- A swiftly changing geopolitical and macroeconomic backdrop has shifted the ESG and climate landscape at a rapid pace, making it imperative that investors understand the challenges and opportunities that companies face.

- Climate remains at the top of the ESG agenda, with regulators increasingly conscious of the role they need to play alongside governments in ensuring companies and countries meet their climate-related obligations.

- Beyond climate, ESG is increasingly affecting many other areas, including impacts on everyday life. This year, we have drilled down to bring these detailed insights to you and help inspire some fresh thinking.

The last year has seen a seismic shift in the ESG and climate landscape. Regulators are upping the ante on everything from greenwashing to stricter climate target disclosures, while the war in Ukraine, disruptions in the energy market, rising interest rates and soaring inflation have all combined to produce a global cost-of-living crisis and renewed geopolitical and macro uncertainty. Add to the mix a spate of climate-induced disasters and the increased politicization of ESG investing, and it’s easy to see why investors have tended to tread cautiously as they seek to understand companies’ challenges and opportunities.

In MSCI’s ESG and Climate Trends to Watch for 2023 we discuss the key topics investors face, from climate change, the environment and the road to net-zero, through to regulatory requirements, supply chain innovations, biodiversity and new technologies, as well as issues affecting everyday life.

Here, we briefly touch on six of the 32 trends that we have identified.

1. Energy crisis, Ukraine war driving fossil fuel agenda, but don't rule out renewables

The ongoing war in Ukraine and high-inflationary environment may limit near-term pressure to reduce global greenhouse-gas emissions as governments prioritize energy security and affordability. But for power companies, swapping coal and oil for natural gas may not be the only practical option.

In 2023, we’ll be watching which companies are keeping their eyes on longer-term decarbonization trends and expanding their deployment of renewables.

Networks and renewables dominate capex plans of major utilities in U.S. and Europe

Data for 26 European and U.S.-based power-generating constituents of the MSCI ACWI Index, as of Aug. 5, 2022. Definitions of capital expenditures are based on MSCI’s ESG climate-change metrics. Source: MSCI ESG Research.

2. Market conditions could test investors’ commitment to say-on-climate voting

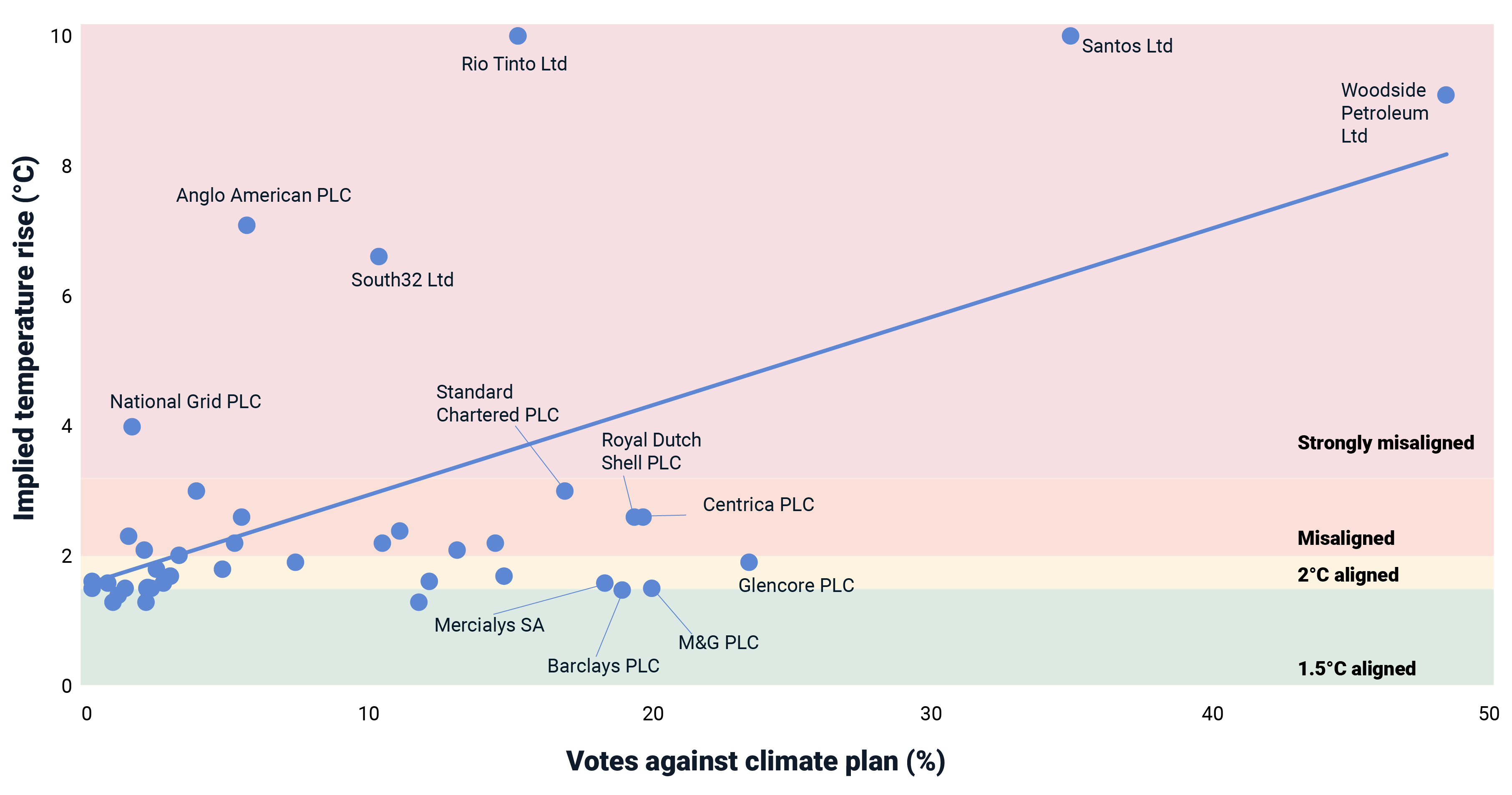

According to our analysis, more investors voted against corporate climate strategies in 2022 compared to 2021, especially where a company’s emissions trajectory was misaligned with global temperature targets. However, energy market turmoil and a focus on energy security may change voting behavior.1

In 2023, we’ll be watching whether opposition to corporate climate strategies will continue or whether more investors will give companies the benefit of the doubt on their climate plans in challenging market conditions.

Companies’ emissions trajectories and 2022 say-on-climate vote results

Analysis covers all 43 constituents of the MSCI ACWI Investable Market Index (IMI) that held management-sponsored say-on-climate votes in 2022 to date. The percentage of votes against accounts for votes in favor and votes withheld/abstained. Data as of Nov. 9, 2022. Source: MSCI ESG Research and company disclosures.

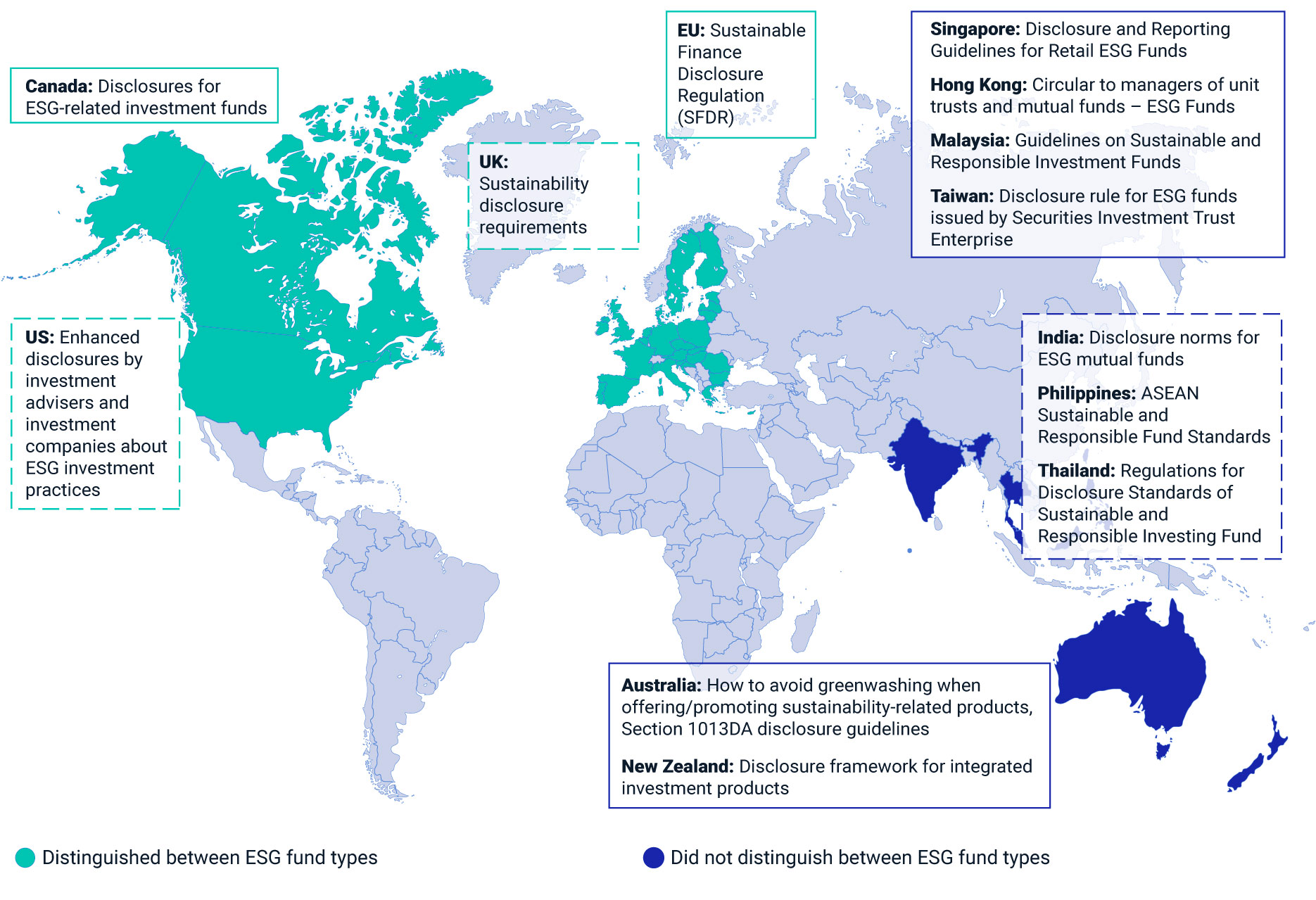

3. Regulators turn their gaze to ESG funds

ESG-oriented funds have long operated with limited regulatory guidance.2 But regulatory interest in fund names and funds’ classification and disclosure obligations are ramping up globally. Spearheaded by the EU’s Sustainable Finance Disclosure Regulation, which imposes requirements on more transparent reporting for ESG funds, other major market regulators are following suit.

In 2023, we’ll be watching for changes in ESG fund names and labels as unfolding disclosure regimes hold managers to stricter account.

Jurisdictions with active and proposed regulations or guidelines for ESG funds

Solid text boxes represent regulations in force, while dashed boxes represent proposed or planned regulations. List of jurisdictions with regulations or guidelines proposed or in force for ESG funds: U.S. (proposed); Canada; EU; U.K. (planned); Singapore; India (proposed); Hong Kong; Australia (including Section 1013DA); Malaysia; New Zealand; Philippines (proposed); Thailand (proposed); Taiwan. Data as of Oct. 12, 2022. Source: MSCI ESG Research.

4. Cutting deforestation: Market restrictions get real

Despite commitments to halt forest loss,3 2021 saw tree-cover loss of 25.3 million hectares globally, an area larger than Great Britain.4 In addition, 2022 saw global wildfires burn down millions of hectares more. COP155 addressed such natural losses, while the European Parliament recently introduced legislation requiring products sold in the EU to be deforestation-free.

In 2023, we’ll be watching which companies exposed to deforestation can improve due diligence and supply-chain monitoring as they seek to maintain access to key markets.

Paper and forest-products companies lead, but deforestation policies remain thin on the ground

Share of companies within selected industries of the MSCI ACWI IMI that have disclosed a deforestation policy; industries included where at least 2% of the peers have disclosed a policy. Data as of Oct. 12, 2022. Source: MSCI ESG Research.

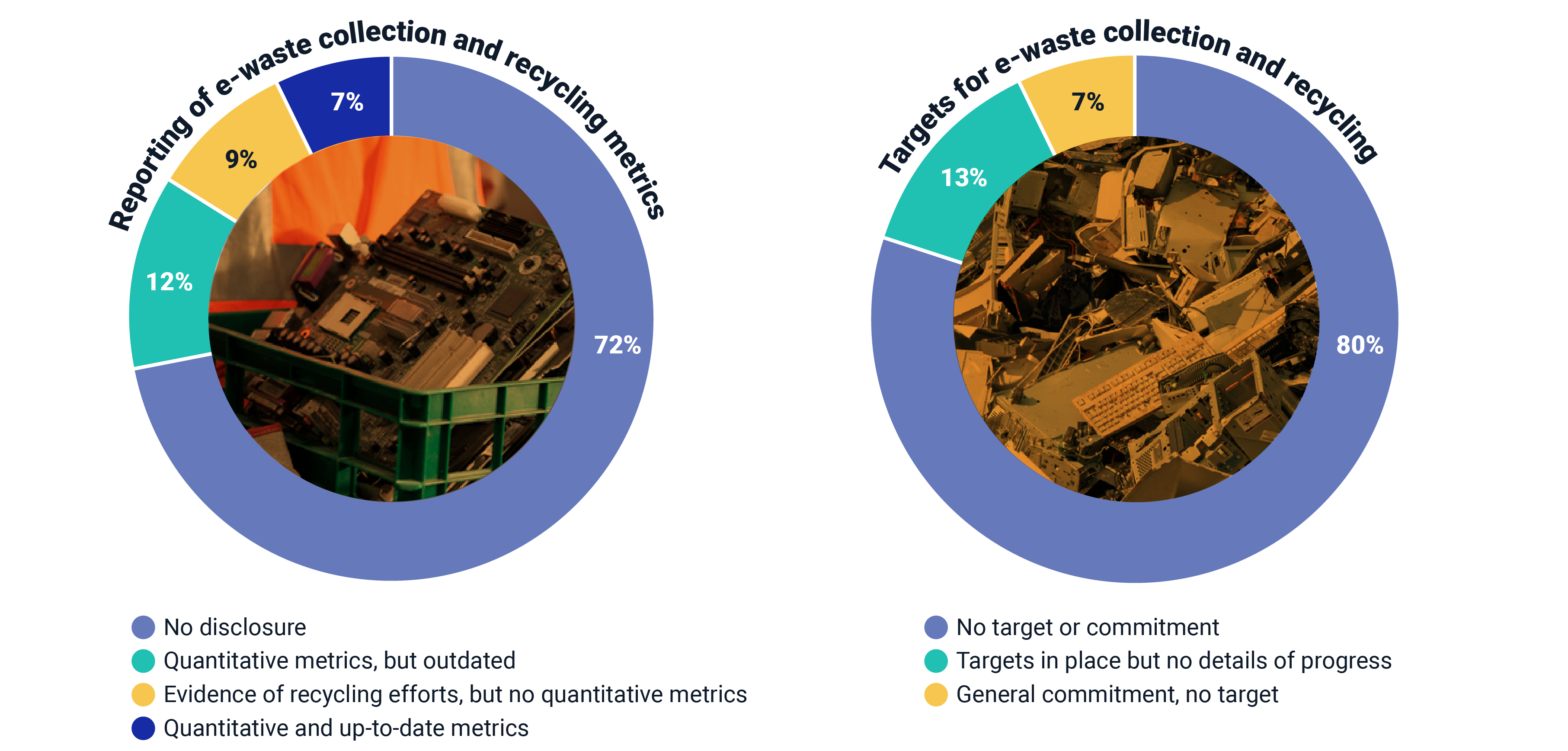

5. Mining old electronics to fuel new energy tech

In recent years, China and the EU have strengthened policies and guidelines on the circular treatment of materials and waste, including electronic waste (e-waste). In September 2022, the U.S. followed suit, passing a bill on recycling electric-vehicle batteries. Efficiently extracting metals from e-waste could reduce dependency on mining and emissions.

In 2023, we’ll be watching which companies up their efforts to mine secondary metals from e-waste — both to keep regulators happy and boost access to metals critical for clean-energy technologies.

A long way off from a circular economy for metal

Analysis includes 68 technology-hardware and household-durable constituents of the MSCI ACWI Index, as of Sept. 27, 2022. Based on the public disclosure of these companies (e.g., annual reports and 10-Ks), we analyzed the differences in the reporting of e-waste collection and recycling metrics, as well as any targets related to these collection and recycling efforts. Source: MSCI ESG Research.

6. Cotton’s crunch point and the future of fiber

Cotton makes over 25% of the clothes we wear, but its harmful impacts, like soil degradation and water consumption, have spurred demand for more environmentally friendly options.6 Apparel retailers have responded by working with third-party certifiers for sustainable cotton and exploring alternatives. However, catastrophic flooding in Pakistan and the withdrawal of some certifications from China have created supply issues.

In 2023, we’ll be watching to see which retailers can navigate these near-term shortages and which ones are prepared to back new, alternative fibers.

Apparel retailers increasingly relied on third-party certification for responsible cotton

Data is based on apparel-retail constituents of the MSCI ACWI Index, as of Oct. 21, 2022. Source: Refinitiv, MSCI ESG Research.

Understanding the impact of ESG and climate

For investors, considering ESG and climate factors is not a new concept, but it is one that is likely to become even more important given increased regulation, demands for transparency and an ongoing quest for standards. The trends identified here, and in our wider publication, are already shaping society and hint at the risks and opportunities that companies and investors may face in the years ahead. Understanding them will be a first step in assessing the potential impact they could have on investment portfolios.

1 Masters, Brooke. “Shareholders back away from green petitions in US proxy voting season.” Financial Times, July 1, 2022.

2 ESG funds are defined as any fund that employs any ESG considerations in its security-selection process (values and screening/ranking/exclusions/integration/optimization, etc., and their combinations). In simplest terms, it is the widest possible net under which any and all funds employing any ESG considerations in security selection are captured. All fund characterizations based on data from Broadridge and MSCI ESG Research, as of July 2022.

3 “Glasgow Leaders’ Declaration on Forests and Land Use.” UN Climate Change Conference UK 2021, Nov. 2, 2021.

4 University of Maryland and World Resources Institute. “Global Primary Forest Loss.” Accessed Oct. 12, 2022.

5 The 15th Conference of the Parties to the Convention on Biological Diversity in Montreal, Canada, commonly abbreviated as COP15 (Dec. 7 to 19, 2022.)

6 In 2021, companies in the apparel-retail sub-industry with combined revenues of over USD 100 billion were sourcing cotton certified to a third-party standard. This reflects revenue from eight out of 12 constituents of the MSCI ACWI Index in the apparel-retail sub-industry that report sourcing third-party certified cotton. Apparel-retail sub-industry defined according to the Global Industry Classification Standard (GICS®). GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Further Reading

ESG and Climate Trends to Watch for 2023

ESG and Climate Trends to Watch for 2023 webinar

What COP27 Means for Companies and Investors