For financial institutions, measuring financed emissions[1] is the foundation of climate disclosure and reporting. There are, however, practical issues to consider when quantifying financed emissions and financed-emissions intensity, such as accounting standards and the availability and quality of data. But it may not always be possible to both align the measurement date of the three key inputs to these calculations (enterprise value including cash, or EVIC, portfolio value and position value) and make the calculations in a timely manner.

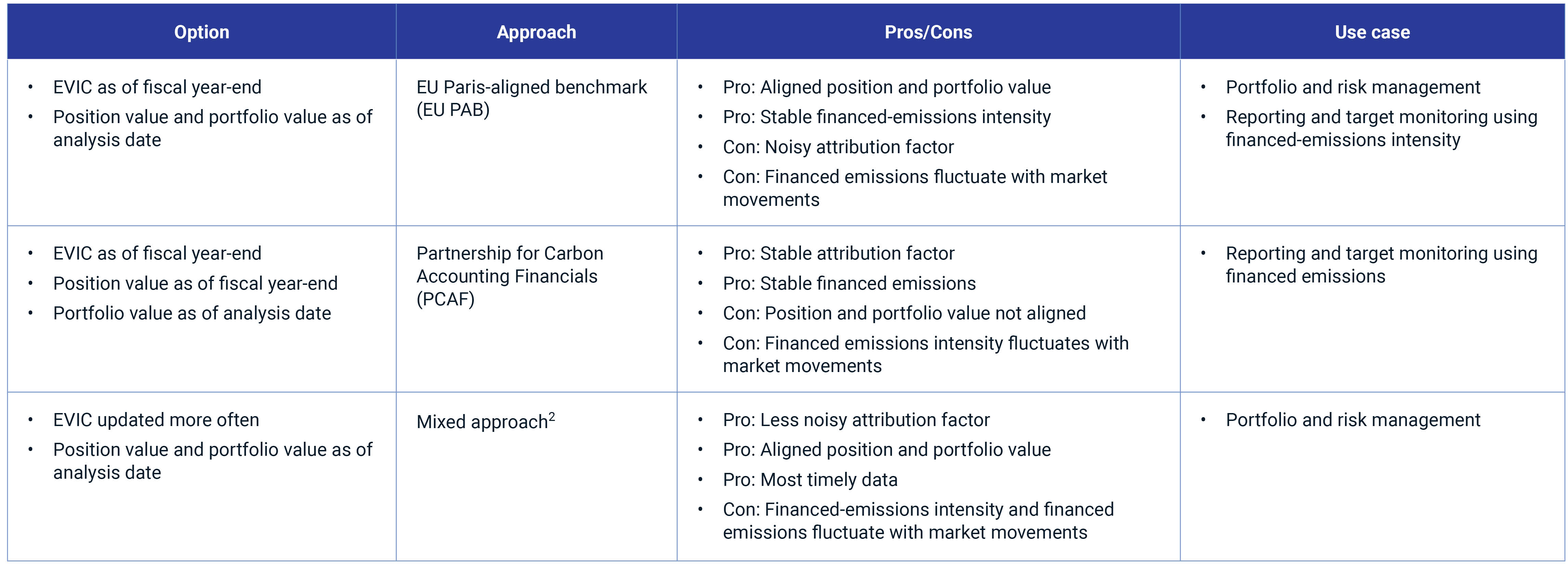

The table below summarizes the main issues around the timeliness and alignment of key data inputs that investors need to consider when calculating financed emissions and the effect on their main use cases.

Key considerations when calculating financed emissions

To better understand the importance of considering these factors when assessing financed emissions and financed-emissions intensity, we can look at the underlying calculations involved.

Defining financed emissions

Financed emissions at the portfolio level are the invested positions’ total emissions of greenhouse gas (GHG). Position-financed emissions are defined as the product of issuer-level GHG emissions weighted by the financing share that the position represents (the attribution factor).

When reporting their financed emissions, financial institutions have a number of metrics they can choose from. For example, there are four listed in PCAF’s global standard:[3] absolute emissions, economic-emissions intensity, physical-emissions intensity and weighted-average carbon intensity. In this blog post, we focus on the financed emissions and the economic-emissions intensity, also known as financed-emissions intensity over EVIC, at the portfolio level.

PCAF defines financed emissions as:

Where attribution factor for the ith constituent in the portfolio is computed as:

For listed companies:

For bonds issued by private companies:

It is important to align the numerator (outstanding amount) and the denominator (EVIC) to the same date to capture the financing ownership accurately. The attribution factor should be updated when a portfolio buys or sells positions that result in ownership changes, or when the company’s financing structure changes. It should not fluctuate with market movements if ownership has not changed.

PCAF recommends aligning the numerator and the denominator as of the fiscal or calendar year-end with the aim of having a stable attribution factor.

Defining financed-emissions intensity

Financed-emissions intensity is a current climate-impact metric that indicates the amount of GHG emissions an investor would be responsible for per dollar of financing. It is calculated as the ratio of total GHG emissions normalized by portfolio value. This allows for a comparison of portfolios regardless of their size.

It is important that the portfolio value is reported in a timely manner to best reflect accurate position weights and portfolio composition. It should be as of the date that the financial institution is conducting its analysis. Practitioners could rearrange the formula for portfolio financed-emissions intensity using one of the equations below so that the portfolio emissions intensity can also be expressed as the weighted-average position intensity.

Where,

This variation of the portfolio financed-emissions intensity will work only if position value and portfolio value are calculated as of the same date, which is also the approach recommended by the EU PAB.

Individual companies, however, usually report EVIC as of fiscal year-end. Given that companies may have different fiscal-year-end dates, EVIC dates of the companies in a portfolio will most likely be different. In addition, EVIC is usually updated less frequently due to technology and operational costs and lack of data availability.

As a result, there may be a measurement-date misalignment between EVIC, position value and portfolio value that could introduce volatility and noise to the intensity metric overtime. While timeliness is less of an issue for regulatory reporting, it is critical for portfolio and risk management to ensure that portfolio decisions are based on the most up-to-date information.

Data alignment and timeliness for informed decisions

Measuring financed emissions is crucial for climate disclosure. This blog post underscores the challenges of aligning and maintaining timely data inputs for accurate calculations and emphasizes the significance of stable attribution factors. Proper data alignment and timeliness are essential to help investors make informed decisions and contribute to effective climate action.