- Broad market-cap indexes have been used as primary benchmarks for evaluating risk and return of active climate funds, but adding a climate index as a parallel benchmark to track climate metrics may provide additional insights.

- Climate indexes can help measure progress toward achieving climate objectives and help to counter claims of “climate-washing.”

- Selecting a suitable climate benchmark will likely depend on the climate objectives of the active climate fund.

Broad market-cap weighted indexes such as the MSCI ACWI Index or MSCI World Index help define the investment universe and are widely recognized as benchmarks for active climate fund performance evaluation and risk management. As climate investing continues to evolve, active climate funds are exhibiting increasingly diverse climate objectives that range from decarbonization (a lower carbon footprint compared to the benchmark), opportunities associated with low carbon transition (higher allocations to companies with green revenues or operations), temperature scenario alignment or an economy-wide climate transition. While broad market-cap weighted indexes may be useful to assess fund performance, they might not fully assess the alignment of the fund towards its climate objectives. Using a climate index can also help track progress toward achieving climate objectives.

Selection of active climate funds

Using MSCI’s Peer Analytics, we selected funds with the keyword’s “climate” or “sustainable” as part of their names. We excluded funds with the words “index,” “ETF” or “indexed” to screen out index-linked funds. On average, our sample included 23 global climate funds over the study period. The funds were equally-weighted on a quarterly basis to calculate performance metrics relative to the MSCI ACWI Index, as well as climate metrics relative to various MSCI ACWI Climate Indexes.

Active climate funds have varied climate objectives

While the transition to a low-carbon economy could manifest as risks for companies with carbon-intensive assets, products and services, it could also offer opportunities for firms that are aligned with a lower-carbon world.

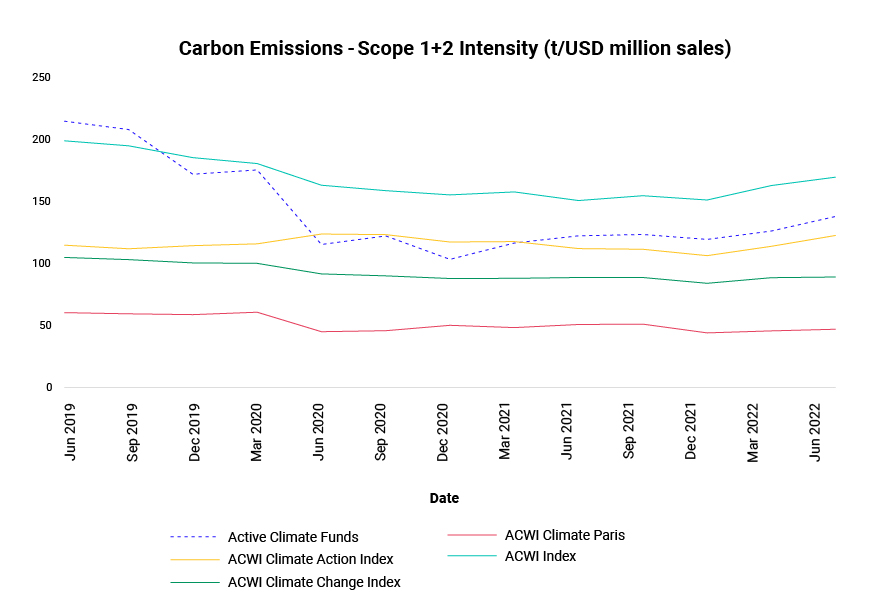

When we analyzed the carbon and green revenue exposure of the active climate funds, we observed that they (shown by dotted blue line below) have a lower carbon intensity and significantly higher green revenue exposure compared to the MSCI ACWI Index. However, when compared to the MSCI ACWI Climate Indexes, the carbon intensity of the active climate funds was similar to the MSCI ACWI Climate Action and MSCI ACWI Climate Change Indexes, while the green revenue improvement was similar to that of the MSCI ACWI Climate Change and MSCI ACWI Climate Paris Aligned Indexes.

Carbon emission intensity comparision exposure

An evaluation of green revenue

Our analysis focused on diversified global equity mutual funds. June 2019 through June 2022.

Grouping the active climate funds

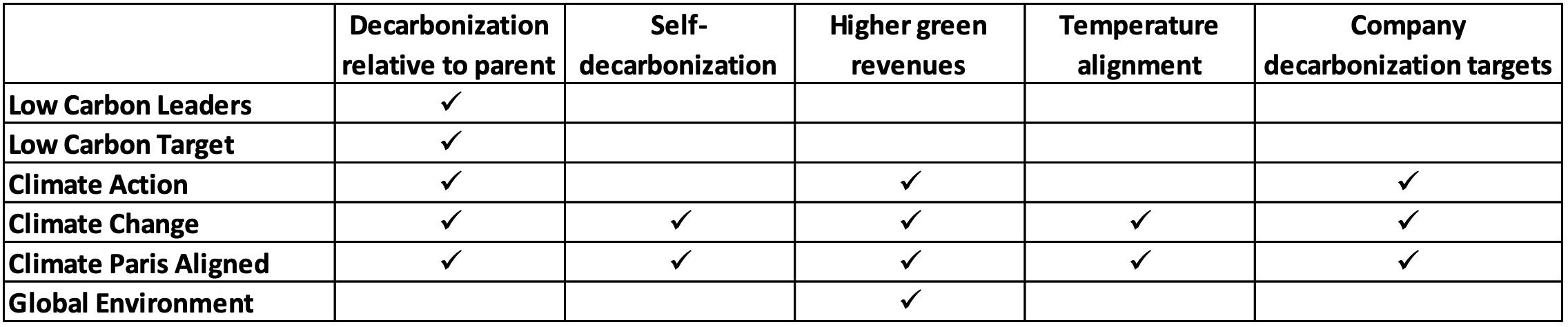

Active climate funds may have a diverse set of climate objectives ranging from targeting low carbon-emission intensity (to reduce transition risk) to higher green revenues (greater allocations to climate solutions). The parallel climate benchmark selection would therefore be dependent on the alignment of climate fund’s objectives with the appropriate climate index (see exhibit below).

Climate objectives of the MSCI climate indexes

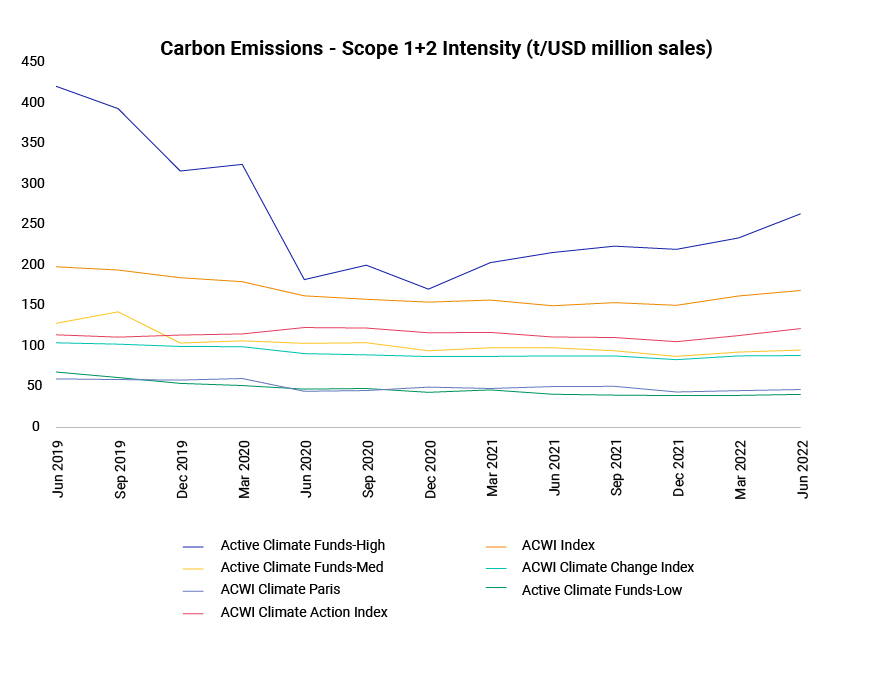

To analyze this in greater detail, we split the active climate funds into three groups, or terciles, every quarter based on their carbon intensity and analyzed each tercile’s aggregate carbon intensity reduction and green revenue improvement compared to the MSCI ACWI Index and MSCI ACWI Climate Indexes (as shown below). It was interesting to see the dispersion of the carbon intensity profile for each tercile. While all three terciles demonstrated a significant green revenue improvement compared to the MSCI ACWI Index, the funds with the highest carbon intensity within the selection of active climate funds (active climate funds-high) had a carbon intensity higher than that of the MSCI ACWI Index. This could indicate that they were only targeting higher allocations to green revenues. In contrast, the active climate funds with the lowest carbon intensity (active climate funds-low) relative to the MSCI ACWI Index were at levels similar to that of the MSCI ACWI Climate Paris Aligned Index. These funds probably had dual climate objectives of reducing carbon intensity targeting higher green revenues.

A comparison of carbon emission intensity

Green revenue evaluation

June 2019 through June 2022.

Parallel benchmarking can provide additional transparency

While broad market-cap weighted indexes are often used to gauge equity-market performance, an important consideration for active climate funds is to demonstrate their ability to meet climate objectives. Using a climate index as a parallel benchmark could help these managers provide targeted transparency. While parallel benchmarking is being utilized by a limited number of active climate funds, most still rely on using a single benchmark.1 It could be particularly useful for asset owners with active climate mandates with the consideration of implementing their policy exclusions and specific climate objectives in a personalized index for the climate alignment of their allocations.

Active climate funds may have varied climate objectives and the appropriate benchmark selection will ultimately depend on aligning with the funds’ climate objectives. However, parallel benchmarking does not have to be the preserve of climate funds. An appropriate parallel benchmark could help many active funds show alignment to fund objectives. This would improve transparency and allow investors to make more informed decisions.

1 Pensions for Purpose, “Half of all funds labelled ‘climate-focused’ still don’t measure against a climate benchmark,” March 2022.

Further Reading

Six ESG and Climate Trends to Watch for 2023

Net-Zero Alignment: Engaging on Climate Change

Footprinting the World’s Largest Asset Managers