- Untangling actual reductions in companies’ carbon emissions from other drivers of change in the emissions of equity portfolios can be a challenge for investors.

- We propose a framework that attributes changes in portfolio-level emissions to their primary drivers, including changes in issuers’ emissions, ownership and financing structure.

- Over three years, in our hypothetical portfolio, only 4.9% of a 7.8% reduction in portfolio emissions resulted from a decline in constituent companies’ emissions; the remainder reflected portfolio rebalancing and reweighting.

Investors who track portfolio-level carbon emissions can struggle to untangle actual decarbonization from other factors that have nothing to do with reducing the amount of carbon that companies put into the atmosphere.

In this blog post, we present a framework that attributes changes in portfolio emissions to their primary drivers. The framework can help investors understand the ups and downs of carbon emissions in their portfolios over time and adjust their strategies accordingly.

Emissions-attribution analysis uses methods drawn from performance attribution that investors have used for decades to understand the drivers of financial return in investment portfolios. As we illustrate below, attribution models can help investors differentiate actual reductions in the carbon emissions associated with their investments — the goal of net-zero-aligned investors — from factors such as portfolio rebalancing that can trigger changes in a portfolio’s carbon footprint.

The ability to attribute emissions with precision holds practical significance for investors who aim to bring credibility to climate commitments while also managing financial risk. More than 550 institutional owners and managers of assets from throughout the financial sector have pledged to align their portfolios with the goal of putting the global economy on a pathway to net-zero that aligns with limiting warming to 1.5°C.1

Emissions attribution in practice

To illustrate how a mix of factors can cause portfolio emissions to change, we examined changes in financed emissions2 for a hypothetical portfolio comprising companies in the MSCI ACWI Investable Market Index over the three years that ended Jan. 31, 2023.

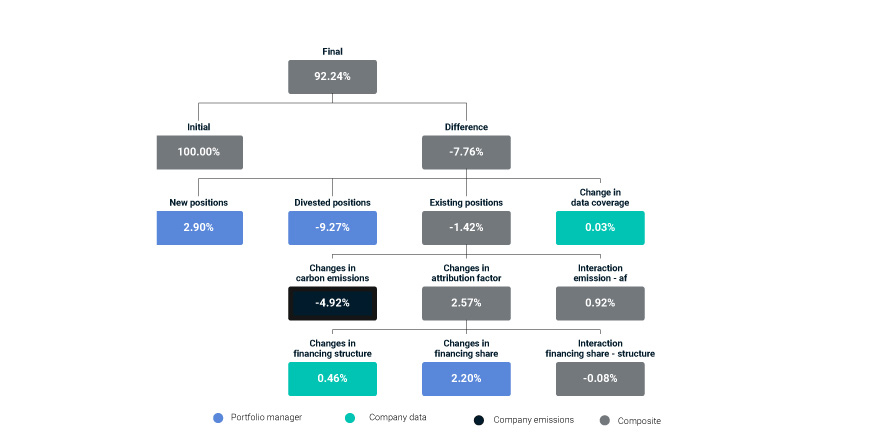

As the exhibit below shows, the direct (Scope 1) financed emissions of our portfolio fell by 7.8% over the study period. Yet only 4.9% of the drop resulted from portfolio companies’ reducing carbon emissions. The rest of the reduction came from index rebalances and reweighting.

Untangling changes of financed emissions of an equity portfolio

Data for the period Jan. 31, 2020, to Jan. 31, 2023. Source: MSCI ESG Research

To understand why financed emissions decompose this way, it helps to know some basic carbon accounting. According to the standard developed by the Partnership for Carbon Accounting Financials (PCAF), which establishes such standards for the financial industry, each position in a portfolio finances a share of the investee company’s emissions in proportion to the position’s value.3

This proportionality factor is called the attribution factor, which is calculated as the ratio of the position-outstanding amount over total enterprise value including cash, or EVIC.4 An investor who owns a USD 1 million position in a company valued at USD 1 billion that emits 20 megatons of CO2 a year finances 20 kilotons of CO2. The portfolio’s total financed emission is simply the sum of position-level financed emissions. PCAF expresses the formula as follows:

Definition and decomposition of financed emissions

We can divide the attribution-factor calculation into two components, financing share and financing structure, as shown below. Financing share shows how many shares the portfolio holds relative to the total shares outstanding for any issuer. Financing structure shows the issuer’s capital structure described as the ratio of equity to EVIC.

Thus, financed emissions can be decomposed to issuer-level emissions and an attribution factor. And the attribution factor can be decomposed to financing share and financing structure.

Applying this framework for attributing financed emissions to our hypothetical equity portfolio, we can isolate the drivers of emissions during the study period, as illustrated in the tree above. The findings show that:

- Securities added to the portfolio from rebalances increased its emissions by 2.90%, while securities divested from the portfolio during rebalances lowered emissions by 9.27%.

- The effect of actual reductions in company-level emissions, however, was only 4.92%.

- A change in the attribution factors in existing securities increased financed emissions by 2.57%, mainly driven by the change in financing shares. Because the portfolio is equity-only, the attribution factor, which represents share of equity ownership, increased by 2.20%.

- A small general shift toward more equity in the financing structures of index constituents — measured by the increasing equity/EVIC ratio — increased portfolio-level financed emissions by 0.46%.

- The boxes labeled interaction on the tree above capture the nonlinear effect when drivers such as changes in carbon emissions and attribution factor, or financing structure and share, change at the same time.

The color scheme of the tree also indicates the variables a portfolio manager can influence (blue). A manager, for example, can influence both the composition of the portfolio (by adding or deleting issuers) and the number of shares in each issuer that the portfolio holds. Changes in companies’ real-world emissions (black) and the effects of market valuation (turquoise) fall outside of the portfolio manager’s direct control.

Looking between constituent companies’ emissions

Investors who monitor their portfolio emissions might want to keep in mind that changes in such emissions do not solely reflect decarbonization by constituent companies. Changes in the composition of portfolios, including from rebalances and reweighting, can contribute more to portfolio emissions than the ups and downs in companies’ emissions themselves. Attribution offers a way to disentangle those effects.

1“2022 Progress Report.” The Glasgow Financial Alliance for Net Zero, Oct. 27, 2022.

2“The Global GHG Accounting & Reporting Standard for the Financial Industry, Financed Emissions, Part A, Second edition.” Partnership for Carbon Accounting Financials, December 2022.

3“The Global GHG Accounting and Reporting Standard for the Financial Industry, Part A - Financed Emissions, Second edition.” PCAF, December 2022.

4Note that according to PCAF, the attribution factor, EVIC and position value are all calculated on the same date, which is the previous financial year-end. For details, see the PCAF standard.

Further Reading

A Framework for Attributing Changes in Portfolio Carbon Footprint

Measuring Climate Impact with Total-Portfolio Carbon Footprinting