Extended Viewer

A Conundrum for the Fed

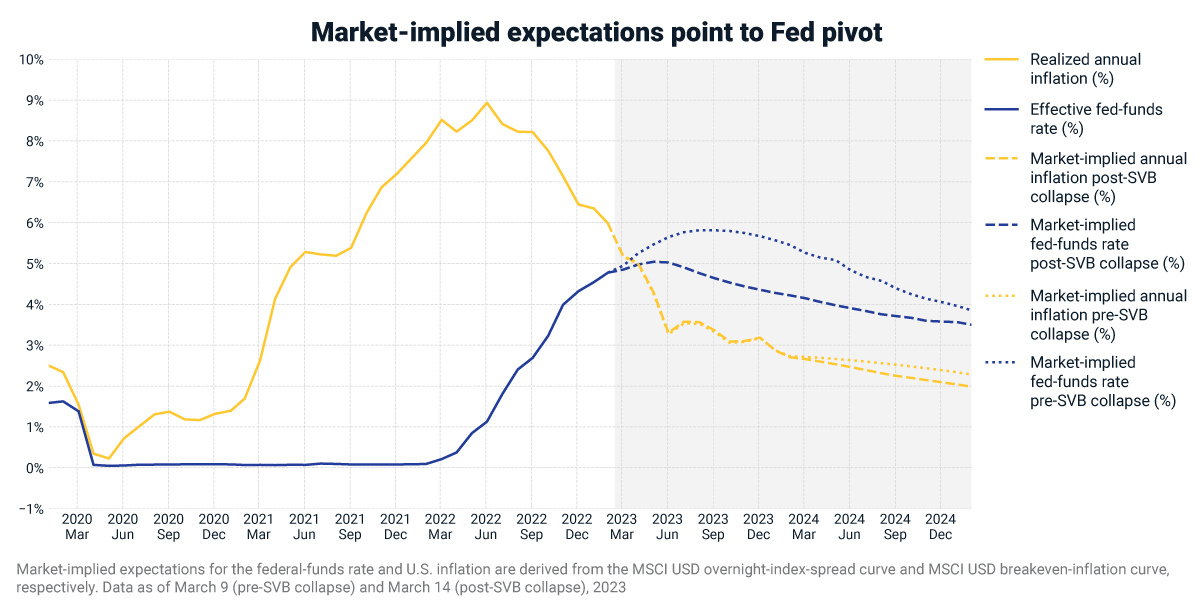

The collapse of Silicon Valley Bank (SVB) triggered a sharp sell-off in the stocks and bonds of regional U.S. banks and a rally in Treasurys, with market-implied expectations for the federal-funds rate now significantly lower than before SVB’s demise (see exhibit below). Ahead of the upcoming Federal Reserve meeting, investors’ expectations, as of Tuesday, March 14, indicated a roughly 70%/30% chance between a 25-basis-point rate hike and no hike at all.1 With the March 14 data release indicating U.S. consumer prices rose 6% year-on-year, it remains to be seen how the Fed will balance financial stability and its battle against inflation: Will the USD 25 billion Bank Term Funding Program be enough to restore stability, and can the Fed continue raising rates, or will the Fed pivot?

Not a Lehman-level crisis

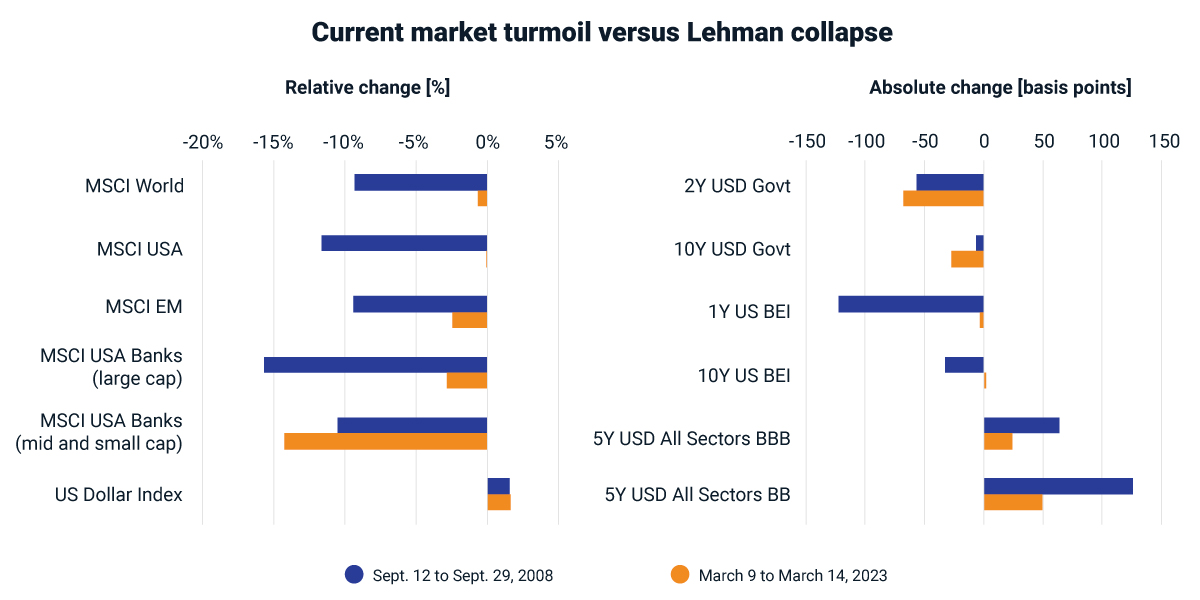

Returning to our earlier scenarios for 2023, some could argue that a “hard landing” has now become more likely. While those scenarios focused on market performance over the full year, investors may also want to consider drawdown risks.2 The recent market turmoil showed similar — though generally less severe — risk-off dynamics as during the aftermath of Lehman Brothers’ collapse, with stocks and corporate bonds selling off, Treasurys rallying and the U.S. dollar strengthening. There are important differences, however: The effects on the broad equity and corporate-bond markets have been less strong; U.S. mid- and small-cap bank stocks experienced a steeper sell-off than in 2008; and breakeven-inflation rates dropped significantly less.

The upcoming Federal Open Market Committee meeting on March 21-22 will test the Fed’s resolve in its fight against inflation. The delicate balance between inflation and financial stability makes it uncertain how the situation will unfold, and investors might consider multiple potential outcomes.

Market-implied expectations point to Fed pivot

Current market turmoil versus Lehman collapse

1 CME FedWatch Tool, as of Tuesday, March 14, 2023.

2 MSCI clients can access historical global financial crisis scenarios for BarraOne® and RiskMetrics® RiskManager®.

Related content

Is Silicon Valley Bank’s Failure a Sign of Deeper Trouble?

Factor analysis of corporate credit spreads following the failure of Silicon Valley Bank shows the bond market has recognized both issuer-specific and systematic consequences.

Learn moreFour Scenarios for 2023: Navigating Uncertainty

The macroeconomic landscape for 2023 is shrouded in uncertainty following a tumultuous 2022. We consider four scenarios for growth, rates and inflation and gauge their potential impact on a portfolio of global equities and U.S. bonds.

Read moreThree Scenarios for Fed Policy, Inflation and Growth

Despite two months in a row of unexpectedly low inflation, the Fed once again raised rates this week. Amid considerable uncertainty over inflation and rate policy, we analyze three scenarios for the U.S. economy and their impact on diversified portfolios.

Explore more