- The market for collateralized mortgage obligations (CMOs) backed by agency residential mortgage-backed securities (RMBS) finances about 27 million tons of greenhouse-gas emissions.

- MSCI Total Portfolio Footprinting uses a tranche-allocation factor to distribute RMBS pools’ financed emissions to the security/tranche level. The tranche-allocation factor is modeled as a ratio of present value of the security/tranche versus the underlying pools.

- Financed emissions for agency CMOs may have interest-rate sensitivities that their underlying pools do not have.

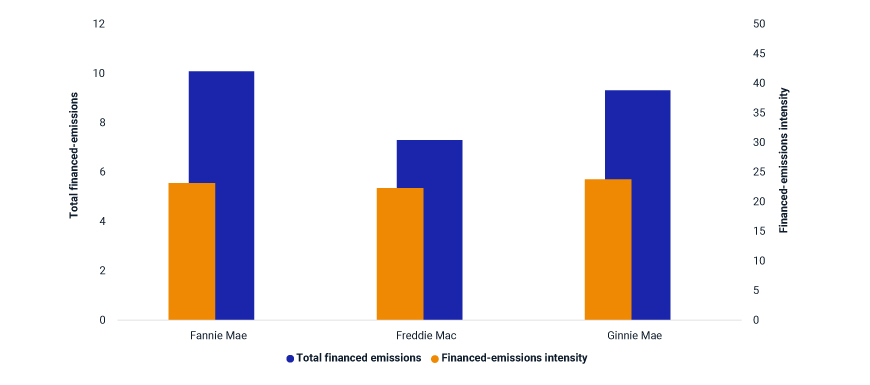

The USD 1.1 trillion market for collateralized mortgage obligations (CMOs) backed by agency residential mortgage-backed securities (RMBS) is a major source of financing for U.S. homeownership. Insurance firms, banks, asset managers and mutual funds are key investors in this asset class. According to the MSCI Total Portfolio Footprinting (TPF) model, approximately 27 million tons of CO2 or equivalent (CO2e) emissions are financed by agency CMOs, with Fannie Mae, Freddie Mac and Ginnie Mae accounting for 10, 8 and 9 million tons of CO2e, respectively (as shown in the exhibit below). As CMOs are structuring existing agency-RMBS passthrough (PT) pools, their financed emissions can be viewed as a structuring of the underlying pools’ financed emissions.

Total financed emissions and emission intensities for RMBS CMOs from across agencies

Data for RMBS CMOs from across Fannie Mae, Freddie Mac and Ginnie Mae, as of May 2023. Financed emissions are measured in millions of tons of Scope 1 and 2 emissions of CO2e, and financed-emissions intensity is measured in millions of tons of Scope 1 and 2 emissions of CO2e per USD millions of outstanding balance. Source: MSCI Total Portfolio Footprinting

MSCI TPF methodology for agency CMOs consists of two major components:

- Modeling the financed emissions of the underlying agency-RMBS pools: The pool financed emissions are driven by loan-to-value ratio (LTV), property location and property size.

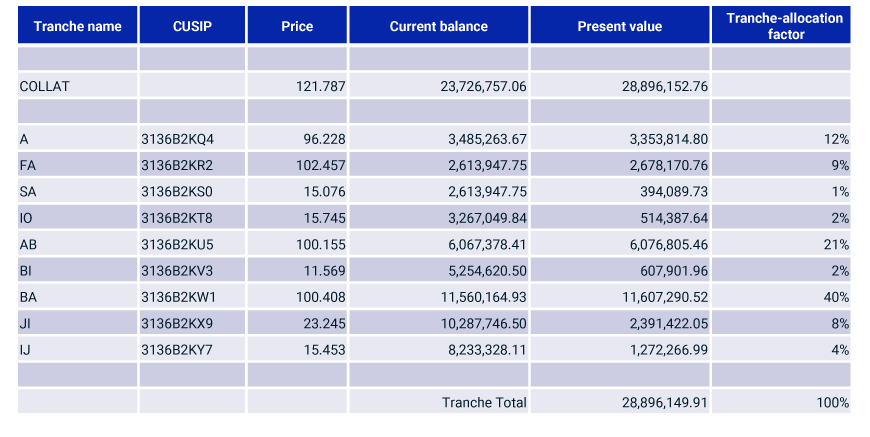

- Modeling the tranche-allocation factors that distribute the financed emissions of the underlying pools to individual securities/tranches. The tranche-allocation factors are approximated by the ratio of the present value (PV) of the tranche versus the PV of the collateral pools. The exhibit below shows an example.

Agency CMOs’ financed-emissions allocation

Data as of May 2023. Source: MSCI, INTEX

Financed emissions for mortgage loans generally do not involve present-value calculations and have no interest-rate sensitivity or duration. Why is it necessary to add these complexities to CMOs?

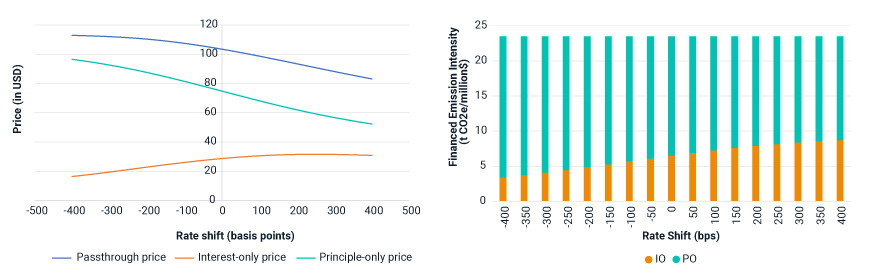

The interest-only (IO) and principal-only (PO) split of a passthrough pool is perhaps a common, and arguably the simplest, structuring of agency pools. The exhibit below shows how valuations and financed-emissions intensity change in response to interest-rate shocks between the passthrough and IO/PO.

Valuation and financed-emissions intensity under varying interest-rate scenarios

Data as of May 2023 for passthrough uniform MBS 5.5 vs. interest-only and principal-only tranches.

If mortgage rates drop and prepayment picks up, the financed-emissions intensities of the passthrough pool and the IO tranche will take very different paths:

- The passthrough pool’s price may appreciate, and the pool factor/outstanding balance may drop faster, but the financed-emissions intensity will not change significantly.1

- Larger prepayments may substantially diminish the cash flow available to the IO tranche and reduce its contribution to the financing and financed emissions of the underlying pool. Consequently, the financed emissions of an IO tranche may have negative duration.

Ultimately, investors may wish to consider these additional layers of complexity in terms of measuring and managing emission risk due to the interest-rate sensitivities of agency CMOs’ financed emissions.

1The prepayment speeds of the mortgage loans in the pool are often correlated with emissions. For that reason, the financed-emissions intensity of the remaining pool would be expected to change gradually.

Further Reading

Breaking Down Financed Emissions for Agency RMBS

Carbon-Emissions Data to Inform the MBS Market

Total Portfolio Footprinting to Transform Green-Bond Emission Accounting