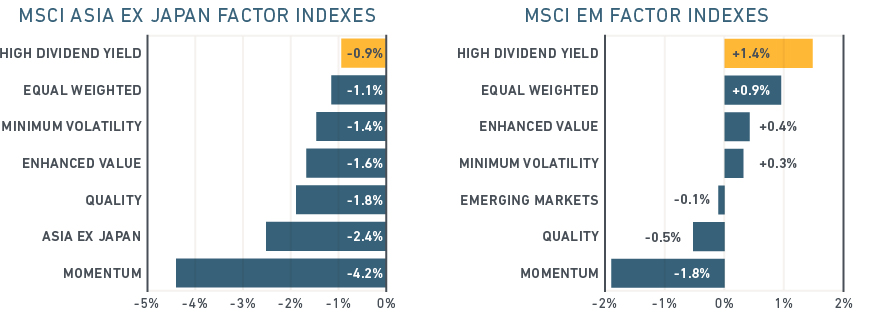

As we highlighted in a recent post, minimum volatility strategies have outperformed this year to date amid unrest in financial markets. At the same time, institutional investors may have paid less attention to the fact that the MSCI High Dividend Yield factor indexes have turned in a stellar performance in emerging markets and Asia ex Japan.

Performance of MSCI Emerging Markets factor indexes (year to date, in USD)

Data as of March 16, 2016

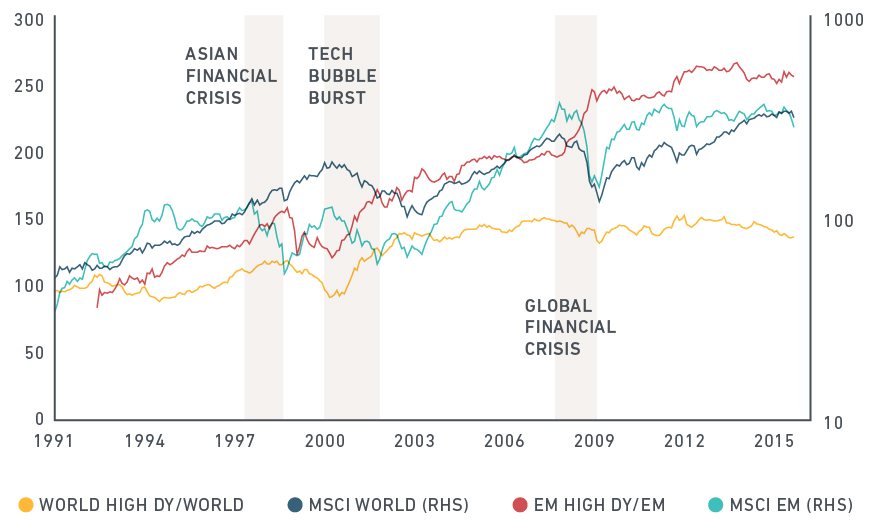

The outperformance makes sense when viewed historically. Over time, yield has performed better in emerging markets than in developed markets.

As the chart below shows, the MSCI Emerging Markets High Dividend Yield Index achieved a higher active return than the MSCI World High Dividend Yield Index, particularly during the 2008 financial crisis. That suggests dividend yield tends to matter more to investors in emerging markets, where stable income may offer a safe harbor against local economic and currency risks.

Relative performance of High Dividend Yield factors in developed and emerging markets

Investors turn to equity dividend income for a variety of purposes. For instance, strategic investors appreciate that dividend yield has contributed steadily to a major portion of long-term total portfolio returns. Liability-constrained investors look for dividend payouts as an alternative to fixed-income exposure. Besides income, the equity yield factor also may offer a long-term positive risk premium and diversification to other factors.

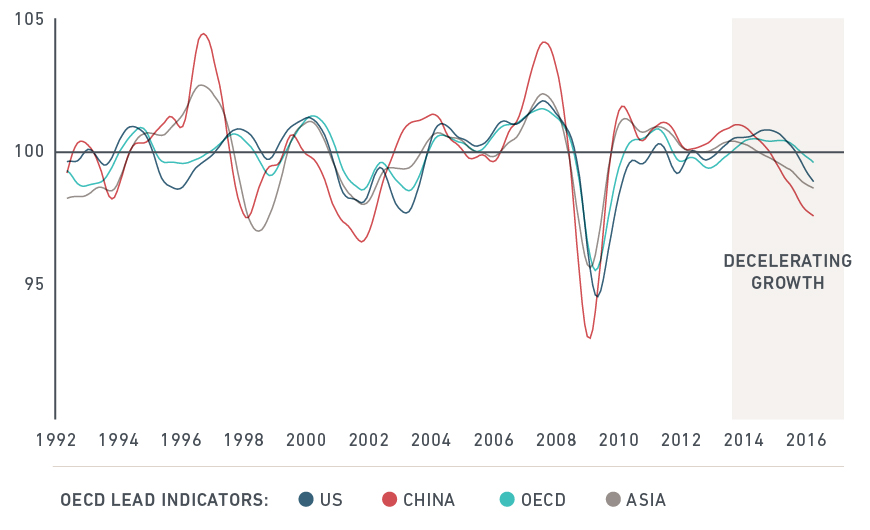

With weakness in the global economy and short-term interest rates near or below zero across much of the world (see chart below), it is little surprise that investors in search of yield are looking for opportunities outside of fixed income. We examine in detail the tendency of the High Dividend Yield factor to outperform in times of economic slowdown or macro uncertainties in a paper titled “Harvesting Equity Yield” that we published in December.

OECD leading indicators for member countries and regions

Dividend factor strategies typically target high-yielding stocks. However, the dividend yield can be artificially high because of temporarily high earnings, high payouts or falling prices.

To help investors avoid so-called yield traps, the MSCI High Dividend Yield Indexes apply four screens that aim to lessen the risk of stocks at risk of cutting future payouts (table below).

MSCI High Dividend Yield indexes apply screens to help identify sustainable income

The table illustrates how strategies to identify and eliminate yield traps can be applied to improve the risk-adjusted performance of a raw high dividend yield strategy. The approach can help income-oriented investors navigate across market cycles.

Further reading:

Harvesting Equity Yield: Understanding Factor Investing