- U.S. auto- and student-loan ABS pools experienced another month of increased payment suspension. Reported delinquencies and defaults did not increase, but the severity rate increased for defaulted auto loans and auto leases.

- U.S. ABS backed by revolving credit, such as credit cards and auto dealers’ floorplans, recorded drops in portfolio yield and the principal-payment rate, amid a stressed economy.

- The May reports for China’s consumer-ABS performance suggested a V-shaped recovery, with bifurcated performance for consumer credit.

As the U.S. COVID-19 lockdown continued in April and confirmed cases ramped up, the U.S. economy experienced another month of distress. The CARES Act and other federal stimulus relieved consumers’ pain somewhat, but investors may wish to take note of the latest data: May remittance reports (reflecting April payments) for asset-backed securities (ABS) indicated performance deterioration and signaled potential challenges ahead.

Distress of US Auto ABS Reflected in Higher Payment Suspension

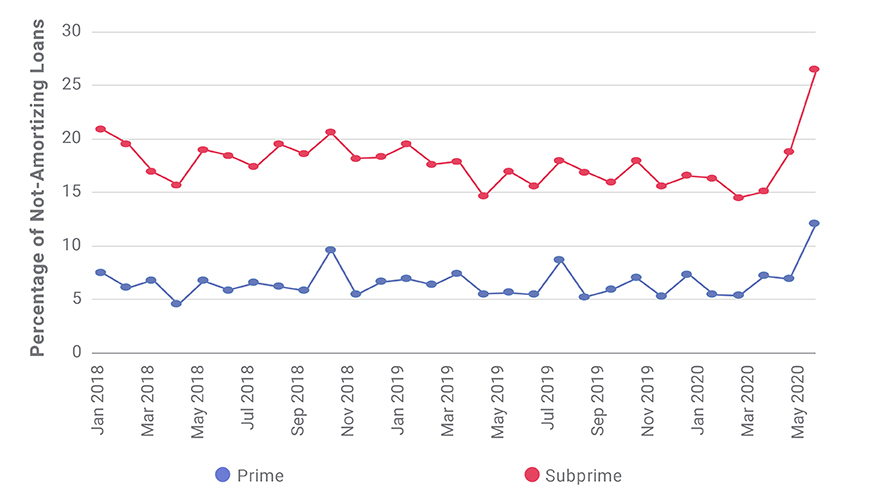

In the April remittance report, securitized auto loans’ new 30-day delinquencies increased, and more nominally current loans stopped amortizing. This trend extended into the May report, as “not-amortizing loans” further increased to 26.5% from 18.8% for subprime and to 12.2% from 7.0% for prime. These sharp increases could be the result of a higher percentage of loans on payment holiday through modifications.

Although the reported delinquency and default rates did not increase, the stress was directly reflected in the rising severity, which is a measure of loss given default.

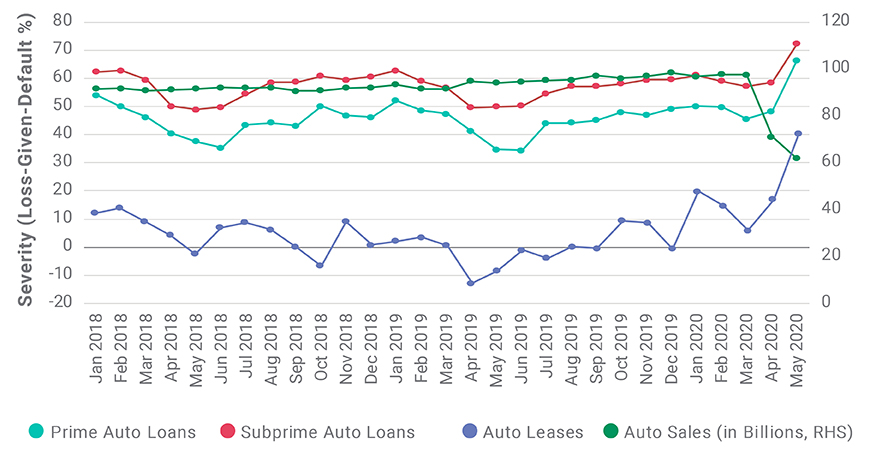

Severity Rate Rose Sharply for Auto Loans and Leases

Historically, severity has oscillated seasonally between 40% and 50% for prime loans, 50% and 60% for subprime loans and at much lower rates for auto leases. In the May report, however, these severity rates jumped to 66%, 72% and 40%, respectively. Severity is derived from the collected recovery and liquidation amount from a given month; and when reported defaults are stable, a higher severity indicates a smaller amount was collected.

MSCI’s collateral model for U.S. auto-loan ABS1 indicates that depressed used-vehicle prices and auto-sales volume both dragged down liquidated vehicles’ resale prices, leaving less to be recovered from repossession and liquidation. If struggling rental-car companies were to fully liquidate their fleet,2 that could be another shock to the already weakened used-car market — threatening the prepayment, default and severity performance of auto loans, according to our model.

Elevated Forbearance in Student-Loan ABS

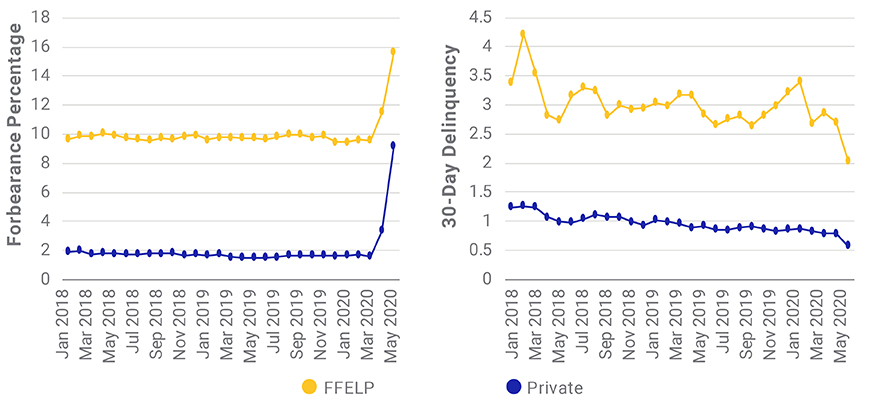

Signs of distress also showed up in securitized student loans, as the percentage of loans in forbearance increased. The Federal Family Education Loan Program (FFELP) and private lenders offer deferment and forbearance options for borrowers experiencing temporary hardship. Loans with deferment or forbearance status are not marked as delinquent or defaulted, and reported 30-day delinquency rates dropped. In the May report, loans in forbearance increased to 15.7% in April from 9.6% in February for securitized FFELP loans, and to 9.2% from 1.6% for private loans over the same period. Given that forbearance can last a few months, the eventual impact may not show up in delinquencies or defaults quickly. Whether these loans will deteriorate or recover to repayment status would depend, in part, on borrowers’ recovery of income.

Forbearance Programs Kept Delinquency Down for Student Loans

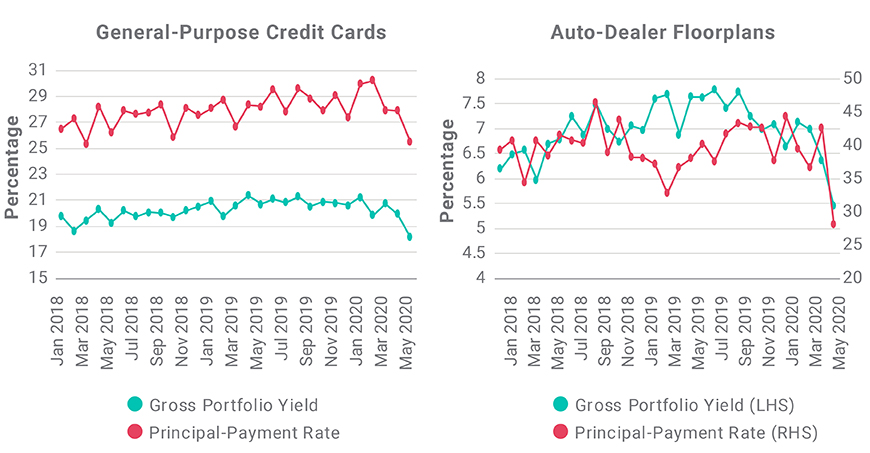

Credit-Card and Dealer-Floorplan ABS Had Lower Gross Portfolio Yield and Principal-Payment Rates

For credit-card ABS, the reported delinquencies and charge-off rate did not increase, possibly due to the flexible repayment nature of card debts and temporary relief programs. But May remittance reports from major general-purpose card issuers indicated a 248-basis-point drop in the principal-payment rate and a 258-basis-point drop in gross portfolio yield from March.

Several consumer lenders were given downward revisions to their rating outlooks.3 Although the continuously tightening credit standards4 and low household debt levels5 for the last two years built up what some may consider a solid foundation for consumer credit-card loans, loan performance could face challenges given the high unemployment rate and weakened GDP environment, according to MSCI’s collateral model for U.S. credit-card ABS.6

For auto dealers’ floorplans, the principal-payment rate dropped to 28.2% from 42.6%, and gross portfolio yield dropped to 5.4% from 6.4%, indicating the hardship that auto dealers were experiencing amid the lockdown, when auto transactions slowed significantly.

ABS Backed by Revolving Credit Showed Lower Issuer Profits and Consumer Repayment Ability

China’s Bifurcated Consumer Credit Performance

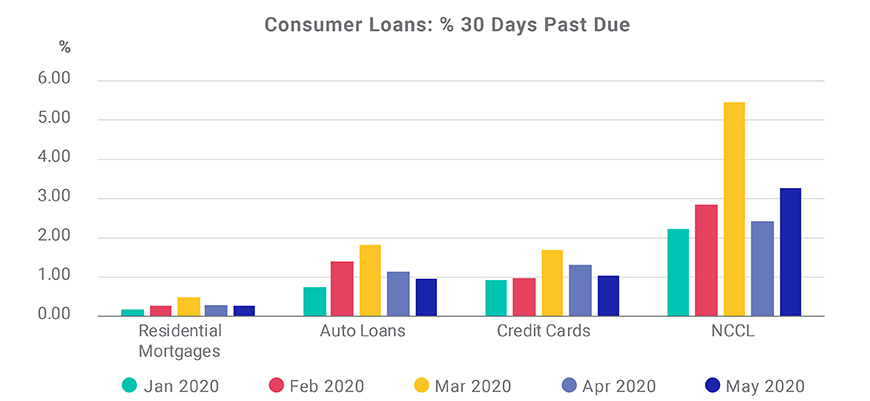

In China, the ABS picture was rosier than the one in the U.S., according to the May remittance report (covering April data). The 30-day delinquency rate of residential mortgages, auto loans and credit-card installments declined for the third consecutive month. This decline suggested that the financial situation of better-off consumers gradually recovered. But the 30-day delinquency rate of noncollateralized consumer loans (NCCL), which have historically had the weakest borrower credit and highest default rates, rose again in April, indicating these borrowers were still vulnerable.

Delinquency Rates in Chinese Consumer ABS Mostly Dropped — but Not for the Weakest Borrowers

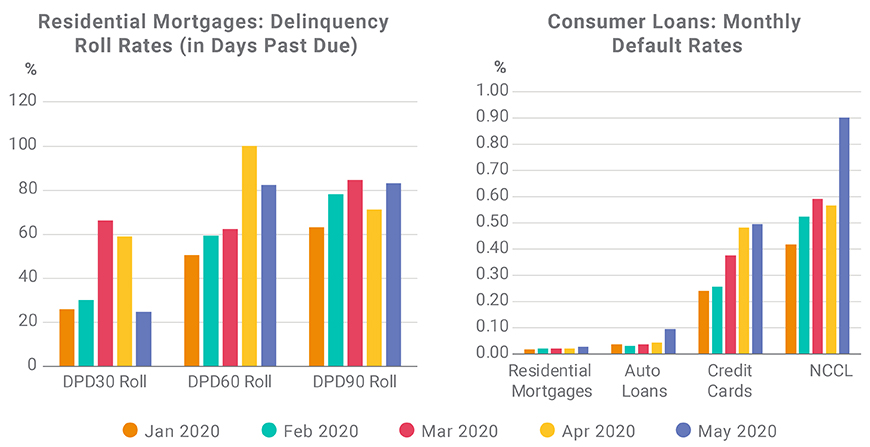

Rates of Serious Delinquency and Default Remained Elevated or Increased

While the current-to-30-day delinquency roll rate continued to trend downward, the 30-to-60-day and 60-to-90-day delinquency roll rates stayed at elevated levels. The sharp increase in default rates suggested the destructiveness of the pandemic in consumer credit started a few months ago. The recovery did not show up in severely distressed borrower groups.

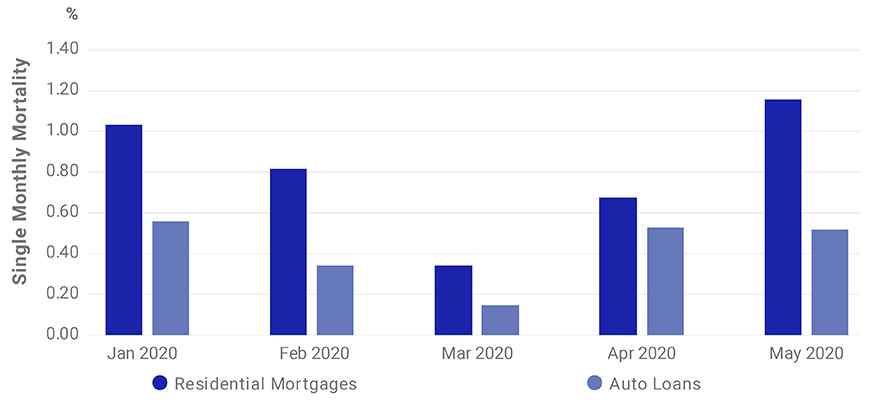

Mortgage and Auto-Loan Prepayment Rates Returned to Pre-COVID Levels

In the May report, the single-month prepayment rate of mortgage and auto loans returned to pre-COVID-19 levels. The recovery in mortgage prepayment was consistent with the V-shaped home-sales recovery,7 which could have been driven by pent-up housing demand during the lockdown period, according to our model. It remains to be seen if this will be a sustained recovery of the China residential real estate market.

While Chinese consumer loans presented a rosy picture with V-shaped recovery — except for some deteriorations in NCCL — the U.S. consumer-loan market remained murky, amid the uncertainty over continued stimulus and eventual recovery. Given that the outbreak came later in the U.S., investors may gain a clearer view in the months ahead.

1Yang, Y. and Zhang, J. 2019. “MSCI US Auto Loan Collateral Model.” MSCI Model Insight.

2Gladstone, A. and Naughton, N. “Rental-Car Company Hertz Files for Bankruptcy.” Wall Street Journal, May 22, 2020.

3Wack, K. “Fitch flags seven consumer lenders, including Amex, Capital One.” American Banker, April 29, 2020.

4“Net Percentage of Domestic Banks Tightening Standards on Consumer Loans, Credit Cards.” FRED.

5“Household Debt Service Payments as a Percent of Disposable Personal Income.” FRED.

6Yang, Y. 2019. “MSCI US Credit Card ABS Collateral Model.” MSCI Model Insight.

7“China Home-Price Growth Accelerates in Property Market Boost.” Bloomberg, May 17, 2020.

Further Reading

Consumer ABS Under Coronavirus in the US and China

Can AI Model the Complexities of MBS Prepayment?

How coronavirus could hurt Chinese consumer ABS

MSCI US Auto Loan Collateral Model (client access only)

MSCI US Credit Card ABS Collateral Model (client access only)

MSCI China ABS Collateral Model (client access only)