small number of assets that are exposed, however, typically suffer significant damage, leading to a more substantial contribution to total portfolio risk. By contrast, tropical storms affect broader areas more uniformly, so the potential damage is generally more evenly distributed. This illustrates how mitigation strategies may vary by risk type. For instance, careful asset selection may be a way to minimize coastal flooding risk, but market allocation strategies may help as a way to address risk from tropical storm exposure.

Transition Risk may also be a Consideration

While there may be a temptation to focus on physical risks for real assets, transition risk may play an increasingly important role as well. As the world moves towards a low-carbon economy, there are several potential emissions pathways available, with the required emissions reduction for each pathway being inversely proportional to the amount of warming. For example, limiting warming to 1.5 degrees Celsius would require more drastic cuts than a 2 degrees Celsius scenario which would in turn require more cuts than a 3 degrees Celsius scenario.

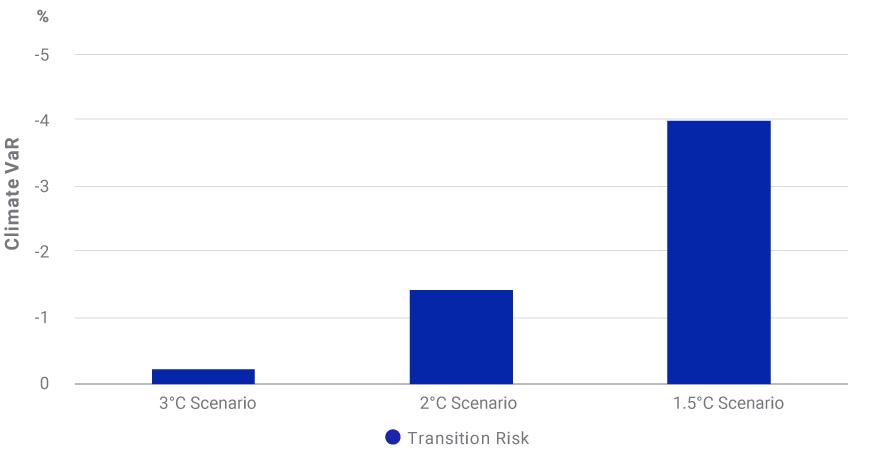

To illustrate how transition risks may vary, we used the same sample of assets to estimate transition VaR under different scenarios. As we expected, the more aggressive reduction requirements under a 1.5 degrees Celsius scenario resulted in the highest VaR at 4.0%, but even under a 2 degrees Celsius scenario, up to 1.4% of the value in these assets was estimated to be at risk from transition costs, according to our model.

Transition VaR for the Asset Sample Under Different Scenarios

Source: MSCI Real Estate Climate Value-at-Risk model run on a sample of assets from the MSCI U.S. Annual Property Index. Index data as of December 2019 and model run as of July 3, 2020.

Irrespective of what pathway is taken, assets and portfolios with higher carbon intensity could face greater reduction requirements over the coming decades, potentially translating into higher transition costs. When those costs are compared to an asset’s value per square meter, it becomes clear that some assets may also be better positioned to absorb those costs.

Given real estate’s long-term nature and fixed locations, the asset class may be particularly vulnerable to climate change. By evaluating their real estate portfolios in terms of different physical risks as well as under different transition-risk scenarios, investors may be able to build a more complete picture of their exposure.

1The MSCI Real Estate Climate VaR model provides a framework for investors (investment managers, asset owners, banks and insurers) to improve portfolio performance, risk management, regulatory reporting and progress towards broader sustainability goals. Developed by MSCI’s Climate Risk Center in Zurich, the framework is closely aligned to the G20’s Financial Stability Board’s Taskforce on Climate-Related Disclosures (TCFD).

2More information on the model can be found in the MSCI Real Estate Climate Value-at-Risk (Climate VaR) Methodology document.

Further Reading

Climate Risk in Private Real Estate Portfolios: What’s the Exposure?

MSCI Real Estate Climate Value-at-Risk (Climate VaR) Methodology

Managing Climate Risk in Investment Portfolios