- Refinancing commercial-property loans has become tougher because of an increase in interest rates and more-conservative lending terms.

- Different trends in asset-price growth and loan-to-value ratios mean that not all asset classes and markets will face pressure equally.

- Using a high-level estimation based on value growth and loan terms, one can home in on the market and asset-class combinations that may face more trouble.

Investors in commercial real estate are alternatively worried or excited about the repricing of assets over the last year. Those who are excited are trying to determine which assets are most likely to default and may be available on the cheap. The answer may lie in the timing of loan maturities.

Simply because prices have fallen in recent quarters does not mean that every owner will default. For instance, if an investor had purchased an asset long before the run-up in asset values in 2021 and 2022 — and even if the headline figures are down a bit — the asset may still have a healthy level of equity growth such that one will be able to refinance. With just the headline figures on market prices and typical loan-to-value (LTV) ratios, one can calculate some high-level estimates of where problems may arise.

Analyzing market-sector combinations

Before the pandemic, the Manhattan office market was the largest, most liquid investment market in the U.S. and arguably the world (though Central London may disagree). The Dallas apartment market overtook Manhattan offices in recent years owing to the property-type preference and a healthy story of tenant demand in the area. Comparing these and market and sector combinations can shed light on where the most pain may be felt.

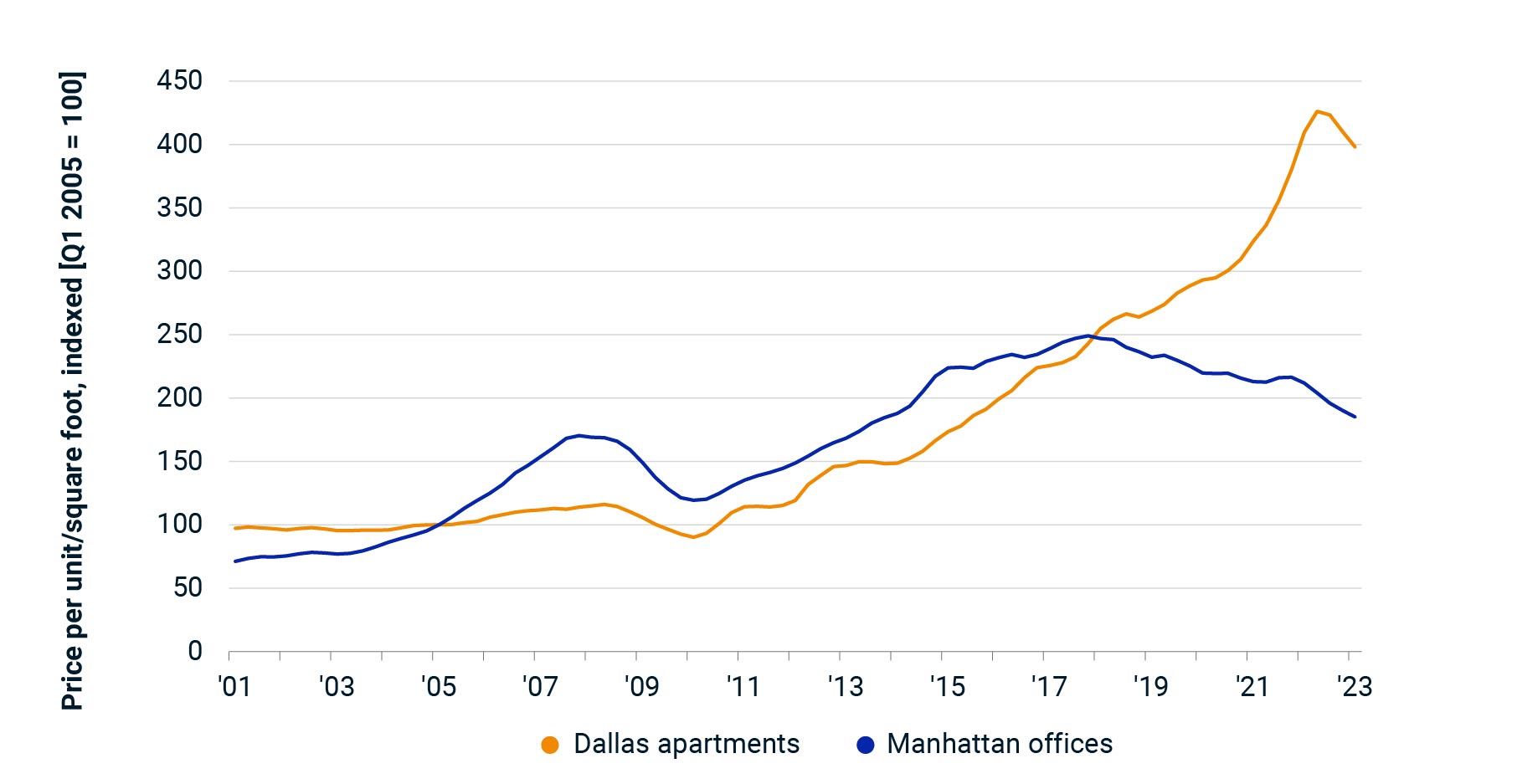

Measuring asset prices using the RCA Hedonic Series, we see that both of these market-sector combinations have shown healthy price growth over the last 22 years. Manhattan office posted a 4.4% compound average growth rate over the period, while Dallas apartments posted a 6.6% pace. The falling-interest-rate environment over this extended period provided a boost to all asset values, but as interest and mortgage rates have risen since their pandemic lows, all asset prices are facing challenges.

Price trends

Source: MSCI Real Capital Analytics, RCA Hedonic Series

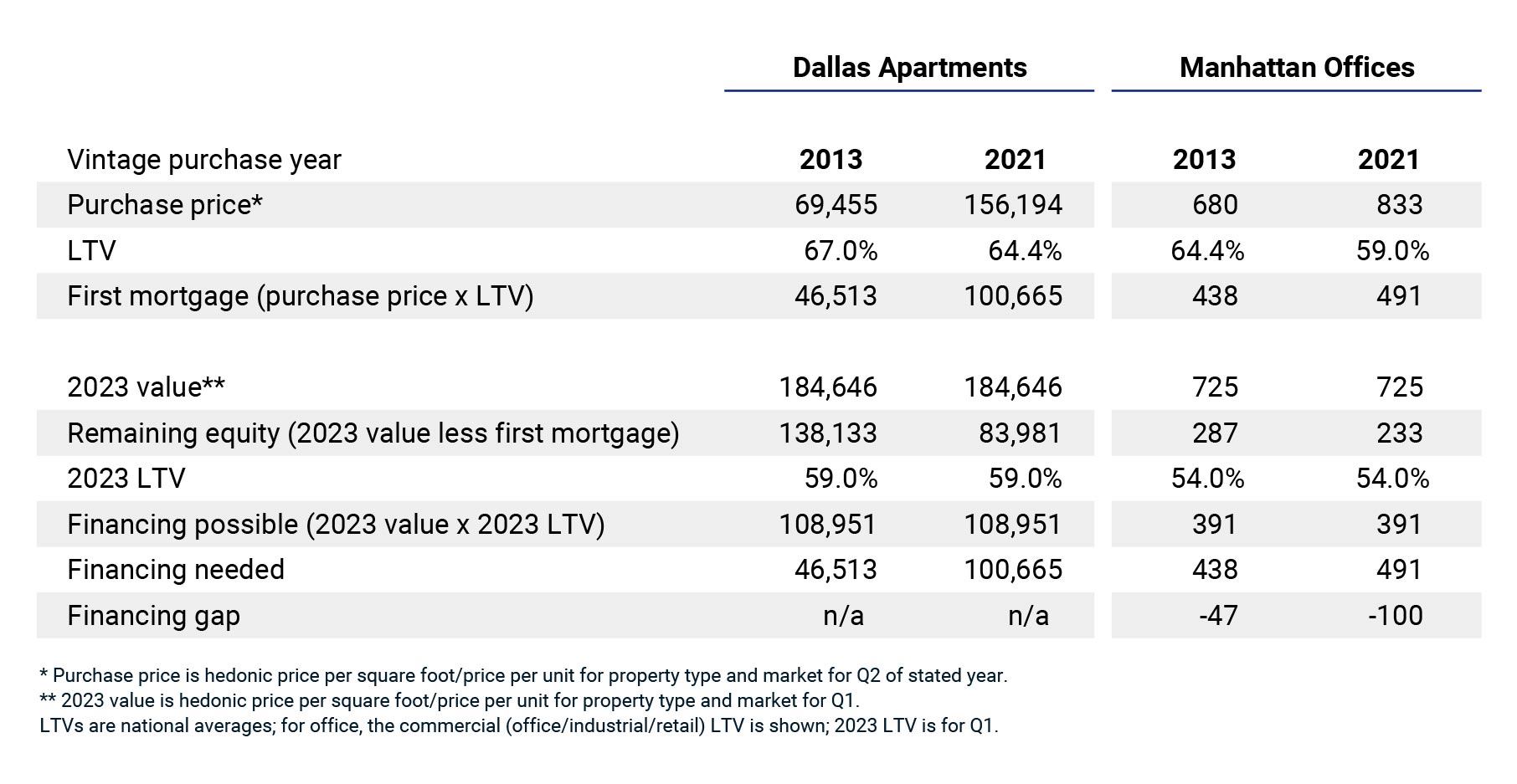

The LTV ratios that lenders will use are often jointly determined with interest rates; and as rates have risen, lenders are less willing to extend credit given uncertainty about valuations. An apartment borrower in Dallas in 2021 could, on average, have gotten a loan at a 64.4% LTV ratio, but only get 59.0% so far in 2023, according to MSCI Real Capital Analytics Mortgage Debt Intelligence.

Assuming that a borrower received an interest-only loan in 2013 and maxed out on the LTV, given a USD 69,455 price per unit for Dallas apartments, it would have resulted in a first mortgage of roughly USD 46,513. (Also, to simplify things, we assume that there is no mezzanine portion of the capital stack.) Given the price growth between 2013 and 2023, this investor could refinance in 2023 and not need to put any additional equity into the deal.

The view from Manhattan offices

Conditions are not looking as good for Manhattan office properties. An investor who bought at USD 680 per square foot in 2013 has seen a cumulative 4.9% gain in pricing since the initial purchase. The achievable LTV has plummeted in the interim, however, to 54.0% from 64.4%. The USD 438 per square foot that could have been financed in 2013 has now fallen to USD 391 in 2023. Assuming the maximum loan possible, this investor would need to find an additional USD 47 per square foot of new equity to refinance at recent levels.

An investor who may be worried likely bought into the Manhattan office market more recently. An asset purchased in 2021, for instance, has seen a 15% decline in value so far. Combine that drop with the lower LTVs on offer, and an investor would need to find an additional USD 100 per square foot to make refinancing work. This figure would represent roughly 14% of the asset value.

Refinancing scenarios

Source: RCA Mortgage Debt Intelligence

With just these headline numbers on prices and LTVs, one can see that even an investment with some value growth along the way can be swamped by changes in the financing situation. This analysis assumes of course that financing is available at some price. Conditions have moved fast in recent weeks, and these benchmarks are largely tied to mortgages originated in the first quarter of 2023. My conversations with clients in recent weeks suggest that few lenders are willing to take on the risk of the debt portion of the capital stack for offices.

Not every loan is going to break bad. Again, many simplifying assumptions were used here to frame the issue. One can quibble about the use of interest-only loans as an example, as well as about the amortization that has occurred over the life of a loan. But even a simplified scenario can help investors swing the spotlight to market and sector combinations that may face trouble.

Further Reading

Prices of All Major US Property Types Fell in April