Extended Viewer

Banking Crisis: Is a Storm Brewing or Behind Us?

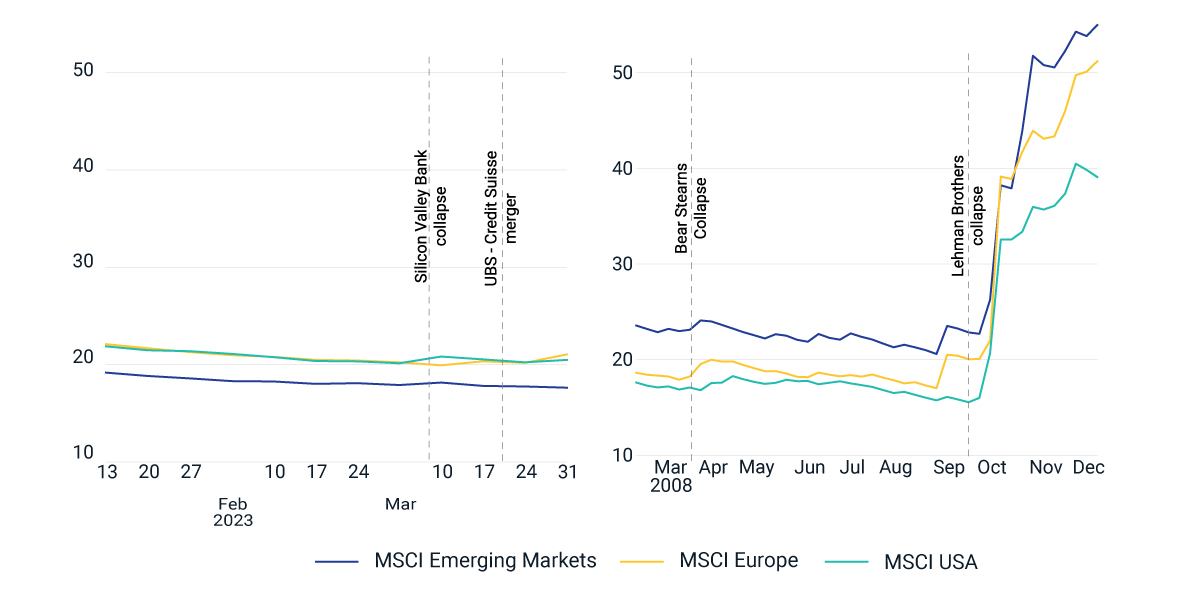

Despite turmoil in the U.S. and European banking industries, the broader equity market was resilient, with the MSCI USA and MSCI Europe Indexes returning 3.6% and 2.5%, respectively, in March. As shown in the left panel of the first exhibit below, realized equity volatility also remained steady, with jumps of less than one percentage point for U.S. and European equities. Although much has changed since 2008, including stricter regulatory requirements, a comparison with the global financial crisis can help put things in perspective: In the month following the collapse of Lehman Brothers in September 2008, the U.S. equity market witnessed a steep increase in realized-return volatility of 17 percentage points, to a level of 33%.

What does the option market indicate?

Implied-volatility metrics linked to the MSCI EAFE Index and S&P 500 suggest that uncertainty persists. Right after Silicon Valley Bank’s (SVB) default, EAFE and U.S. options’ implied volatility1 had a steep inversion in term structure, due to elevated short-term versus long-term market uncertainty. Since then, short-term (30-day) volatility has come down quickly and the long end (730-day) has also returned to a level only slightly higher than its pre-crisis level. However, the spread between the short and long ends opened significantly, to 2.0% in the U.S. and 2.8% in EAFE — compared to one-month pre-SVB crisis averages of 0.2% and 1.3%, respectively. This suggests that investors are more concerned about the medium- to long-term trajectory of equity markets.

Equity volatility rose modestly after recent bank collapses, compared to 2008 Lehman collapse

Option-implied volatility’s term structure steepened

1 Options linked to the MSCI EAFE Index and S&P 500 have been used for EAFE and U.S. calculations.

Related content

Banking on the Brink of Crisis? Three Scenarios for Investors

The broad equity market remained relatively resilient in the wake of recent bank failures, but how might it spill over in the coming months? We present three scenarios for potential risks and opportunities from the recent banking-industry upheaval.

Learn moreIs Silicon Valley Bank’s Failure a Sign of Deeper Trouble?

Factor analysis of corporate credit spreads following the failure of Silicon Valley Bank shows the bond market has recognized both issuer-specific and systematic consequences.

Read moreBanks Have Investors Feeling Déjà vu All Over Again

Banks failing, another sold and governments stepping in to backstop the fallout. Add to that a global economy coping with high inflation and still shaking off the COVID-19 cobwebs and, on top of that, regularly scheduled meetings for two major central banks. Our panel of MSCI experts helps put these events into context for investors managing multi-asset-class portfolios.

Explore more