The low size factor, or the premium that has been historically realized by investing in smaller sized companies over long time periods, forms an integral component of many institutional portfolios. However, its implementation has varied. Some investors make dedicated low size allocations believing that low size is a distinct style factor and warrants an independent investment decision framework. Others believe a dedicated small-cap allocation may not be needed. Instead, they allocate to small companies when building portfolios based on other factors, such as value or momentum. While such an approach can offer low size exposure, it could potentially interfere with maximizing target factor exposure or impact overall portfolio behavior. With that in mind, we have outlined a few key considerations for investors who are making low size allocations. We identify four questions that investors could ask themselves:

- What is the low size exposure across all my equity allocations?

- Is there dilution in exposure to the target factor because of embedding low size factor?

- Is the low size exposure consistent over time?

- Does low size allocation interfere with my investment objective or impact portfolio behavior?

Before answering these questions, we first test whether active managers indeed have historically demonstrated a low size bias in their factor strategies.

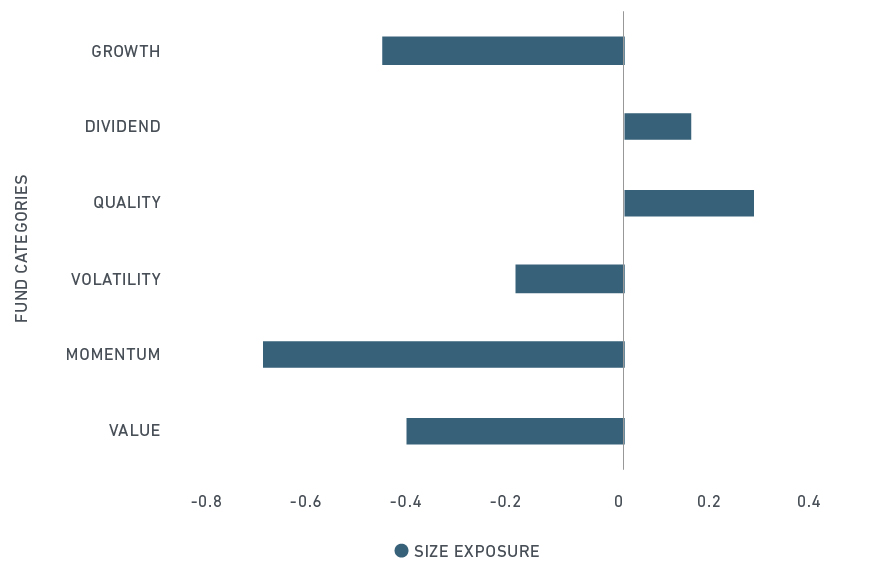

Indeed, our analysis suggests that many actively managed equity mutual funds had a low-size bias in their factor portfolios. We selected equity mutual funds from the MSCI Peer Analytics database that had a U.S. and global geographic focus and assets under management greater than USD 10 million. As of November 2017, this group comprised 1,548 funds. We then grouped these funds into categories – value, momentum, volatility, quality, dividend and growth – based on key words found in the fund name1 and determined their size exposures using MSCI FaCS.2 As the exhibit below shows, we found that funds classified in the value, momentum, volatility and growth categories had significant low size exposure, while those in the quality and dividend categories did not.3

FaCS size exposures of active mutual funds

Data based on end of November holdings for each year from 2012 to 2017. FaCS size exposures for funds with above median exposure to the target factor. The size exposures are equal-weighted across funds to compute the average. The historical averages of the number of funds in each category were Growth: 512, Dividend: 197, Quality: 15, Volatility: 16, Momentum: 6 and Value: 444.

Implications of embedding low size allocations in factor portfolios

Investors may wish to better understand the implications of embedding low size within portfolios focused on other factors:

- Having too much low size exposure. Investors may have a separate allocation to small caps within their broader equity portfolio. Additional small-cap exposure from factor portfolio(s) can potentially lead to exposure levels exceeding the investor’s risk appetite for low size.

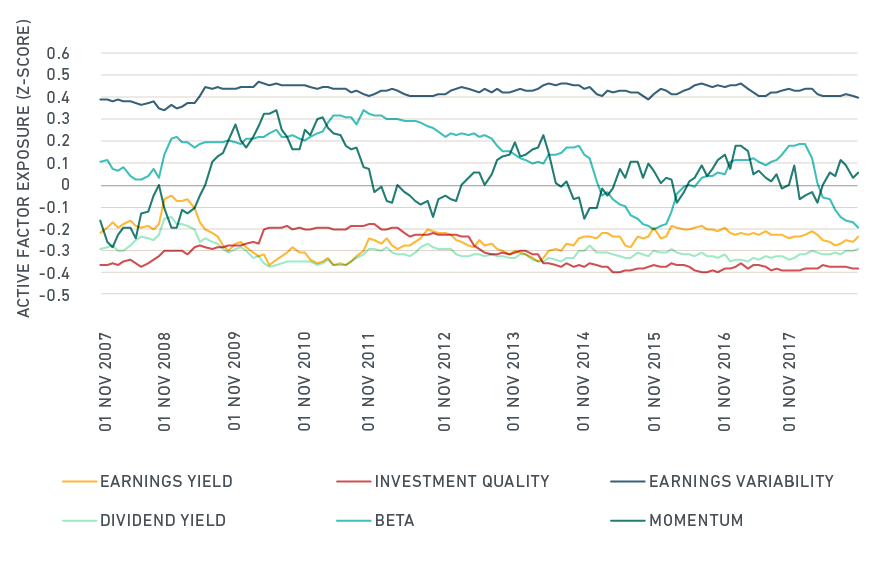

- Compromising target factor exposure. As shown below, compared to large- and mid-caps, small caps had lower earnings yields (a value factor descriptor), lower dividend yields (a dividend factor descriptor), higher earnings variability and lower investment quality (quality factor descriptors). Consciously selecting securities from small caps can thus potentially interfere with efficient construction of value, quality and dividend factor portfolios, compromising target factor exposures. Momentum and beta (a volatility descriptor) were more dynamic as they tended to rotate in and out of small caps during the observation period. As a result, targeting low size when constructing momentum and low volatility factor portfolios could dilute target factor exposure when small caps are trending down or are generally more volatile.

Select factor exposures of the MSCI ACWI Small Cap Index relative to the MSCI ACWI

Factor exposures based on MSCI’s Barra Global Equity Model for Long-Term Investors (GEMLT). GEMLT model has 16 factors. Factors shown here are selected based on the intensity and direction of active exposures.

- Inconsistency in low size exposure. Investors who capture the low size premium by allocating to small caps when building other factor portfolios, may not get a consistent exposure to low size over time, especially since that was not the objective of the factor strategy. This may be true for times when factors rotate out of small cap companies (such as momentum, as explained above).

- Inability to preserve investment objective or portfolio behavior. Small caps, historically, have been cyclical. Embedded low size exposure within defensive factors, such as low volatility, quality or high yield can be counterproductive and may compromise expected protection during down markets. Similarly, embedded low size exposure within more traditionally cyclical factors, such as value or momentum may intensify cyclicality and magnify the impact of losses during down markets. Allocating to small companies when building portfolios based on other factors can thus impact portfolio behavior and interfere with investment objective.

As shown earlier, embedding low size in other factor portfolios can have significant implications. We discuss two approaches that can provide an alternate way to making a low size allocation:

- Building single factor portfolios (such as MSCI Enhanced Value Index or other MSCI single factor indexes) by selecting and reweighting securities from the large- and mid-cap size-segment only (excluding small caps) overcome the above implications around factor dilution or impact on portfolio behavior. Within this framework, investors who want to actively seek the low size premium often consider a dedicated small-cap allocation and gain consistent exposure to the low size factor.

- Using a bottom-up optimization framework (such as MSCI Diversified Multi-Factor Indexes) to capture low size alongside other factors can provide consistent exposure to the low size factor without dilution of exposure to other target factors. This framework allows for an efficient way to maximize exposures to all target factors. The behavior of such a portfolio will be dependent on the behavior of the underlying target factors and their interactions.

Investors can choose different ways to capture the low size premium. The key is to understand and manage the implications of each approach and weigh its benefits and tradeoffs.

The author thanks Raina Oberoi for her contributions to this blog post.

All factor exposures are measured relative to MSCI ACWI IMI for comparison purposes, unless otherwise stated.

1 We used key words “value,” “momentum,” “volatility,” “quality,” “income,” “yield,” “dividend” and “growth” to group funds into categories. The “dividend” category contains funds with “yield,” “income” or “dividend” in their name

2 MSCI FaCS is a factor classification standard that provides a framework for evaluating, implementing and reporting factor allocations across six persistent equity risk premia factors – value, momentum, quality, low volatility, size and yield.

3 For what constitutes "significant” factor exposure, please see Roisenberg, L., R. Subramanian, G. Bonne. (2017). “Anatomy of Active Portfolios.”