Extended Viewer

Are Private Capital’s Cash Flows Back to Normal?

Back in 2022, we noted a precipitous drop in private-capital distributions and asked “where have all the cash flows gone?” Since that time, private-market investors experienced a sustained slump in distributions across buyout and venture capital and, to a lesser extent, private credit. We now look at the recent apparent recovery in private-market cash-flow activity and what that could mean for limited partners (LPs).

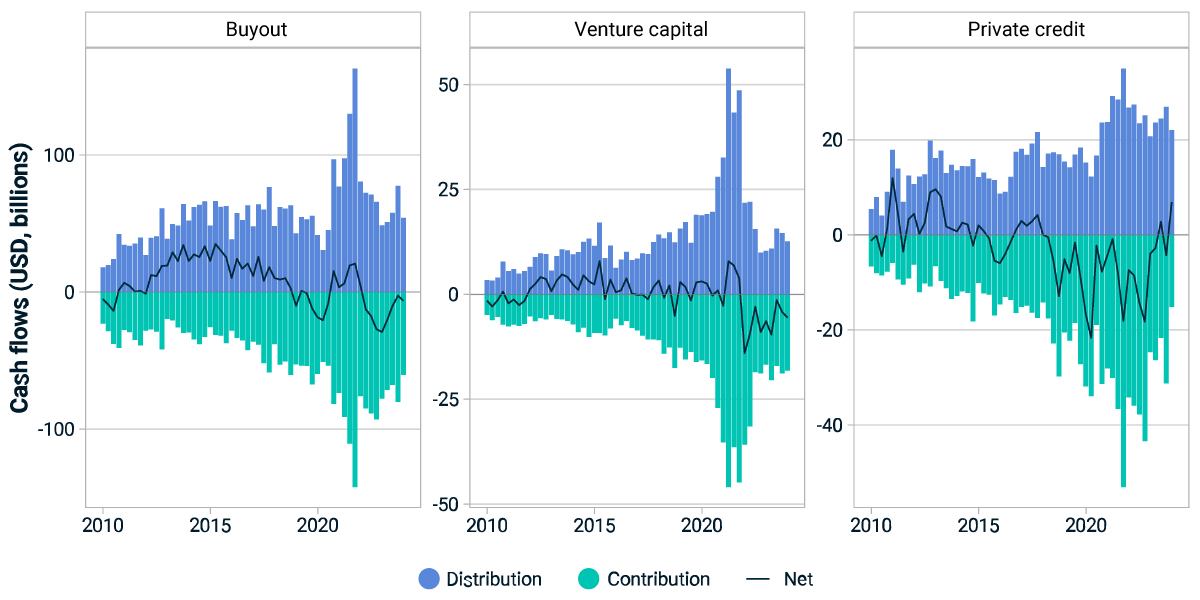

Strategy-wide, buyout and venture capital have been calling capital on net since 2022, and private credit has been doing so even longer. For LPs nervously awaiting liquidity, recent quarters have offered glimmers of hope, with distributions finally recovering from several depressed quarters. As we discussed in our earlier research, however, simply adding up the universe dataset’s cash flows is probably not the best approach an LP could take: Most portfolios are weighted quite differently from the aggregate private market, especially when vintage capitalizations grow dramatically over time, as in venture capital and private credit.

Mature portfolios have tilted more toward distributions

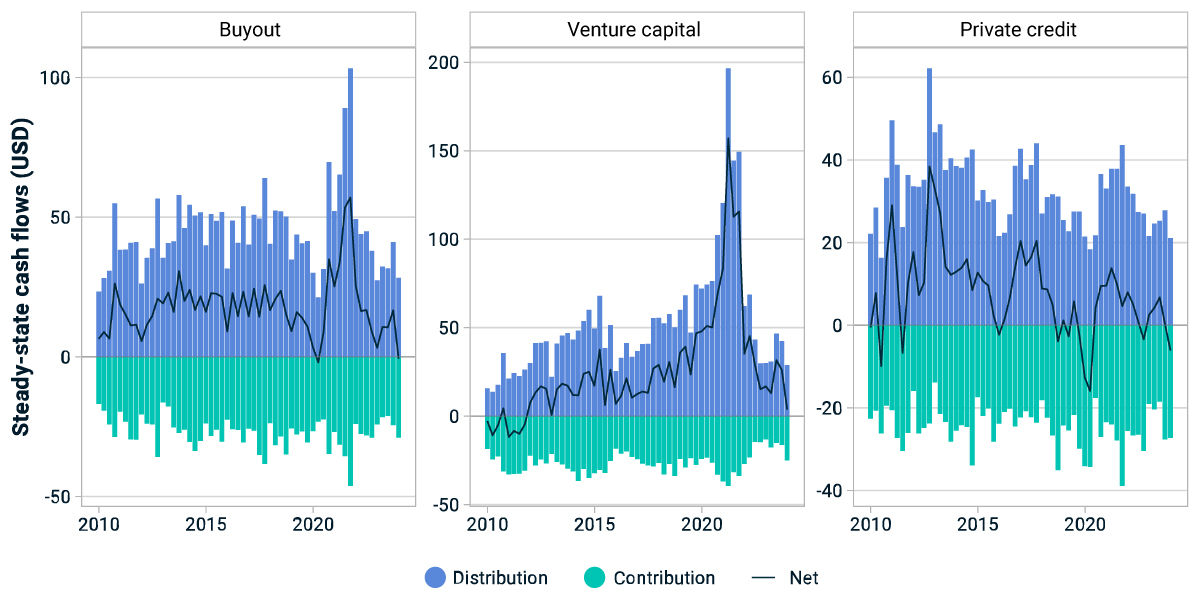

While aggregate cash flows are the appropriate way to view the market, we should revisit our “steady-state” portfolio, which untangles changes in cash-flow behavior from changes in fund-age demographics. We reweight the private-capital universe to create such a portfolio — one that emulates an LP allocating USD 100 to each vintage of an asset class.

In 2023, diminished capital-call activity and an uptick in distributions boosted steady-state net distributions. However, across all three of these asset classes in the first quarter of 2024, steady-state distributions faltered while contributions held steady, dampening nascent optimism for net cash flows. Persistently high interest rates have bolstered private-credit cash flows to LPs, though capital-call activity in late 2023 and early 2024 has fully offset this tailwind.

While unadjusted cash flows point to early signs of a rebound in distributions, after adjusting for demographic changes in the private-capital universe, distribution activity clearly remains depressed relative to historical norms.

Quarterly cash flows across private-capital strategies

Quarterly cash flows from hypothetical steady-state portfolios

Related content

Are Subscription Lines of Credit Still Worth the Cost?

Subscription lines of credit have become widespread across buyout, private-debt and real-estate funds, but elevated interest rates are prompting investors to reassess their sub lines’ value. How much has it cost funds to service this debt?

Learn morePrivate Capital in Focus: Q1 Performance and a Dive into Distributions

We summarize the performance of major asset classes based on the latest update of MSCI’s private-funds data universe and explore trends in distributions — a key concern for asset owners.

Read moreInvestment Trends in Focus: Quarterly Roundtable Q2 2024

Our panel discusses what’s happening in public equity markets, the importance of governance and of sustainable investing more broadly, as well as the growing world of private assets, including private credit and the ways in which these assets might come to resemble their public counterparts more than they do today.

Explore more