- The global market rallied in Q1 2023, with the MSCI ACWI index up 7.4% for the quarter, led by quality stocks.

- Valuations of factor indexes were lower than the historic average at the current interest-rate levels.

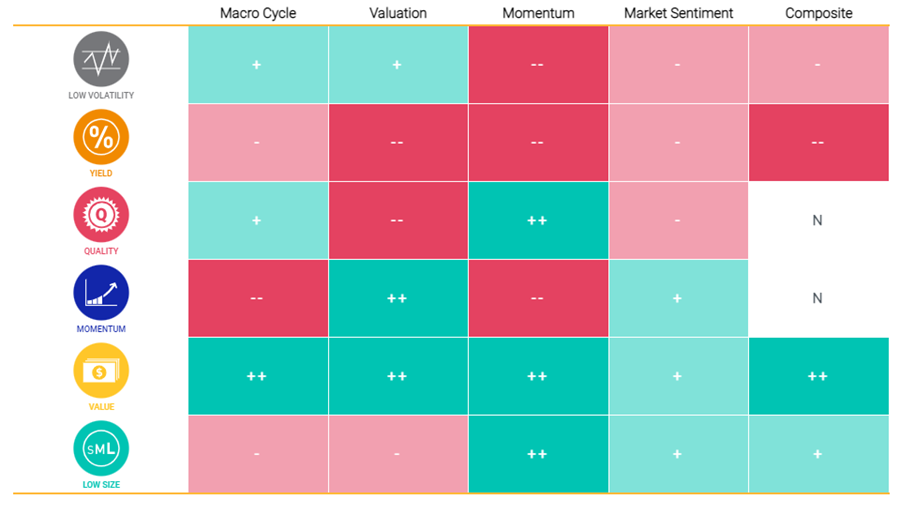

- MSCI’s Adaptive Multi-Factor Allocation Model pointed to an overweight to value and low size as of March 31, 2023.

In our previous Markets in Focus blog post, we highlighted how investors were looking to capture big market shifts across country allocation, factor allocation, ESG, climate and thematic opportunities. In the first quarter of 2023, the MSCI ACWI Index gained more than 7.4%, having delivered the second-highest January return (+7.2%) over the last 36 years. The strong start to equities, led by high beta, small caps and pro-cyclical sectors, indicated investors may have become more confident that inflation and economic growth concerns will ease. Several technology-related thematic indexes posted strong gains, and European markets outperformed global equities from relatively lower valuations. The prospect of increased consumer demand from the re-emergence of China also occurred after the country lifted zero-COVID policies.

The first quarter didn’t finish without bumps, however. The collapse of Silicon Valley Bank (SVB) on March 10 resulted in a severe selloff of banks across the globe (see below) and U.S. interest rate implied volatility reaching a 15-year high (16th March 2023) as measured by the ICE BoAML MOVE index. While the drawdown amongst banks was most acute amongst USA mid-cap banks the fall and subsequent takeover of Credit Suisse by UBS added to investor concerns.

Pre-SVB Event Period: Dec. 30, 2022 to Mar. 8, 2023. Post SVB Event Period: Mar.8, 2023 to Mar.31, 2023. Active returns against regional/country benchmarks.

Unwinding of crowded trades in high beta stocks

The strong start in equities and the increase in risk appetite was most evident in the outsized performance of high beta stocks relative to all other style factors (until the SVB event). The subsequent change in market sentiment led to a sell-off in high beta stocks. Value stocks and high-profitability stocks were also among the better-performing segments, with investors turning to fundamentals as equities’ valuations adjusted to reflect the prevailing macro environment. Stocks with momentum, high leverage and/or high residual volatility were among the worst performers.

Pure factor performance for styles

Performance of the MSCI Global Equity Factor Model pure factors from Dec. 30, 2022 to Mar. 8, 2023, and Mar. 8,2023 to Mar. 31, 2023.

European stocks led a broad global equity market rally

All the regions were positive in the first quarter, with developed markets outperforming emerging markets (EM). Europe outperformed the U.S., driven by strong gains in France and Germany and led by demand from China. Within EM ex China, countries with high economic exposure outside the domestic market, namely Mexico, Taiwan and Korea, fared well.

Among style factors (as shown below), quality delivered positive active returns across all regions except the Emerging Markets. Among thematic indexes, all the indexes listed under Transformative Tech outperformed the MSCI ACWI Index by a wide margin, reinforcing investor interest in pro-cyclical, higher-beta exposures. Performance was mixed among other thematic indexes.

Quality and technology oriented thematic indexes led in Q1 2023

The table shows regional variations of the MSCI Minimum Volatility Index (USD), MSCI High Dividend Yield Index, MSCI Quality Index, MSCI Momentum Index, MSCI Enhanced Value Index, MSCI Equal Weighted Index and MSCI Growth Target Index, from Dec. 30, 2022 to Mar. 31, 2023. The bar chart shows the active returns of the same indexes, by region, for each month in the quarter, as well as for the full quarter.

Have factor valuations adjusted to the new rate environment?

The hike in U.S. interest rates over 2022 coincided with one of the greatest rotations from growth to value stocks (+25.7%) since 2000 (+29.8%), and it exceeded 1976 (+24.2%). We spotlight the concept of equity duration (generally used much less frequently by equity investors than by fixed-income investors), which considers the impact of interest rates on stocks. Value stocks are sometimes considered short duration with their relatively more stable short-term cash flows and earnings, whereas growth stocks are considered long duration given their future trajectory of earnings growth. Interest rate hikes not only impact valuations (via the discount rate), but also earnings growth as the cost of financing increases.

We looked at the relative valuation of the MSCI USA factor indexes to the MSCI USA Index at the current levels of 10-year constant-maturity yields and compared them with past periods of similar levels. We found several factor indexes are discounted relative to history, namely value, size and high dividend yield. While momentum also has a historically low relative valuation, that could adjust quickly if underlying market trends change.

The table below gives an indication of the potential returns should valuations revert back to the average, driven entirely by price, holding earnings for the factor indexes and the parent index constant. For example, if the relative valuation of the MSCI USA Enhanced Value Index reverts back to its average given where 10-year U.S. yields are, that would imply 26.7% upside active return (holding earnings constant).

Data from Jun. 2003 to Mar. 2023

MSCI Adaptive Multi-Factor Allocation Model

Our adaptive multi-factor framework is a model designed to analyze factor-based decisions. Our research shows that and may suggest the value in taking a holistic approach to factor assessment. This approach encompasses not only the macroeconomic environment as shown above, but factor valuations, recent performance trends and risk sentiment.

As of Mar. 31, 2023, our Adaptive Multi-Factor Allocation Model showed the following exposures across the four pillars:

- Macro Cycle: Overweighted quality, low volatility and value, with signals from the Chicago Fed National Activity Index, Federal Reserve Bank of Philadelphia’s ADS Index and PMI being mixed.

- Valuation: Overweighted value, momentum and low volatility based on the valuation gap compared to an equal-weighted factor mix in the context of nearly 30 years of a factor’s history.

- Momentum: Selected value, quality and low size based on relative performance over the last three months.

- Market Sentiment: Showed a slight overweight to low size, value and momentum, with mixed signals from VIX and credit spreads.

At the end of the first quarter of 2023, the MSCI Adaptive Multi-Factor Allocation Model showed an overweight to value, with low size being slight overweight, relative to an equally weighted factor mix (as shown below).

Exposures from MSCI’s Adaptive Multi-Factor Allocation Model

As of Mar. 31, 2023. Positive exposures are denoted as + or ++, negative as - or -- and neutral as N.

Further Reading

Markets in Focus: Investors Look to Capture Big Market Shifts