Extended Viewer

Green-Bond Issuance: MENA vs Global

The green-bond market in the Middle East and North Africa (MENA), while still relatively small, has expanded in the last five years. Between 2019 and 2022, the number of issuances doubled year on year and included high-profile bonds such as Egypt’s USD 750 million sovereign green bond in October 2020.

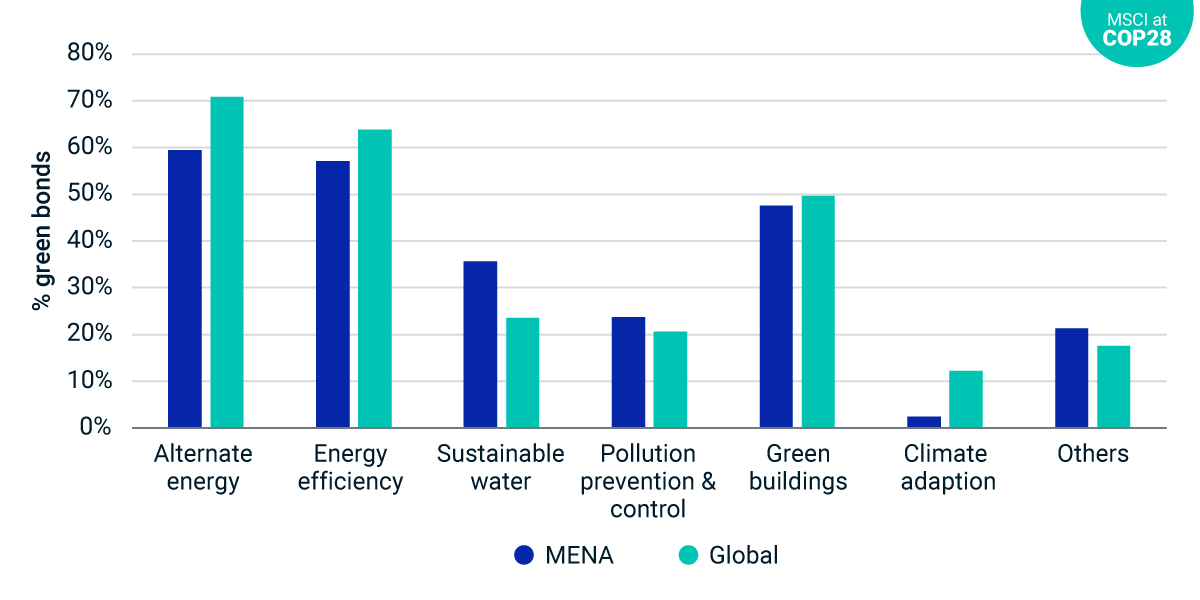

Under the Green Bond Principles, issuers have flexibility to select from a broad range of green-project categories when allocating funds raised from their green bonds.1 We identified seven distinct use-of-proceeds categories, with issuers able to allocate funds across multiple categories. How have green bonds issued by MENA-based entities differed from those issued globally?

Since the first green bond was issued in MENA in 2017, 36% of such bonds in the region have been used to finance sustainable-water projects, compared to 24% globally.2 This possibly reflects an understandable focus on alleviating water scarcity in MENA.3 MENA’s green-bond issuers have, however, been less likely to use this capital to finance renewable-energy projects, with 60% of bonds allocated to this use of proceeds, compared to 71% globally — even though MENA has some of the highest renewable-energy potential in the world.4 We see a similar pattern in climate-adaptation projects, to which only 2% of the region’s bonds direct funds, in contrast to 12% globally.

One area where MENA’s green-bond issuers lead is on credibility. We can assess credibility by verifying whether proceeds are allocated as stated at issuance. We found that 94% of MENA green bonds were followed up with timely allocation reports with clear descriptions of the projects funded.5 This compares to 90% for globally issued green bonds. Based on these allocation reports, projects financed by the proceeds in MENA are consistent with the general categories disclosed at issuance, demonstrating conformity in the utilization of funds.

Allocation of green-bond proceeds by project category

1 Green Bond Principles are a voluntary set of guidelines administered by the International Capital Market Association (ICMA).

2 Our analysis sample includes green-bond issuances before Oct. 31, 2023.

3 “Running Dry: unprecedented scale and impact of water scarcity in the Middle East and North Africa.” United Nations International Children's Emergency Fund, Aug. 22, 2021.

4 “Middle East and North Africa Climate Roadmap (2021-2025) — Driving transformational climate action and green recovery in MENA.” World Bank Group, Jan. 25, 2022.

5 MSCI ESG Research requires a green-bond issuer to release a proceeds-allocation report within a maximum of 18 months from the issuance date.

Related content

Green Bonds and Climate — Towards a Quantitative Method

While examining use of proceeds remains a key element of analyzing green bonds, we highlight four additional metrics to assess these bonds and their issuers in a more quantitative way. They offer a new set of lenses with which to tackle the analysis.

Read moreHow Sovereigns Have Changed the Green-Bond Market

Green bonds’ issuance by governments has increased significantly and changed the green-bond universe and its indexes. Investors have had to adjust accordingly.

Learn moreSustainable-Debt Issuers on a More Credible Decarbonization Path, but Is It Enough?

Corporate decarbonization targets without capital commitments can lack credibility, and issuers of labeled corporate bonds led other bond issuers on climate targets. But just how well did these issuers perform in our assessment?

Explore more