U.S. equity investors in 2016 experienced a roller coaster ride. The U.K.’s vote to leave the European Union and the U.S. presidential election each resulted in sharp market moves. Together, the two events contributed to a shift in the underlying fabric of equity markets starting in the second half of the year.

While the Brexit vote created huge uncertainty in markets, particularly in Europe, the election of Donald J. Trump and an upbeat assessment by the Fed had an opposite effect: Institutional investors shifted their strategies toward U.S. companies that benefit from economic growth and away from minimizing risk. Money followed investor sentiment in primarily three ways: from defensive to cyclical sectors, from large-cap to small-cap stocks, and from defensive to cyclical (dynamic) factors. Our findings shed light on allocations across sectors, factors and the rest of the investment spectrum.

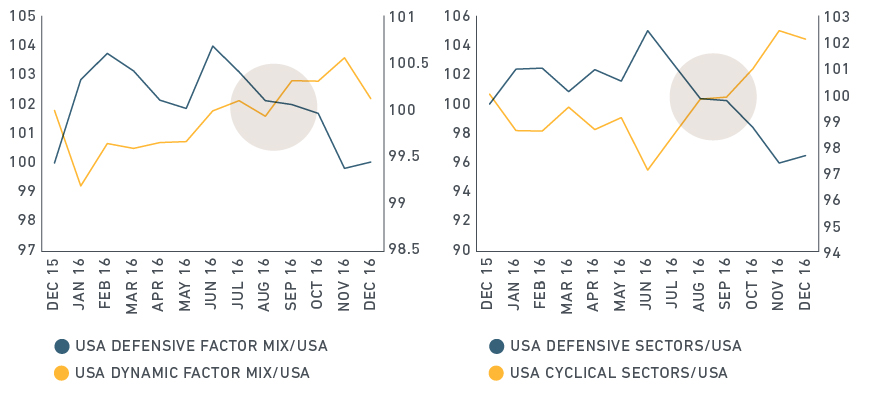

The chart below shows the rotation in sectors and factors in the run-up to the U.S. election. Sectors and factors that reflect economic expansion found favor as investors prepared for what they perceived to be an incoming administration that would champion pro-growth policies.

The return of the cyclicals

Source: MSCI Research. Data from Dec. 31, 2015 to Dec. 30, 2016.

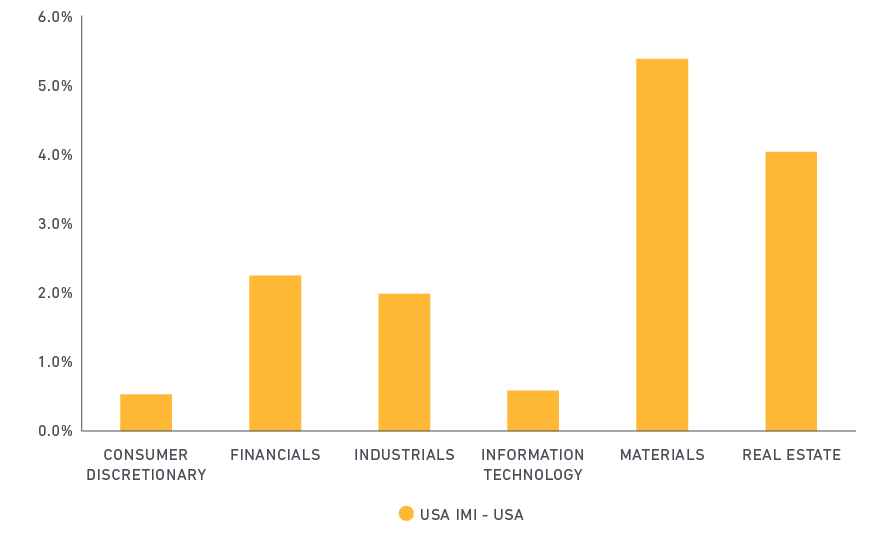

Amid the shift, a rally in small-cap stocks led cyclical sectors such as materials and real estate to outperform (below chart). The MSCI USA Investable Market Index, which is designed to measure the performance of the large, mid and small-cap segments of the market, ended the year up 19.8%. By comparison, MSCI’s USA Index, which tracks the large and mid-cap segments of the market but excludes small-cap stocks, ended the year up 11.6%.

Broader cyclical sectors outperformed in 2016

Source: MSCI Research. Data from Dec. 31, 2015 to Dec. 30, 2016. The USA IMI Index is designed to measure the performance of large, mid and small-cap segments of the U.S. market.

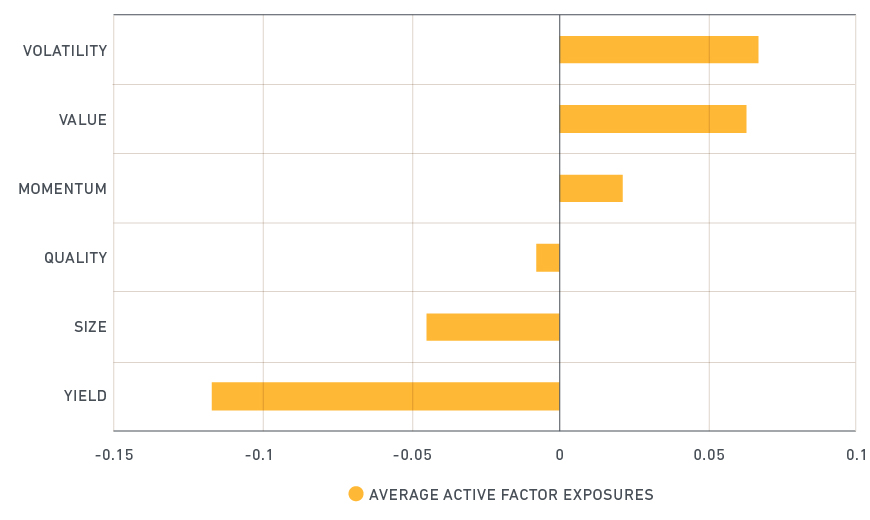

The rotation that we witnessed across sectors, factors and small caps also shows that sectors are influenced by factors. Cyclical sectors showed cyclical (dynamic) factors at work (below chart).

One perspective on drivers of sector return

Source: MSCI Research, MSCI Long-Term Global Equity Model. Data from Dec. 31, 2015 through Dec. 30, 2016

Cyclical sectors tilted toward volatility, value, momentum and size, which are all cyclical measures. A negative exposure to size implies a tilt toward smaller cap stocks. Meanwhile, cyclical sectors tilted away from defensive factors such as quality and yield.

As of mid-January, the market appeared to be pulling back from its expectations for growth. It remains to be seen how developments, including the policies of the new administration, influence those expectations.

The author thanks Raina Oberoi for her contributions to this post.

Further reading:

What do factors tell us about the regime change in U.S. stocks following the election?

How to think bigger small cap investing

One size does not fit all: Understanding factor investing

What the rise in policy uncertainty might mean for institutional portfolios