- Global equities were down 6.7% in the third quarter of 2022. Emerging market equities registered their worst drawdown since the onset of the pandemic, down 36.2% since mid-February 2021.

- The pendulum swung far and wide on high-beta stocks, propelled by accelerated annual U.S. inflation for August. We believe that allocations to minimum-volatility strategies may have helped mitigate high beta exposure in higher-risk portfolios.

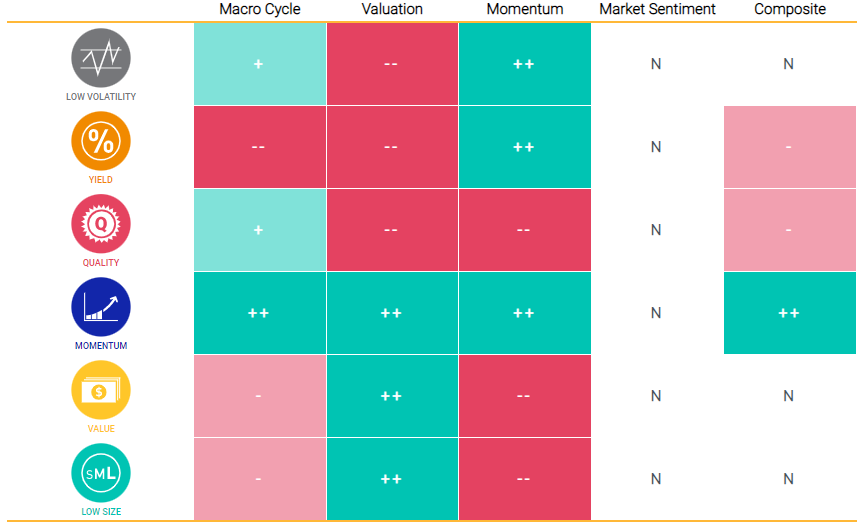

- MSCI’s Adaptive Multi-Factor Allocation Model pointed to an overweight in momentum, low volatility and quality as of Sept. 30, 2022.

Investors remained fearful of inflation and recession worries in the third quarter of 2022, in a period where global equities declined by 6.7%. Volatility in European energy prices, driven by sanctions on Russia and supply constraints, also added to the downside pressure. Global recessionary fears continued to place pressure on oil and commodity prices, which fell in the third quarter. Rising U.S. yields added strength to the surging dollar, sending both the euro and the yen to lows not seen in more than 20 years. The U.K. government’s fiscal policy rattled investors, especially in sterling (record low of USD 1.035 on Sept. 26) and gilts, which led to spillover effects in major bond markets.

The pendulum swings on high-beta stocks

Investors entered the third quarter having experienced the worst start to a year since 1975. A bear market rally materialized, and investors chased stocks with high beta (relative to low beta). However, the acceleration in U.S. annual core inflation to 6.3% in August led to a sharp downturn in the performance of high-beta stocks, while energizing momentum stocks. Our historical data indicates that this phenomenon has not been uncommon in structural bear markets. Oil-related industries continue to advance despite oil being down about 20% for the quarter, as the energy crisis driven by the Russia-Ukraine war lacked resolution.

Pure-factor performance for styles

Performance of the MSCI Global Equity Factor Model pure factors from June 30, 2022, to Sep. 30, 2022.

Equities in emerging market hit hard

The MSCI ACWI Index was down 6.7% for the quarter, along with declines in all the regional indexes. The MSCI Emerging Markets Index was particularly hit hard, and it also registered its most significant drawdown since March 2020 (down 36.2% from Feb. 17, 2021, to Sept. 30, 2022). The strong U.S. dollar has been challenging for emerging markets (EM), given weaker purchasing power that impacts global trade growth, lower credit worthiness for countries with dollar-denominated debt and inflationary pressures from higher raw materials costs. The MSCI Momentum Index and the MSCI Minimum Volatility Index outperformed the MSCI Emerging Markets Index by 9.7% and 4.4%, respectively.

The MSCI Adaptive Multi-Factor Allocation Model generated a continued underweight (relative to the second quarter of 2022) to value and yield, and an overweight to momentum and low volatility, relative to an equal-weight factor mix (the MSCI ACWI).

A strong divergence in factor-index performance across regions

The table shows regional variations of the MSCI Minimum Volatility Index (USD), MSCI High Dividend Yield Index, MSCI Quality Index, MSCI Momentum Index, MSCI Enhanced Value Index, MSCI Equal Weighted Index and MSCI Growth Target Index, from June 30, 2021, to Sep. 30, 2022. The bar chart shows the active returns of the same indexes, by region, for each month in the quarter, as well as for the full quarter.

The beta cycle has been closely tied to crisis events

Our research indicates that managing exposure to beta has been critical during volatile market conditions. As recent history shows, stocks with high beta were vulnerable to rapid shifts in market conditions. We looked back at almost 30 years of historical data to illustrate the performance characteristics of high-beta vs. low-beta stocks through multiple economic cycles. Historical data in the chart below shows that the performance differential between high-beta stocks and low-beta stocks has tended to be exacerbated during crisis periods and could have contributed to portfolio volatility.

The historical performance of high- vs. low-beta stocks

The chart shows the cumulative monthly returns of a portfolio constructed by going long top decile stocks (high beta exposure) and going short bottom decile stocks (low beta exposure) from the MSCI ACWI Investable Market Index universe.

Structural prolonged bear market periods have tended to contain bear market rallies, and the third quarter was no exception. The following table below shows the monthly return of long-high-beta as compared to short-low-beta stocks during historic bear market rallies (or during the early stages of a market recovery). All of these time periods are characterized by a quarter to a year of outsized monthly returns.

The performance of stocks during bear market rallies and early-stage recoveries

| Time period | Length (months) | Average monthly return | |

| Asian financial crisis | March ‘97 - July ‘97 | 4 | 5.7% |

| Russian financial crisis | Aug. ‘98 - March ‘99 | 7 | 6.5% |

| Tech bubble | Sept. ‘01 – Dec. ‘01 | 3 | 14.9% |

| Sept. ‘02 – Oct. ‘03 | 13 | 4.8% | |

| Global financial crisis | Feb. ‘09 - May ‘09 | 3 | 19.7% |

The MSCI Crowding Model indicates that high beta is the most crowded factor right now, with levels not too distant from those seen in the tech bubble in the early 2000s. This might cast further doubt on the persistence of high-beta stocks. The implication for investors may be that they have exposure to high-beta stocks without realizing it. We list the top 10 ETFs (with AUM above USD 5 billion) that have the highest beta exposure as measured by the MSCI Global Equity Factor Model. It turns out that growth and technology-oriented ETFs contained stocks with the highest beta-factor exposure.

The top 10 ETFs with highest beta factor exposure

| ETF | AUM ($ bn) | Beta factor exposure |

| iShares PHLX Semiconductor ETF | 6.28 | 1.41 |

| VanEck Vectors Semiconductor ETF | 6.32 | 1.29 |

| SPDR S&P Biotech ETF | 6.98 | 1.15 |

| Consumer Discretionary Select Sector SPDR Fund | 14.13 | 1.08 |

| iShares US Technology ETF | 6.35 | 1.00 |

| Vanguard Mid-Cap Growth ETF | 9.00 | 0.92 |

| iShares Russell 2000 Growth ETF | 8.93 | 0.92 |

| iShares Russell Mid-Cap Growth ETF | 11.05 | 0.92 |

| Vanguard Information Technology ETF | 40.44 | 0.92 |

| Fidelity MSCI Information Technology Index ETF | 5.07 | 0.91 |

As of June 30, 2022.

MSCI Adaptive Multi-Factor Allocation Model

Our adaptive multi-factor framework is a model designed to analyze factor-based decisions. Our research shows that and may suggest the value in taking a holistic approach to factor assessment. This approach encompasses not only the macroeconomic environment as shown above, but factor valuations, recent performance trends and risk sentiment.

As of Sept. 30, 2022, our Adaptive Multi-Factor Allocation Model showed the following exposures across the four pillars:

- Macro Cycle: Overweighted quality, low volatility and momentum with signals from the Chicago Fed National Activity Index, Federal Reserve Bank of Philadelphia’s ADS Index and PMI being mixed.

- Valuation: Overweighted value, momentum and low size based on the valuation gap compared to an equal-weighted factor mix in the context of nearly 30 years of a factor’s history.

- Momentum: Selected momentum, quality and low volatility based on relative performance over the last three months.

- Market Sentiment: Showed a slight overweight to low volatility, yield and quality with mixed signals from VIX (volatility) and credit spreads.

At the end of the third quarter of 2022, the MSCI Adaptive Multi-Factor Allocation Model showed an overweight to momentum, with low volatility and quality also being slight overweight, relative to an equally-weighted factor mix (as shown below).

Exposures from MSCI’s Adaptive Multi-Factor Allocation Model

As of Sept. 30, 2022. Positive exposures are denoted as + or ++, negative as - or -- and neutral as N.

1”EU climate benchmarks and benchmarks’ ESG disclosures.” European Commission, September 2019.

2The minimum year-on-year self-decarbonization for EU PAB benchmark indexes is 7%. This is in line with or beyond the decarbonization trajectory from the Intergovernmental Panel on Climate Change (IPCC) 1.5°C scenario. Please see for more details: “TEG Interim Report on Climate Benchmarks and Benchmarks’ ESG Disclosures.” European Commission, June 2019.

3The MSCI Net-Zero Tracker showed that a near-10% decarbonization rate is required for net-zero alignment starting from MSCI ACWI IMI, as of October 2021. See, “The MSCI Net-Zero Tracker: A quarterly gauge of progress by the world’s listed companies toward curbing climate risk.” MSCI, October 2021.

Further Reading

Factors in Focus: Disentangling Market Gyrations Through the War

Factors in Focus: Are Your Equity Styles Ahead of the Curve?

Factors in Focus: Impact of Inflation on Style Factors

Factors in Focus: Where’s the Value in Defensive Positioning?