Discretionary managers use fundamental analysis to select stocks and construct portfolios that seek to beat the market. These managers face substantial headwinds in the current environment. From a business perspective, they are under pressure to reduce cost and improve performance. The market environment has also been challenging, as high correlations between stocks and the dominance of a handful of large technology companies have made it harder to generate alpha from stock selection.

In this blog we examine how discretionary managers could enhance their strategies by incorporating factor information while preserving their fundamental investment process and the added value from security selection. Our analysis indicated that adding factors to a universe of active portfolios led to improved performance historically, across various levels of manager skill. Crucially, portfolio characteristics and the managers’ stock selection contribution remained largely unchanged after the integration of factors.1

INTEGRATING FACTORS INTO ACTIVE DISCRETIONARY PORTFOLIOS BY REWEIGHTING EXISTING PORTFOLIO HOLDINGS

We focus on the eight common factors that have historically affected risk and performance in equity markets: value, size, momentum, volatility, quality, yield, growth and liquidity. These factors have been documented through empirical research and are used extensively in portfolio risk models and in active investment strategies. These factors also mirror some of the criteria used in fundamental security selection, for example, attractive valuations (value), high earnings growth (growth), high profitability (quality).

The main challenge in integrating factors in discretionary strategies is that portfolio managers may have concerns that adding factor information may distort their investment process and compromise their ability to generate alpha from stock selection. To address these concerns and avoid substantial modifications to an existing discretionary portfolio, we incorporated factors by reweighting portfolio holdings. This method ensured that all existing securities remained in the portfolio following the integration of factor information, albeit with modified weights. Specifically, we increased the weight of holdings with above average factor exposures and decreased the weight of stocks with below average exposures. As a result, we introduced a modest tilt towards rewarded factors across the portfolio.

We tested this method of integrating factors in active portfolios on a universe of 1,182 global and international (global ex US) actively managed mutual funds from December 2008 to December 2017. We assess the impact of factor tilts across all active funds and within groups of funds, sorted on historical 5-year trailing performance, prior to the introduction of factors. For every month during the simulation period, we reweighted the portfolios in our data set using factor information.

INTEGRATING FACTORS AFFECTED PORTFOLIO PERFORMANCE WITHOUT REDUCING STOCK SELECTION CONTRIBUTION

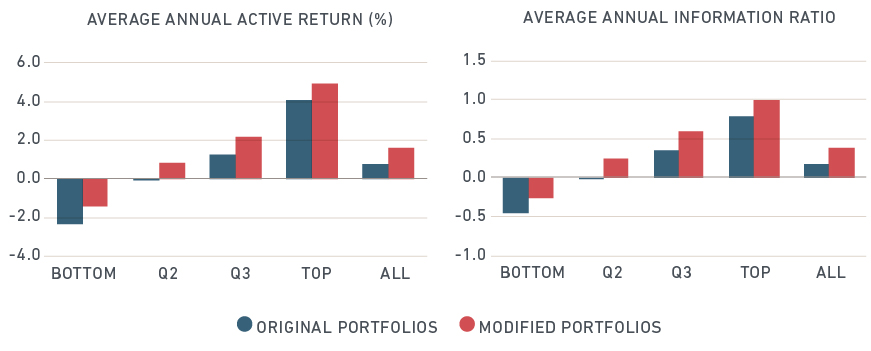

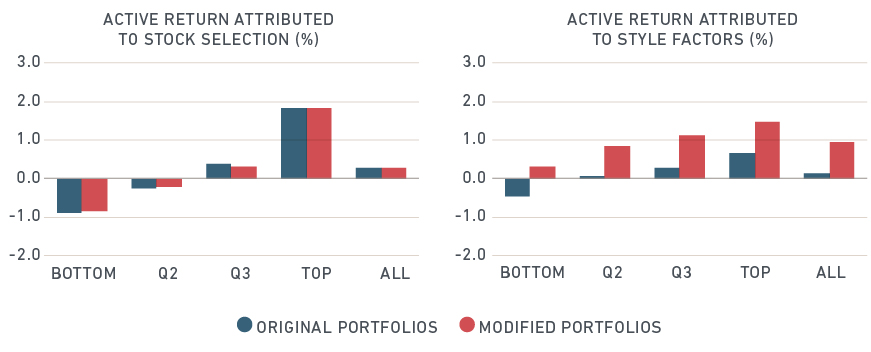

The original portfolios achieved average annual outperformance of 0.73% with information ratio of 0.17. Most of the outperformance, 27 basis points (bps), came from stock selection, while countries and industries each contributed 20 bps. In fact, stock selection made the highest contribution across all four performance quartiles in the original active portfolios.

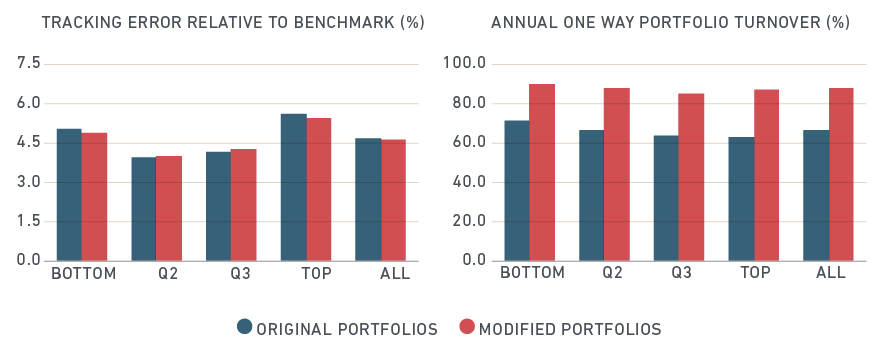

Adding factors improved performance substantially both in absolute and risk-adjusted terms. Simulated modified portfolios had average outperformance of 1.63% with IR of 0.39. Performance attribution shows that the added return came from the factor tilts we introduced to the portfolios, while performance attributed to security selection remained virtually unchanged at 26 bps. So, tilting the portfolios towards rewarded factors added 90 bps to active return without altering the specific contribution and therefore the manager’s ability to generate alpha from security selection. Also, the introduction of factors through this reweighting process did not increase the active risk of the simulated portfolios and was achieved with a relatively modest increase in turnover.

ADDING FACTORS IMPROVED PERFORMANCE WHILE RETAINING SPECIFIC RETURNS

In summary, our process of integrating factors in active portfolios improved performance historically without altering the characteristics of these portfolios and without compromising the managers’ ability to deploy their skills and generate alpha from stock selection.

1 Note that backtested results may differ from actual results and that past performance, backtested or actual, is not indicative of future results.

Further Reading

Weighty matters: going beyond stock-picking