- With the expansion of the global green-bond market, there has been a notable rise in the share of green bonds issued by governments. Sovereign green bonds now constitute over 20% of the Bloomberg MSCI Green Bond Index.

- Sovereign green bonds appear to already offer investors a diverse range of project exposures — such as proceeds used for conservation, biodiversity and physical-risk adaptation.

- Sovereign bonds’ rising share in global green-bond indexes has consequences for the benchmark’s profiles. For example, sovereign green bonds tended to have a slightly higher duration compared to other green bonds.

Since the United Nations’ global summit on climate change in Sharm El Sheikh, Egypt, there has been renewed attention to how governments can fund environmental-development programs — especially in emerging markets. One such financing vehicle that has emerged is sovereign green debt, where governments issue bonds akin to traditional sovereign bonds, but with proceeds ringfenced for green projects. Even amid more challenging conditions in fixed-income markets in 2022, evidence so far still suggests strong investor appetite for sovereign green bonds, with a growing number of countries that issue green debt. The rise of sovereign green debt has significantly changed the green-bond universe and the indexes that track it, however, and investors have had to adjust accordingly.

Sovereign green bonds: A fifth of the green-bond market

Since the launch of the Bloomberg MSCI Green Bond Index1 in 2014, agencies, supranational entities and financial institutions have been the main issuers of green bonds. However, data suggests that this may be shifting. Bonds issued directly by government departments have risen from approximately 7% of the USD 167 billion total market value on Dec. 31, 2017, to over 20% of the USD 986 billion market on March 31, 2023.

The growing share of government-issued green bonds

Dates represent Dec. 31 of each stated year, except for 2023, where the data is as of March 31. “Government-issued” bonds refer to all sovereign issuance, as either local-currency sovereign bonds or hard-currency sovereign bonds. Source: Bloomberg MSCI Green Bond Index, MSCI ESG Research, MSCI’s BarraOne®

Sovereign green bonds: Broadening environmental-project exposure

Some investors have looked to sovereign green bonds as a way to potentially diversify investment opportunities in larger green or public-sector projects, some of which have been traditionally harder to access via corporate issuers, due to their magnitude of financing requirements and geographic scope (i.e., national, regional and supranational investment projects).

These include bonds that finance insect-conservation projects in Germany and national infrastructure to defend against flooding in the Netherlands. These securities could appeal to investors seeking exposure to biodiversity, conservation and climate-adaptation projects, for example.

Government-issued green bonds finance a broad mix of projects

Data as of June 15, 2022. Charts show share of use-of-proceeds categories as defined in the Bloomberg MSCI Green Bond Index’s methodology document. The charts take all bonds in the index as of Aug. 8, 2022, and count the categories mentioned across all bonds. The charts are not weighted by bond size or constituent weighting in the index. “Other issuer types” include local authorities, financial institutions, utilities, agencies, corporations and supranationals. Source: MSCI ESG Research

How the market for sovereign green bonds has evolved

- More issuers have begun participating: Since the first sovereign green bond in 2016, issued by Poland, more than 20 sovereign issuers have joined course, ranging from Germany to Chile.

- Issuance volume per issuer has increased: In addition to the number of sovereign issuers, some governments have issued green bonds on a semiregular basis (e.g., annually).

- Role of the public sector has been increasingly important: Governments have become noteworthy green-bond issuers, in part because of the state’s unique role in spearheading climate-transition projects (e.g., large-scale national infrastructure).

- Other sustainability structures have arisen: Some sovereign issuers have also explored sustainability-linked-bond structures in recent quarters (e.g., Uruguay).

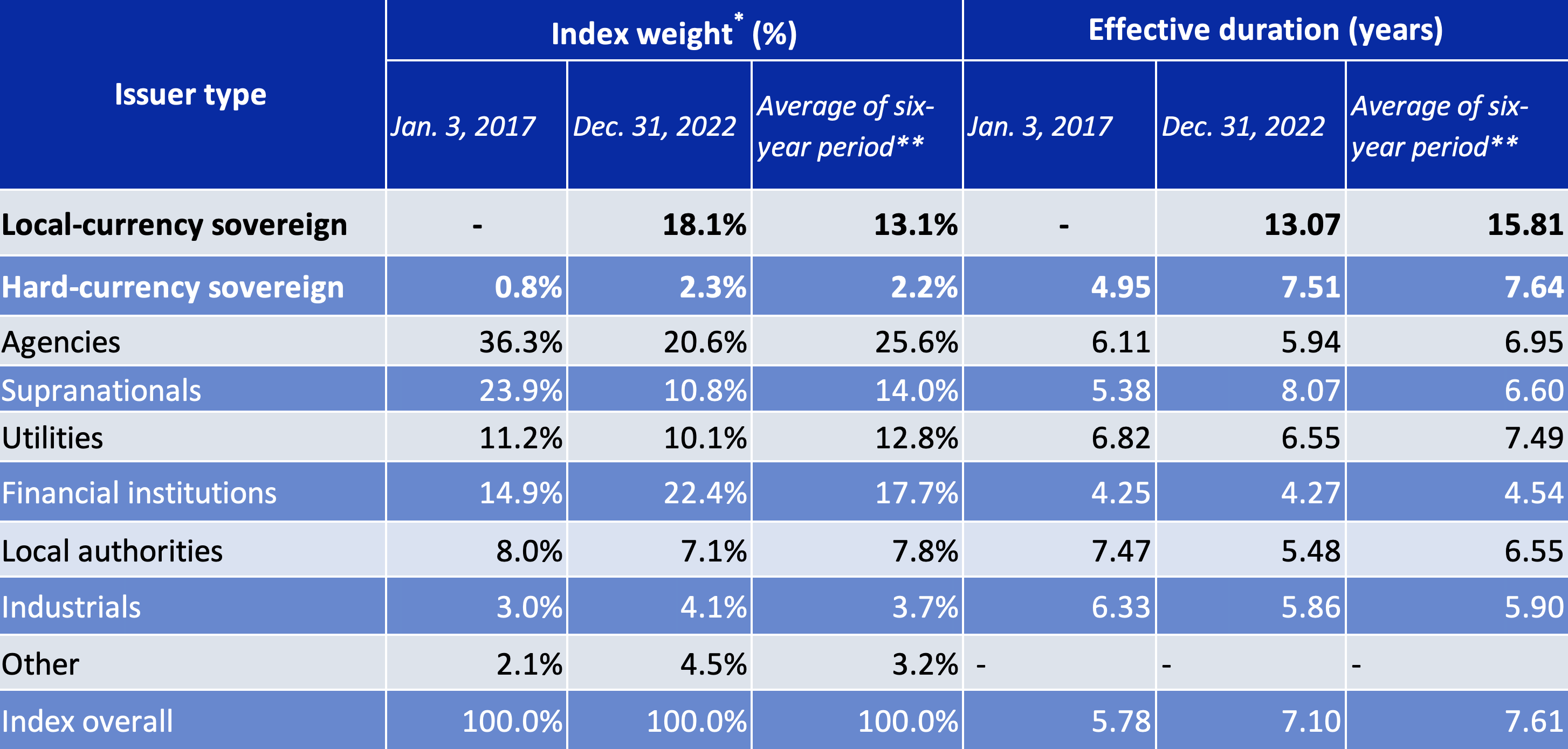

Changes to the index’s risk and return profile

The proportional increase in sovereign issues in the Bloomberg MSCI Green Bond Index has affected the index’s risk and return profile — so far, mainly through the higher average effective duration of sovereign green bonds compared to other issuer types, as shown in the table below.

How the effective durations and weights have changed within the index

*Index weight refers to weight within the Bloomberg MSCI Green Bond Index on the date stated. **Six-year period from Dec. 31, 2016, to Dec. 31, 2022. Source: MSCI ESG Research, MSCI BarraOne® Analytics

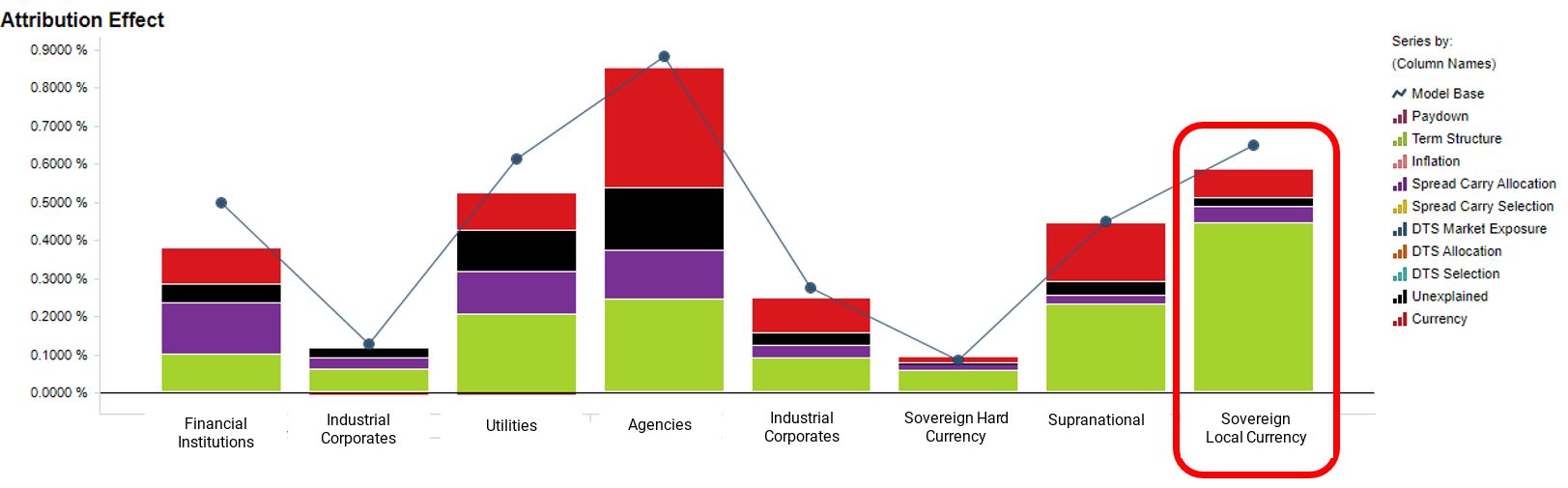

The increase in weight of sovereign green bonds between 2018 to 2023 likely also contributed to an increase in the index’s sensitivity to interest-rate movements. As such, government-issued green bonds were one of the major contributors to the index’s positive returns in USD from 2017 until late 2021, a period of relatively low and stable global interest rates.

Performance attribution of the Bloomberg MSCI Green Bond Index, January 2017 to November 2021

Data from Dec. 31, 2016, to Oct. 31, 2021. This analysis uses the MSCI Fixed Income Performance Attribution. Sources: MSCI ESG Research, MSCI BarraOne® Analytics

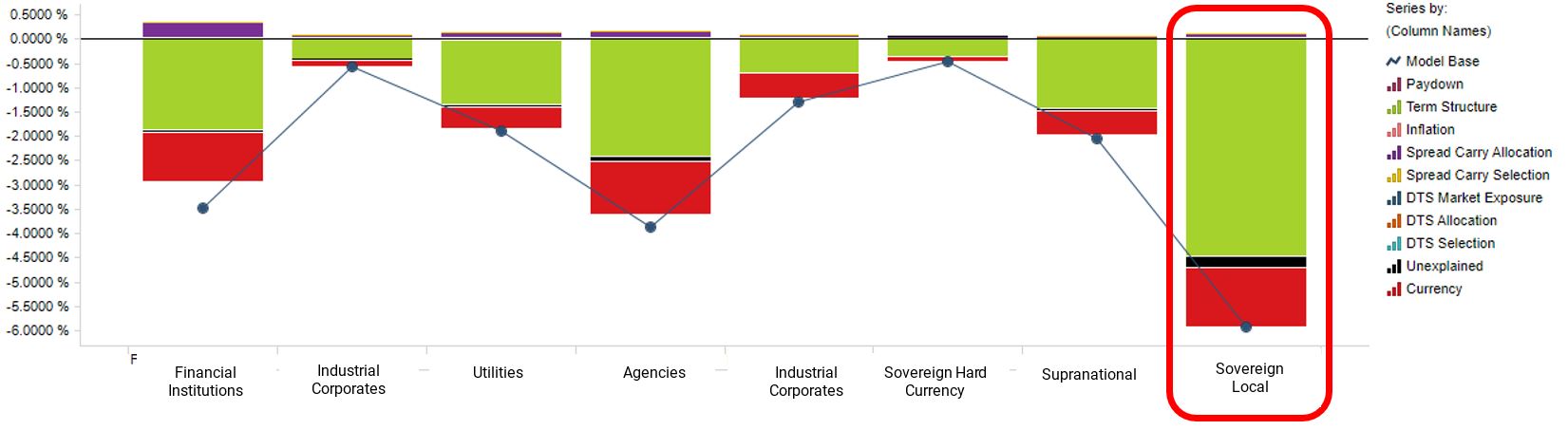

Performance attribution of Bloomberg MSCI Green Bond Index, November 2021 to January 2023

Data from Oct. 31, 2021, to Dec. 31, 2022. This analysis uses the MSCI Fixed Income Performance Attribution. Source: MSCI ESG Research, MSCI BarraOne® Analytics

In summary, sovereign green bonds have become a bigger part of green-bond indexes. Investors may wish to note the difference in risk profile of sovereign green bonds — and the influence sovereigns may have on their benchmarks.

The authors thank Jarrad Linzie, Mehdi Alighanbari, Andras Bohak, Michael Ridley and Meghna Mehta, among others, for their contributions to this blog post.

1The Bloomberg MSCI Green Bond Indexes capture approximately 83% of all self-labeled investment-grade green bonds issued between Jan. 1, 2014, and May 31, 2022. See: “Bloomberg MSCI Green Bond Indices.” MSCI and Bloomberg, Sept. 7, 2021.

Further Reading

Navigating the Complexities of ESG Bonds

Total Portfolio Footprinting to Transform Green-Bond Emission Accounting