- Buoyed by a relatively strong GDP growth rate, Indian equity markets have historically delivered positive active returns to emerging and developed equities and may be considered by investors for strategic asset allocation and diversification purposes.

- Futures linked to the MSCI India Index could help capture a deeper opportunity set and manage Indian equity exposure and its associated risks in preference to simulated indexes focused on a select group of holdings.

- India equity futures that capture a narrow subset of the local universe had high tracking error risk and concentrated sector exposures.

India, which is the world’s fifth largest economy1 and one of the fastest-growing major markets, is projected to become the world’s third largest economy by the end of the decade.2 As illustrated below, the weight of India3 within the MSCI Emerging Markets (around 14%) and MSCI ACWI (1.6%) Indexes has reached new highs over the last few years, increasing its importance to international investor allocations. The MSCI India Index has historically4 provided higher risk-adjusted returns relative to the MSCI Emerging Market and MSCI ACWI Indexes with an annualized active return of +3.8% and +5.8% over more than two decades.

India’s relative GDP growth

India’s relative weighting

India’s performance comparison

The IMF’s classification of countries comprises advanced, emerging and developing economies and is not exactly congruent to MSCI’s classification of countries into developed, emerging and frontier markets. Forecasts from 2022 to 2027.

Managing Indian equity exposure

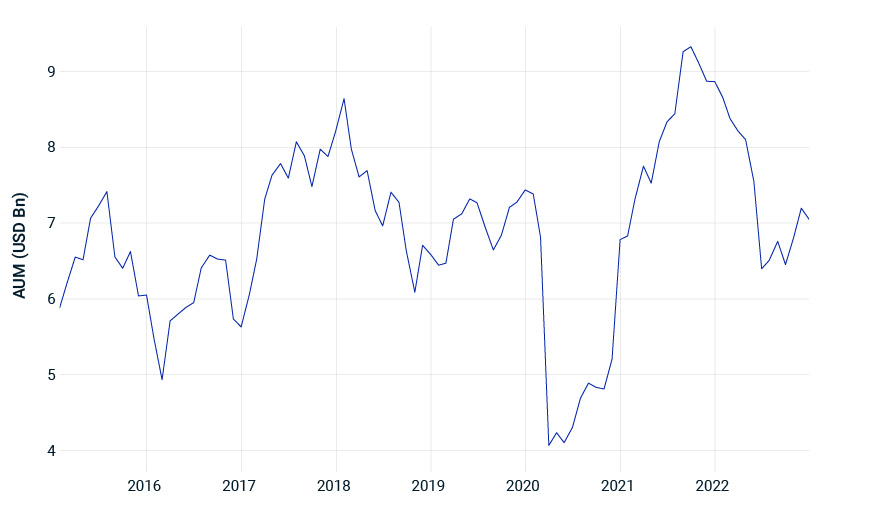

There has been increased interest in Indian equity markets over recent years with USD 43 billion5 of assets now benchmarked to all MSCI India equity Indexes, and an additional USD 60 billion indexed to Indian equities through its weight in the MSCI Emerging Markets and MSCI ACWI indexes.6 Investors may seek to manage Indian equity exposure using a variety of products that may include listed ETFs and/or futures. The exhibit below shows the AUM of ETFs7 linked to the MSCI India Index over time.

The notional volumes of MSCI India USD-denominated futures contracts across various exchanges depict an increasing trend over time as shown below8. Futures volumes also indicate that investors have rolled futures each quarter to maintain their exposure to the MSCI India Index.

ETF’s linked to MSCI India Index

Futures linked to MSCI India Index

The returns of single-country benchmarks, such as the MSCI India Index, are composed primarily of two sources of risk for international investors: local equity market and currency risk. International investors may seek to replicate currency-unhedged or hedged India exposures using USD-denominated futures contracts. But this may depend on the underlying reference index’s currency exposure. We detail two potential scenarios:

- 1) Equity future and index currency exposures are aligned: If the future is linked to the MSCI India Index (USD) and it is trading in USD, then a USD investor may use USD-denominated futures to seek currency-unhedged India exposure.

- 2) Equity future and index currency exposures are not aligned: If the future is linked to the MSCI India Index (INR)9 and trading in USD, then a USD investor may use USD-denominated futures to seek currency-hedged India exposure.

Alternatives to capture the India opportunity set

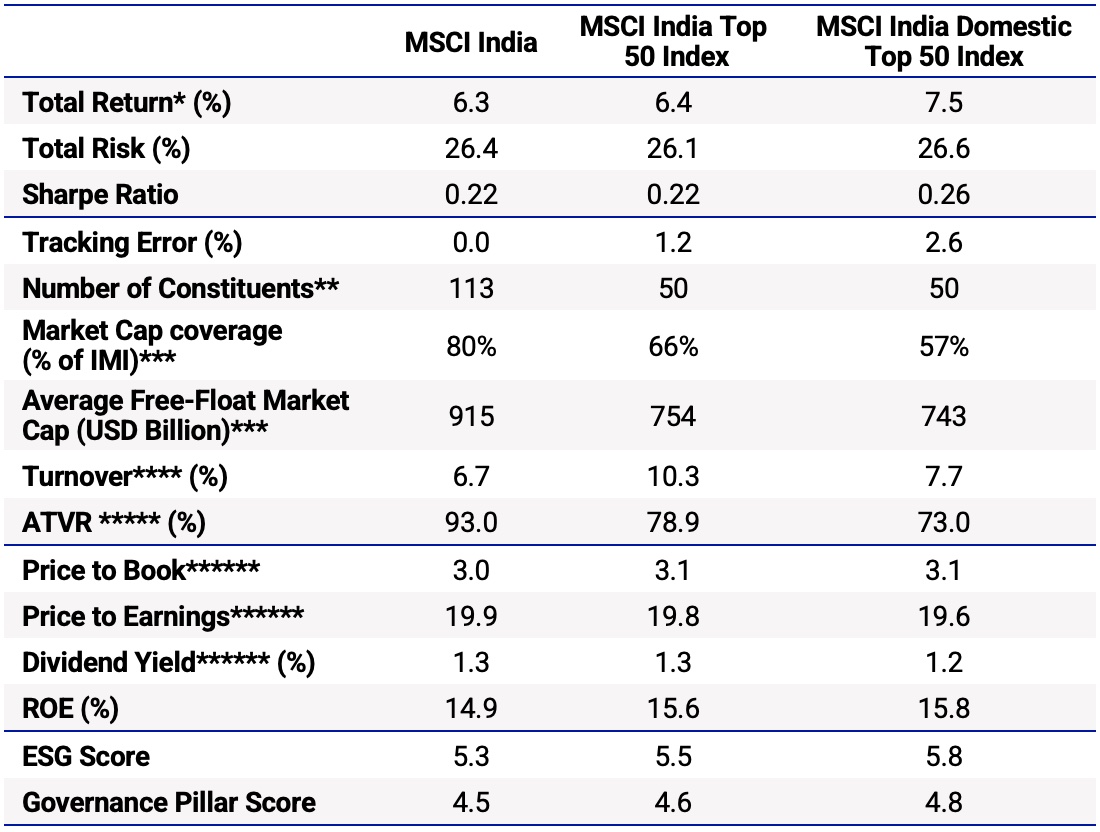

Some investors may have a preference to trade local futures linked to a more concentrated portfolio of large, well-established companies (rather than a larger universe) based on their concerns around investability, liquidity and profitability metrics. We compare these characteristics using the MSCI India Index, as well as two simulated indexes, the MSCI India Top 50 and MSCI India Domestic Top 50 Indexes. The simulated indexes consist of the top 50 securities by weight from their respective parent indexes. These are all free-float adjusted market-cap indexes based on the MSCI Global Investable Indexes (GIMI) methodology, where the MSCI India Index uses a foreign inclusion factor (FIF)10 while the MSCI India Domestic Top 50 Index uses domestic inclusion factor (DIF) adjustments.

Key relative performance metrics

* Gross returns annualized in USD. ** As of Dec 30, 2022. *** Month-end averages of last 1 year. Market cap coverage calculation for the India Domestic Top 50 Index uses the MSCI India Domestic IMI Index. **** Annualized one-way index turnover over index reviews. ***** Weighted average ATVR that measures trading volume in a security as a proportion of market capitalization. ****** Monthly averages. From June 30, 2008, to Dec. 30, 2022.

The key takeaways from the above comparison are:

- Performance: The India Domestic Top 50 simulation provided slightly higher risk-adjusted returns compared to the other two index simulations.

- Valuation, profitability and ESG: All indexes were comparable in terms of valuation ratios, profitability and ESG metrics.

- Investability: The MSCI India Index provided access to higher market-cap coverage with lower turnover and more liquidity (higher annualized trade value ratio11).

- Tracking risk: The Top 50 indexes resulted in sizeable tracking error versus an index that captured a wider opportunity set (the MSCI India Index), especially the MSCI India Domestic Top 50 Index simulation. The tracking risk has remained elevated especially during more volatile times (more than 3% since 2020 for the MSCI India Domestic Top 50).

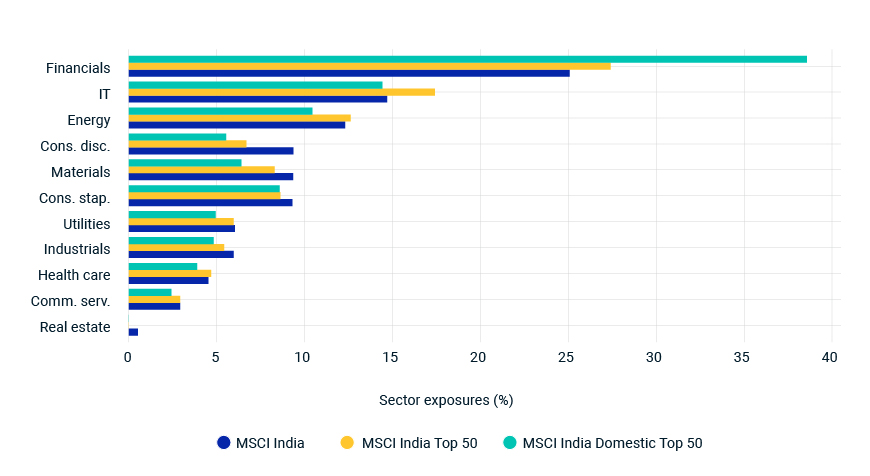

- Sector composition (see bellow): The MSCI India Domestic Top 50 Index provided greater exposure to the financial sector at the expense of other sectors (compared to the MSCI India Index). This was primarily driven by the inclusion of regulated financials with zero foreign room. For example, HDFC Bank Limited represented 9.15% in the MSCI Domestic Top 50 Index but was not in the MSCI India Index as of Dec. 30, 2022.

Concentrated sector exposures

As of Dec 30, 2022.

Diversified relative to concentrated

In summary, the MSCI India Index relative to a concentrated, simulated portfolio of the MSCI India Top 50 Index resulted in similar performance, valuations, profitability and ESG characteristics, higher market-cap coverage and liquidity, lower tracking risk and more diversified sector exposures. After considering factors such as liquidity and open interest, investors could weigh these outcomes against taking direct exposure using futures linked to India indexes that capture a narrow subset of the local universe.

The authors would like to thank Hitendra Varsani for his contribution to this blog.

1 Source: IMF. Historical data from 1980 to 2021. Forecasts from 2022 to 2027.

2 Source: IMF, World Economic Outlook Database, October 2022, State Bank of India “Ecowrap,” Sep. 3, 2022.

3 As of December 30, 2022

4 From Dec 31, 1998, to Dec 30, 2022.

5 The information is generated from third party sources and MSCI doesn’t assert the accuracy of the information. Includes both active and indexed investors in all MSCI India equity indexes. As of Sep 30, 2022.

6 This calculation is a conservative approximation based on the weight of India in MSCI Emerging Markets and MSCI ACWI indexes. The AUM figures used are for indexed investors covering all MSCI Emerging Markets and ACWI equity indexes. As of Sep 30, 2022.

7 ETF Fund providers include iShares, Lyxor, Amundi, Barclays etc. listed on various exchanges globally. The information is generated from third party sources and MSCI doesn’t assert the accuracy of the information.

8 Based on data from ICE Futures U.S., ICE Futures Europe, Eurex, HKEX.

9 India Rupee.

10 The FIF of a security is defined as the proportion of shares outstanding that is available for purchase in the public equity markets by international investors. This proportion accounts for the available free float of and/or the foreign ownership limits applicable to a specific security (or company). The DIF of a security is defined as the proportion of shares outstanding that is available for purchase in the public equity markets by domestic investors.

11 The Annualized Trade Value Ratio (ATVR) is used to measure liquidity. MSCI uses ATVR as an investability criterion to determine the inclusion of securities into the MSCI indexes.

Further Reading

Markets in Focus: Investors Look to Capture Big Market Shifts

Index Replication with Futures in a Deglobalized World