- Corporate loans of the six U.S. banks participating in the Federal Reserve’s pilot climate scenario-analysis exercise currently contribute to over 90% of the total emissions of their lending exposures.

- Using MSCI Climate-Adjusted Probabilities of Default estimates, we found that the transition-risk-adjusted probability of default of an average corporate-loan portfolio would rise 95 basis points under a “net-zero 2050” scenario.

- The six banks’ latest Task Force on Climate-related Financial Disclosures reports indicate that some are more advanced than others in the use of climate risk measurement approaches to inform business decisions.

This January, the Federal Reserve joined central banks and supervisors in 35 other jurisdictions1 in requiring climate-related scenario analysis to help banks understand their risk exposure.2 The six largest U.S. banks — Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and Wells Fargo & Co. — have started to estimate the effects of select scenarios for physical and transition risk on a subset of their loan portfolios, as part of the Fed’s pilot program.3

This and comparable exercises around the world are similar in their objective: They look to build banks’ capacity to assess their climate risk, but do not (yet) inform capital requirements. They do, however, differ in key design choices.4 Although they do not allow for a straightforward comparison of results, the differences may provide insight into regulators’ views of the plausible future pathways of climate policies.

The Fed’s physical-risk module focuses on the impact over one year of a severe hurricane in the Northeast region of the U.S. on banks’ real-estate portfolios. Its transition-risk module — which is where our analysis is focused — emphasizes the impact over 10 years of the Network for Greening the Financial System’s (NGFS) current policies and “net-zero 2050” scenarios on corporate and commercial-real-estate loans. For the transition-risk analysis, the banks are required to project their loans’ probability of default (PD), internal risk-rating grade and loss given default (LGD).

Comparing the biggest US banks' credit exposures and climate-transition risks

The loan portfolios of the six in-scope banks vary in size, ranging from Goldman Sachs’ USD 184.8 billion to JPMorgan’s USD 1.1 trillion, as at the end of 2022. Bank of America and Wells Fargo had the biggest corporate and commercial-real-estate portfolios, respectively. While corporate portfolios on average accounted for less than half (44%) of the banks’ loan books, they contained loans from carbon-intensive sectors such as energy, utilities and mining. Our estimation5 suggested that corporate loans contributed to more than 90% of the banks’ total greenhouse-gas emissions associated with lending. Among the six banks, Morgan Stanley had the highest percentage of loans concentrated in the energy and utilities sectors (5.5%).

How loan balances and emissions broke down by bank

Loan-balance breakdown is based on banks’ public disclosures for fiscal year 2022. Emission data includes Scope 1 and 2 financed emissions for each loan segment (quality score of 5) and was calculated using the MSCI Total Portfolio Footprinting solution, which follows the Partnership for Carbon Accounting Financials (PCAF) principles. Data as of May 24, 2023. Source: MSCI ESG Research

Based on MSCI Climate-Adjusted Probabilities of Default6 estimates, the annualized PD of an average corporate-loan portfolio (using the MSCI ACWI Investable Market Index weighted by enterprise value including cash, or EVIC, as a proxy) would gradually increase over time, reaching 0.29% by year 10 under current policies (baseline).

Under different NGFS scenarios, however, transition risks will have different credit impacts, including changes in costs associated with reducing emissions and revenues generated by developing low-carbon technologies. And through these changes, we found that the forecast PD term structure changed significantly.

In the “net-zero 2050” scenario,7 the transition-risk-adjusted PD immediately rose to 1.03% under the assumption that all expected future climate costs would be priced in instantaneously. Meanwhile, the annualized PD decreased over time, reaching 0.51% by year 10 as companies’ valuation dynamics were conditional on survival.8

Transition-risk-adjusted PD for an average corporate-loan portfolio under different scenarios

The chart comprises constituents of the MSCI ACWI Investable Market Index as of May 24, 2023, weighted by EVIC. Each company's transition-risk-adjusted PD change was calculated based on the downside policy-risk exposure according to all emission sources (Scopes 1, 2 and 3) and upside technology-opportunity exposure. Source: MSCI ESG Research

Banks’ current approaches to managing climate-related financial risks

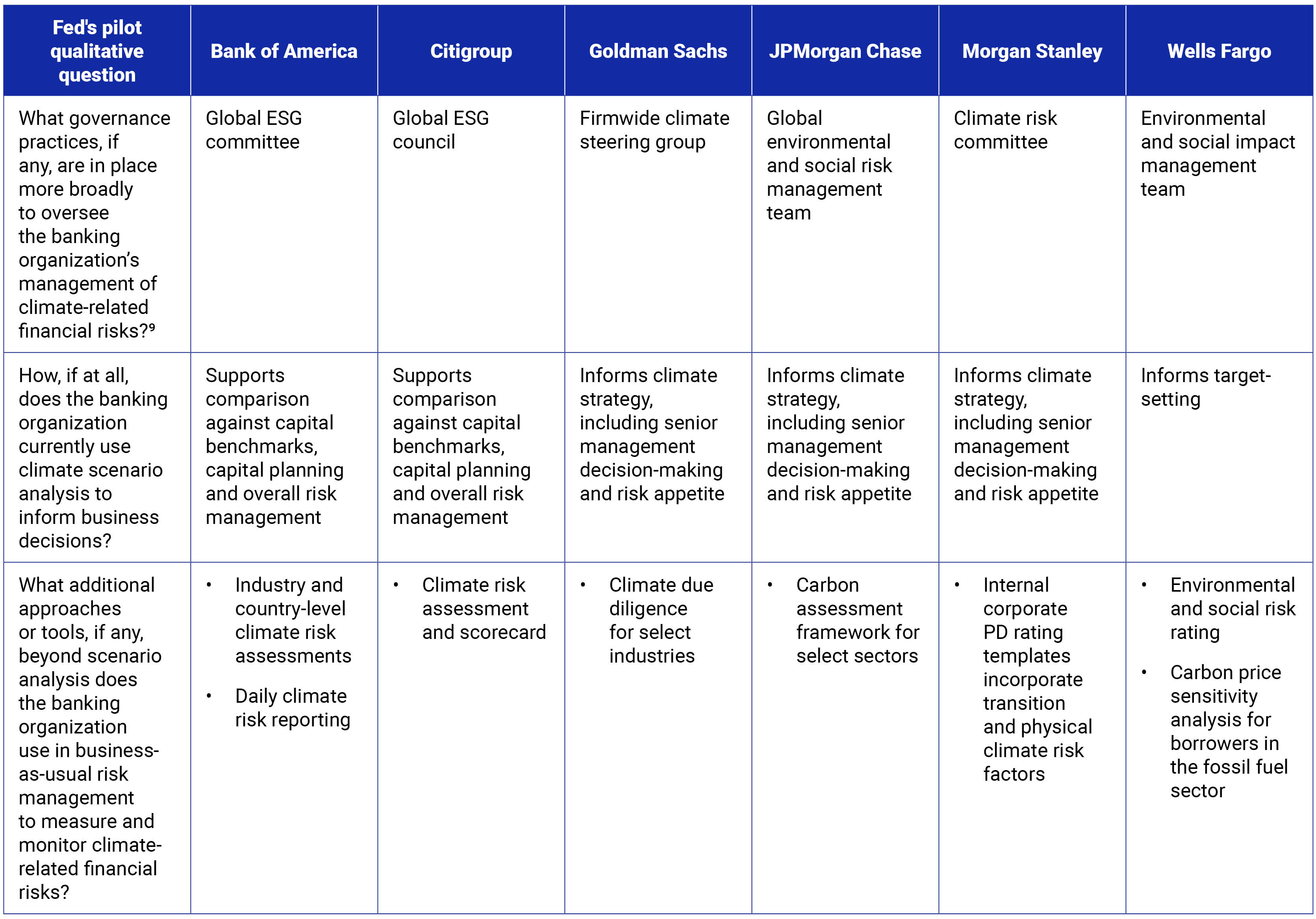

In addition to providing credit-risk projections, the six banks must also respond to qualitative questions on governance and risk management practices to help the Fed understand their current approaches and challenges in evaluating climate-related financial risks. Our analysis of the banks’ most recent Task Force on Climate-related Financial Disclosures (TCFD) reports indicated that all the banks have developed their own environmental credit policies related to oil and gas and power utilities. They were, however, at varying stages of developing and using climate-risk measurement approaches to inform business decisions. For example, Wells Fargo noted it uses climate scenario analysis to set enterprise-level targets for net-zero in 2050 and interim 2030 sector targets, while Bank of America and Citigroup disclosed that they are beginning to integrate the results into firmwide risk management and capital planning.

Select qualitative questions from the Fed’s pilot and banks’ current initiatives

Data as of May 24, 2023. Source: MSCI ESG Research and latest publicly available TCFD or ESG reports

The Fed is expected to publish findings from the pilot by the end of this year. While expectations for banks to develop their approaches to measuring climate risk grow, investors will likely focus on how prepared banks are to weather the impact of the low-carbon transition.

The authors want to thank James Edwards for his contribution to this post.

1Central banks and supervisors across the Financial Stability Board’s and Network for Greening the Financial System’s membership.

2“Climate Scenario Analysis by Jurisdictions.” Financial Stability Board, Nov. 15, 2022.

3“Pilot Climate Scenario Analysis Exercise — Participant Instructions.” Board of Governors of the Federal Reserve System, Jan. 19, 2023.

4Key design differences include scenarios analyzed, time horizons chosen, portfolios in scope and balance sheet assumptions.

5Emissions estimates were calculated using each bank’s loan-balance breakdown by sector and each sector’s emissions intensity (Scope 1 and 2) based on MSCI Total Portfolio Footprinting methodology.

6MSCI’s Climate-Adjusted Probabilities of Default forecast credit risk shocks resulting from climate-induced firm financial shocks. The financial shocks are in turn driven by MSCI Climate Value-at-Risk (Climate VaR) Model’s climate cost and profit forecasts for various climate scenarios.

7Assuming a global 1.5°C target and using carbon prices from the REMIND model under the SSP2 Orderly scenario.

8If the company survives the large initial climate-driven valuation shock, its financial health will on average revert to a less risky position over time.

9Analysis focused on the most senior management body responsible for oversight of climate-related risks.

Further Reading

Climate Stress Tests: Upping the Ante for Banks and Insurers