Extended Viewer

Banking on Commercial Real Estate

Worries about U.S. banks' exposure to souring commercial-property loans have weighed on bank stocks, particularly regional ones. In the four months following the collapse of two lenders in March (and another failure in May), the MSCI USA Banks Index fell 15%, compared to a 12% increase for the MSCI USA Index.1

Using data from MSCI Mortgage Debt Intelligence, we examined the commercial-mortgage originations of the seven regional banks and nine diversified banks in the MSCI USA Banks Index to identify exposures to the property types and markets under pressure.2

Comparing originations

Regional banks constituted 10.8% of the index’s closing weight at the end of July but accounted for 12.4% of the commercial-mortgage volumes originated by index constituents over the last decade.3

These regional banks were less active in office lending over the last decade, with only 18% of their originations in office, compared to 26% for diversified banks. Regional banks also originated a lower share in retail, industrial and hotels. They were more active in multifamily, with 47% of their volume in this property type, compared to 29% for diversified banks.

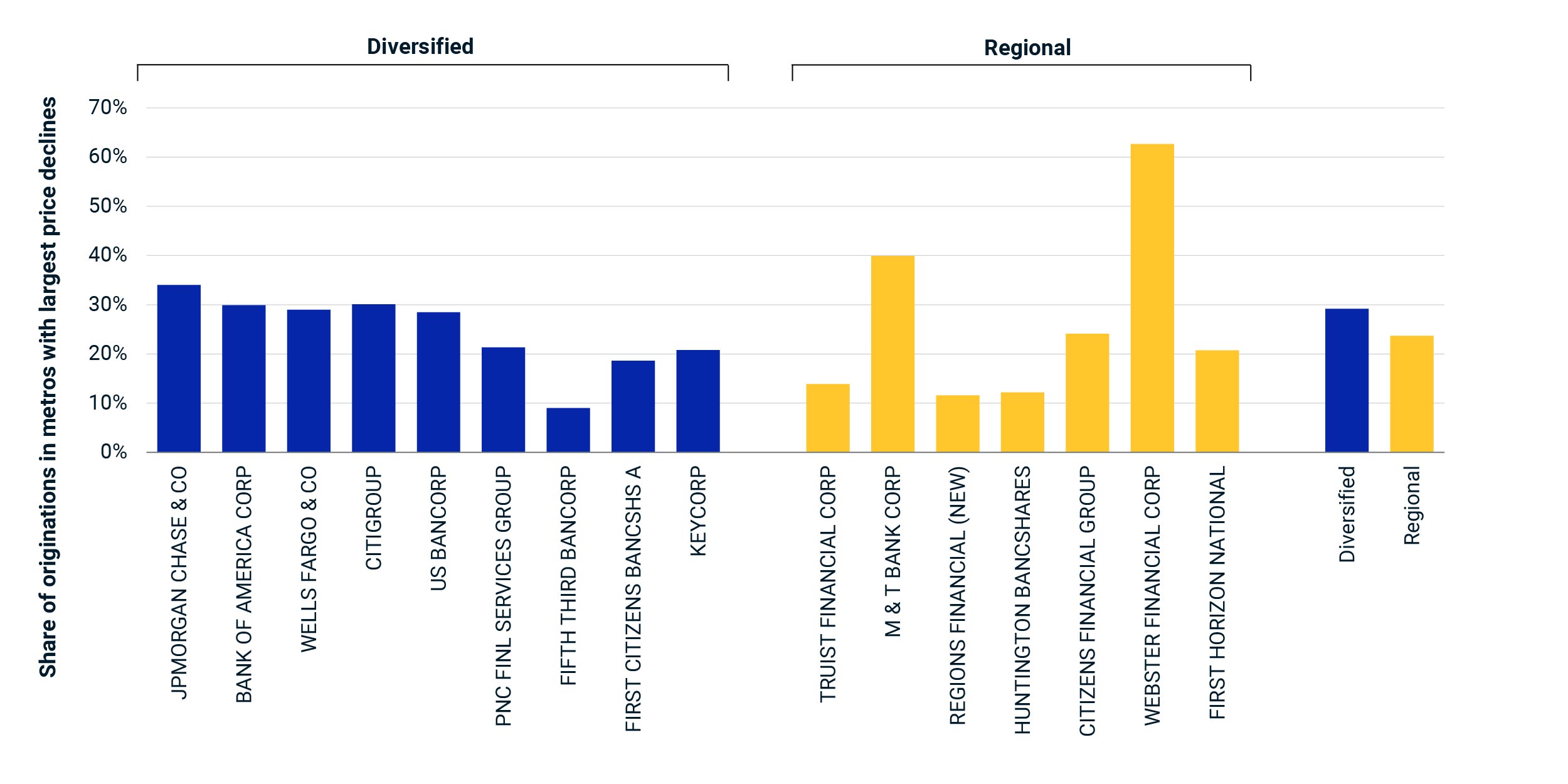

Looking at more recent originations and by geography, in the last 24 months diversified banks originated 29% of their volume in the 10 metros that recorded the largest overall price declines in the past year.4 Regional banks originated 24%, though shares varied significantly across the individual banks analyzed. Mortgages originated in these markets recently may be more vulnerable due to declining asset values.

The author thanks Adam Schreiber, Jim Costello and Michael Savino for their contributions to this post.

Composition of originations by property type

Share of recent originations in metros with steepest price drops

1 Feb. 28, 2023, to June 30, 2023.

2 Diversified banks are large, geographically diverse banks.

3 July 2013 through June 2023.

4 Originations from July 2021 through June 2023. Price declines as measured by the RCA CPPI (commercial property price indexes) for office, industrial, retail and apartment; 12 months through June 2023.

Related content

Distress in US Commercial Property Increased Further

The balance of distress in the U.S. commercial-property market rose to USD 71.8 billion at midyear, marking the fourth consecutive quarter of increase.

Explore moreLooking for Loan Trouble

Refinancing commercial-property loans has become tougher because of an increase in interest rates and more-conservative lending terms.

Read moreFewer Lenders Active in US Commercial Mortgages

The debt markets have come into sharp focus with the failures of Silicon Valley Bank and Signature Bank.

Learn more