Extended Viewer

Is Silicon Valley Bank’s Failure a Sign of Deeper Trouble?

Silicon Valley Bank’s (SVB) failure on March 10 was, by some accounts, a consequence of its unique business model serving technology start-ups, and therefore may be an isolated failure.1 Others have noted that its failure has heightened investors’ fear of trouble among other regional banks, and more generally among interest-rate-sensitive companies, suggesting that trouble may lie ahead for the broader market.2 The subsequent failure of Signature Bank, with a large crypto exposure, increased investor concern.

What do the data show?

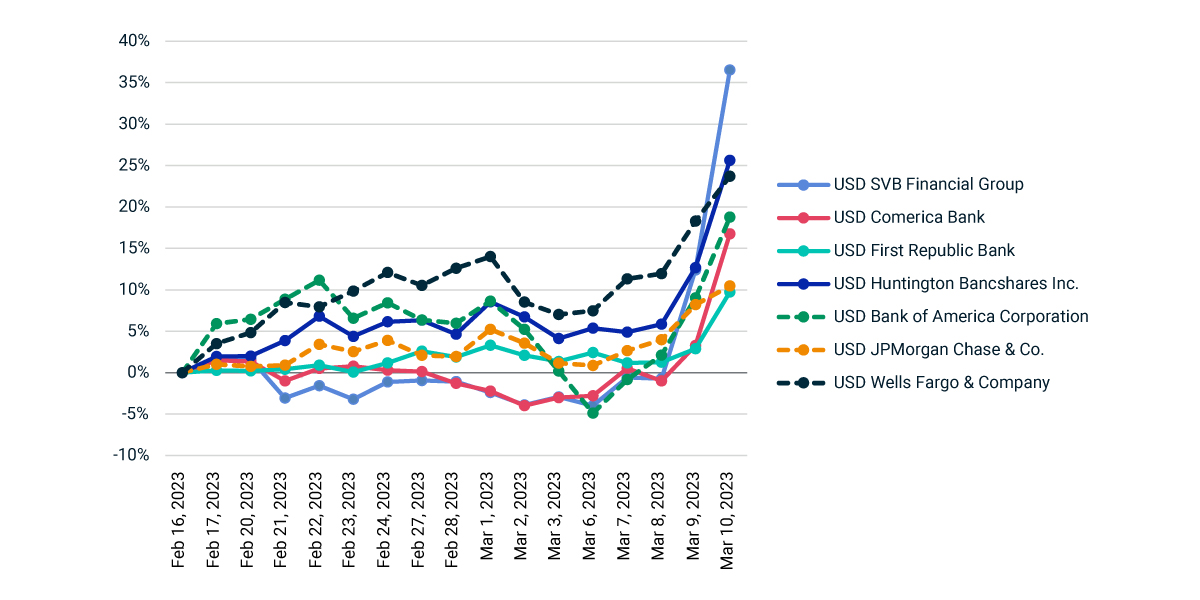

A factor analysis of corporate credit spreads shows that the bond market has recognized both issuer-specific and systematic consequences. The issuer-specific effects on SVB credit were large, but SVB’s collapse also led to a broad selloff in the banking sector.

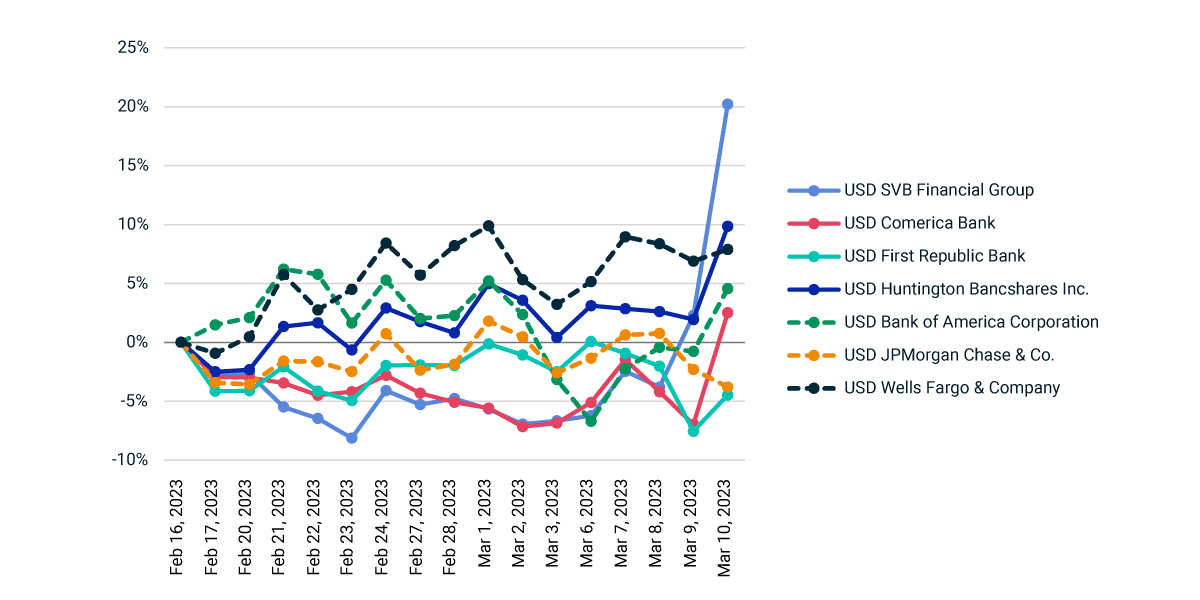

As of market close on March 10, we find that regional banks suffered more, relative to national banks. Looking at the issuer-specific return of a sample of three national and three regional banks’ bonds, issuer-specific spread remained flat or tightened for national banks JPMorgan Chase & Co. and Wells Fargo & Company. The exception for national banks was The Bank of America Corporation, whose issuer-specific spread widened on Friday after tightening on Thursday. In contrast, the issuer-specific spread of all three regional banks in the sample (Comerica Bank, First Republic Bank and Huntington Bancshares Incorporated) widened significantly.

It's not clear whether SVB’s or Signature Bank’s failures will lead to broader financial panic, or what it means for the creditworthiness of other regional banks. Historically, one large move in issuer-specific spread has been followed by another large move (in either direction).3 Noting further differentiation among credit spreads of banking issuers may be on investors’ horizons.

SVB’s collapse led to a broad sell-off in banking bonds

Regional banks were more negatively affected than national banks

1 Matt Levine, Startup bank had a startup bank run, Bloomberg, March 10, 2023.

2 Eric Wallerstein, Matt Grossman, and Gregory Zuckerman, Wall Street Braces for the Next Silicon Valley Bank, Wall Street Journal, March 12, 2023.

3 Alexei Gladkevich and Zach Tokura. “FI400S Factor Model Validation. Empirical study of historical model performance.” February 2018.

Related content

Factors and Corporate Bonds: Single and Multi-Factor Approaches to Corporate Credit

Investors have increasingly turned to equity factors as building blocks for their stock portfolios as a way to measure performance, analyze risk exposures or seek enhanced returns.

Learn moreWill the US Government Default?

The debt-ceiling debate has heated up in Congress, and the U.S. government’s ability to borrow could be exhausted sometime between July and September. But what does the market for credit-default swaps say about the likelihood of U.S. default?

Read moreMatching Portfolios and Clients’ Expected Returns, with Factors

Wealth managers face the challenge of matching clients’ objectives with an ever-growing set of investment products. Standard practice is to build strategic asset-allocation models based on broad capital-market assumptions. But we present a new approach.

Explore more