Social Sharing

Extended Viewer

Carbon Footprinting for Banks

Nov 28, 2023

Measuring financed emissions is an increasingly relevant process that banks may need to consider in the face of rising stakeholder expectations. It is also the first step for banks in understanding the carbon exposure from their lending and investment activities, which may in turn help define strategies and actions for moving toward a net-zero transition.

In this report, the first in a series on net-zero alignment for banks, we present an overview of financed emissions and demonstrate how a bank can use MSCI Climate and Net-Zero Solutions to calculate its financed carbon footprint using a fictitious bank’s balance sheet as an example.

In subsequent reports we will cover other steps in banks’ net-zero alignment journey, including sector-specific physical emissions-intensities calculations, target setting and stewardship.

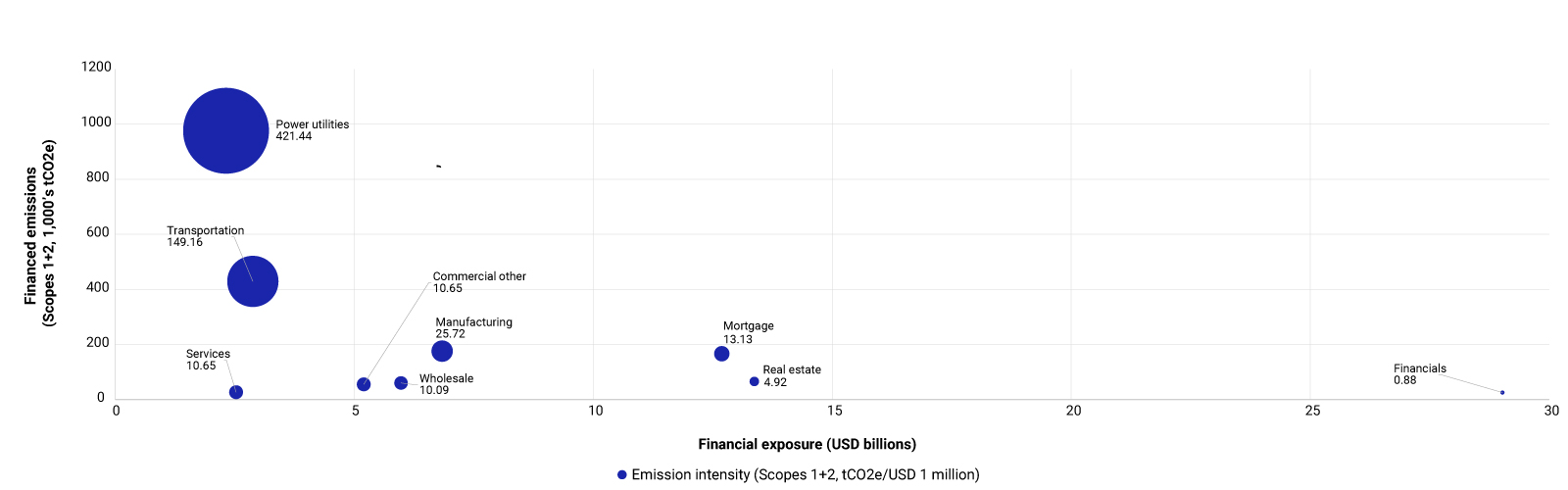

Financed emissions vs. loan size and emissions intensity across sectors in the loan book

Data as of Aug. 10, 2023. Source: MSCI ESG Research

Download report

Research authors

- Guilherme de Melo Silva, Vice President, MSCI Research

- Xinxin Wang, Executive Director, MSCI Research

- Guido Giese, Managing Director, MSCI Research

Total Portfolio Footprinting

Total Portfolio Footprinting means, you’ll benefit from visibility over your whole portfolio with a snapshot of financed emissions for all asset classes and subsets.

Learn moreThe Fed's Pilot — Are Banks Prepared for the Climate Transition?

Regulators around the world are focusing on climate-related scenario analysis to assess banks’ climate-risk exposure and their preparedness for the low-carbon transition. We look at the Fed’s pilot to see how the six biggest U.S. banks stack up.

Read the blog postClimate Stress Tests: Upping the Ante for Banks and Insurers

When institutional investors and financial supervisors seek to understand climate risk exposures of banks and insurers, they look to climate scenario analysis.

Read the blog post