Labor Day in the U.S. marks a point where for the last two years investors have wondered if office workers will return to post-pandemic levels of attendance. Fewer people are expecting such a return at this juncture, though it could be easy to get people back to the office. People respond to economic incentives: If workers are needed back in the office, simply pay them more to be there. The compensation required to motivate such a return need not be limited to wages, nor does the inducement have to be provided by employers; improved transit options and reduced travel time could quicken workers’ return to the office.

Record high in office vacancy

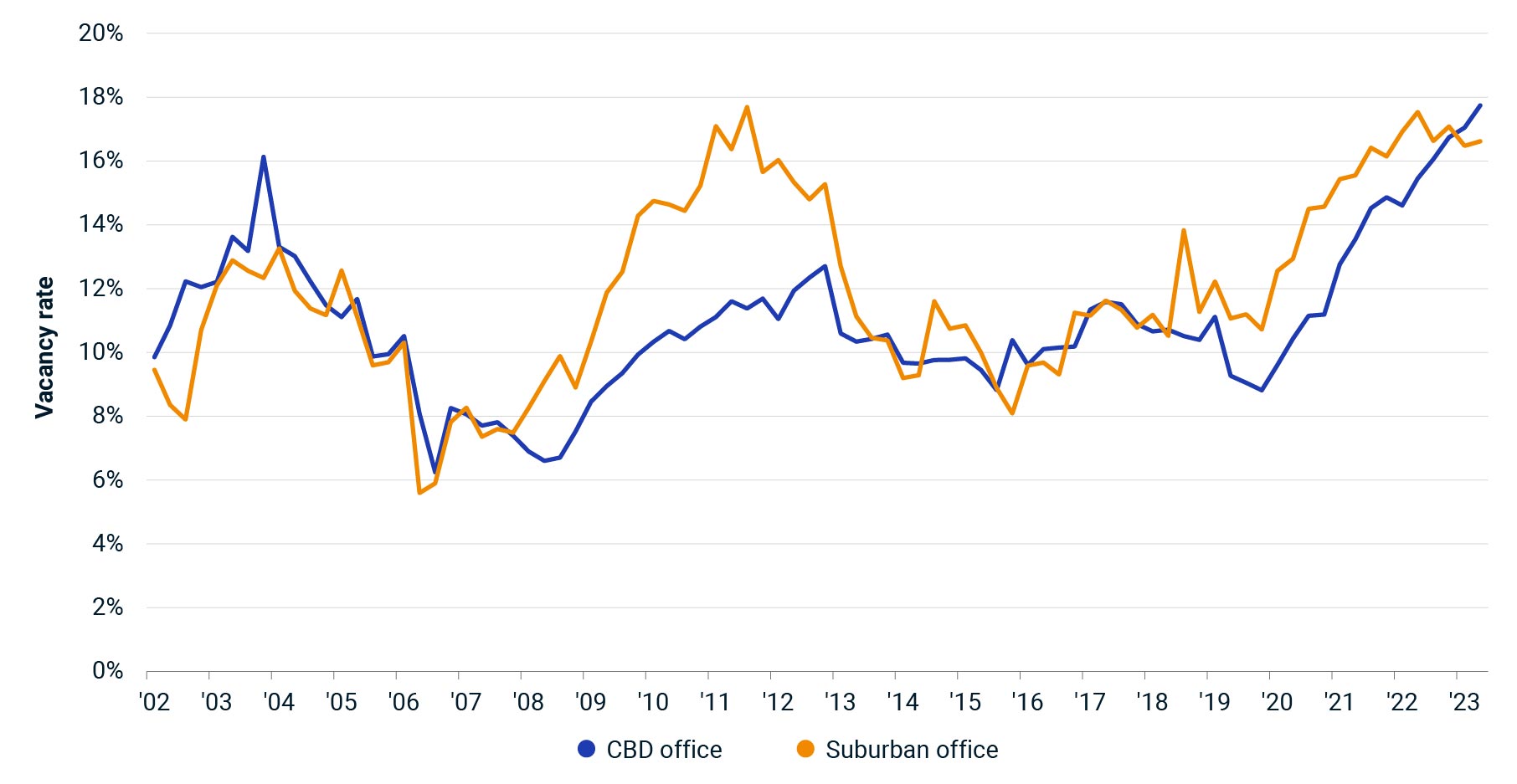

Office vacancy has been on the rise. Vacancy for offices in central business districts (CBDs) hit a record high of 17.7% in the second quarter of 2023 for the high-quality assets tracked as part of the MSCI U.S. Quarterly Property Index. CBD office vacancy was ahead of that for suburbs, which came in at 16.6%. The fact that CBD vacancy is now tracking higher than the suburbs suggests that there is simply less demand for office space in the former locales. From 2008 to 2019, by contrast, CBD vacancy averaged 180 basis points lower than suburban. Why should demand for space be facing more challenges in CBD locations and not suburbs?

Office vacancy in CBDs has overtaken suburban vacancy

Weaker demand in CBD locations is driven by a variety of factors, but differences in the commute could easily play a role. The CBD office assets tracked in the MSCI U.S. Quarterly Property Index are typically found in the large, coastal cities where public transit played an important role in moving people around before the pandemic. Suburban assets, by contrast, include more car-focused transit. Safety, speediness, and cleanliness concerns associated with public transit after the pandemic will weigh more heavily on CBD locations. The time spent commuting is a challenge as well.

Compensation for longer commutes

To arrive in Lower Manhattan from the New York suburb of New Rochelle at 8:30 a.m., for instance, one faces a minimum 70-minute commute time by train, with a change to the subway when in Manhattan. Building in time to get ready for the day and get to the train station, a person may need to wake up before 6:00 a.m. to make an early-morning meeting in person. (New Rochelle is just 20 miles from Lower Manhattan.) By contrast, a worker living in downtown Brooklyn would face only a 15- to 20-minute commute to the same location at that hour.

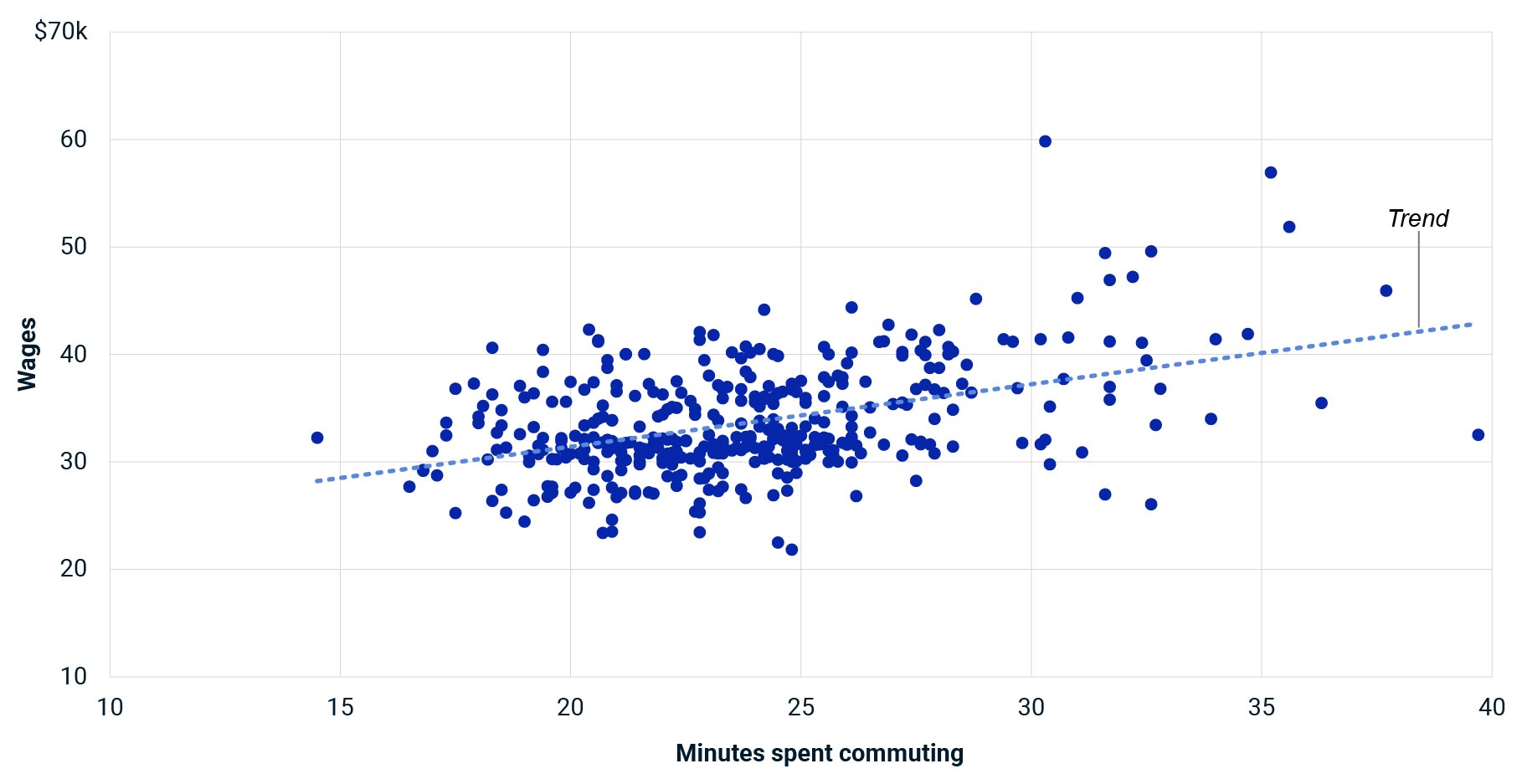

That time to commute has, in the past, translated to higher average wages for workers facing longer commutes. Across U.S. metro areas in 2019, for every extra minute spent commuting, wages were USD 581 higher. Generally speaking, metro areas where workers face longer commutes put employers in a position where they must pay more to be able to attract workers. Firms compete for qualified workers, and those workers face an opportunity cost in their commutes. That opportunity cost is why there is the wage premium in locales with longer commutes in the exhibit. As those firms compete for qualified labor, workers need to be incentivized for every minute they spend away from their home lives.

Long commutes translated to higher wages in the US in 2019

If investors are worried about the rise in vacancy and reduction in demand for CBD offices, improving the mass-transit experience of workers in those locales would be a public-policy solution that could effectively act as a wage boost and incentivize some workers to return. If, for instance, the Northeast Corridor had the equivalent of one of Japan’s Shinkansen lines, firms could draw in workers from a much wider area with shorter commute times to the city. Improving the safety and cleanliness would also help, as fewer disturbances keep trains running and would reduce the fear some people sadly face when commuting.

Firms that mandate return-to-office policies for workers are, effectively, telling these workers that they will be reducing their net compensation. If wage compensation is held steady and the opportunity cost of commuting rises, some firms will face challenges retaining workers. If the agglomeration benefits of having multiple workers in one place is important to a firm, there is a wage price that these firms should be able to pay to bring back these workers. If those higher wage costs outweigh the agglomeration benefits of getting workers together each week, it could spell a darker future for some of the office buildings in the U.S., particularly in key CBD locations.

The (rail)way forward

A darker future for CBD offices is a challenge real-estate investors face that is not of their own doing. They did not overextend using debt or massively overbuild supply in these locations over the last cycle. Their tenants have an evolving relationship with their workforce that incentivizes many workers to stay away from the office. Public leaders haranguing people to come back to offices will likely face limited effectiveness as they ask people to defy their own self-interests. These same leaders could help these areas by promoting fast, efficient, clean and safe commuter rail and subways.