- Anecdotal, noncomparable and often subjective reporting on impact measurements is a challenge for institutional investors seeking to evaluate corporate alignment with the UN Sustainable Development Goals (SDGs).

- Goals 7 (clean energy), 12 (sustainable consumption and production) and 13 (climate action) had the highest percentage of companies (8%-9%) misaligned with the goals, driven mostly by continued reliance on fossil fuels.

- U.S. companies were behind on Goal 8 (decent work and economic growth): Only 8% of U.S. firms aligned with this SDG compared to 15% for Australia and New Zealand, 17% for Europe and 19% for Asia.

Five years ago, the United Nations adopted 17 UN Sustainable Development Goals (SDGs) in an effort to end extreme poverty, reduce inequity and protect the planet by 2030.1 While adherence has grown,2 there are questions whether companies are walking the walk as well as talking the talk.

Inconsistent and incomplete data has implications for asset managers who may have to report on portfolio companies’ alignment with the SDGs. In addition, impact investors may find that portfolio companies are engaged in “impact washing,” in which the company claims to support an SDG while being implicated in conduct that may belie that support. Conversely, some companies that fail to publicly commit to any SDG but align with at least one of the goals may fall below the radar of impact investors seeking to target positive-impact companies.

For example, earlier this year, we found that 283 (9%) of the companies in the MSCI ACWI Index had committed publicly to support an SDG but had been implicated in one or more recent serious controversies. Conversely, we found 860 companies (28%) offered products or services that align with at least one of the goals but did not publicly commit to any.

Fragmented data on how companies are aligned with a respective SDG further exacerbates the challenges facing investors. Most standardized information provided by companies covers only “traditional” ESG performance metrics, e.g., carbon emissions, water consumption and employee injury rates. SDG-related reporting is generally anecdotal, pertaining to specific projects and initiatives and lacking a full assessment of companies’ impact on society and the environment throughout the value chain. Several frameworks seek to set a standard on impact reporting, yet market participants have not agreed on a common reporting and measurement tool that offers the comparability and scalability needed to understand how different companies measure impact.

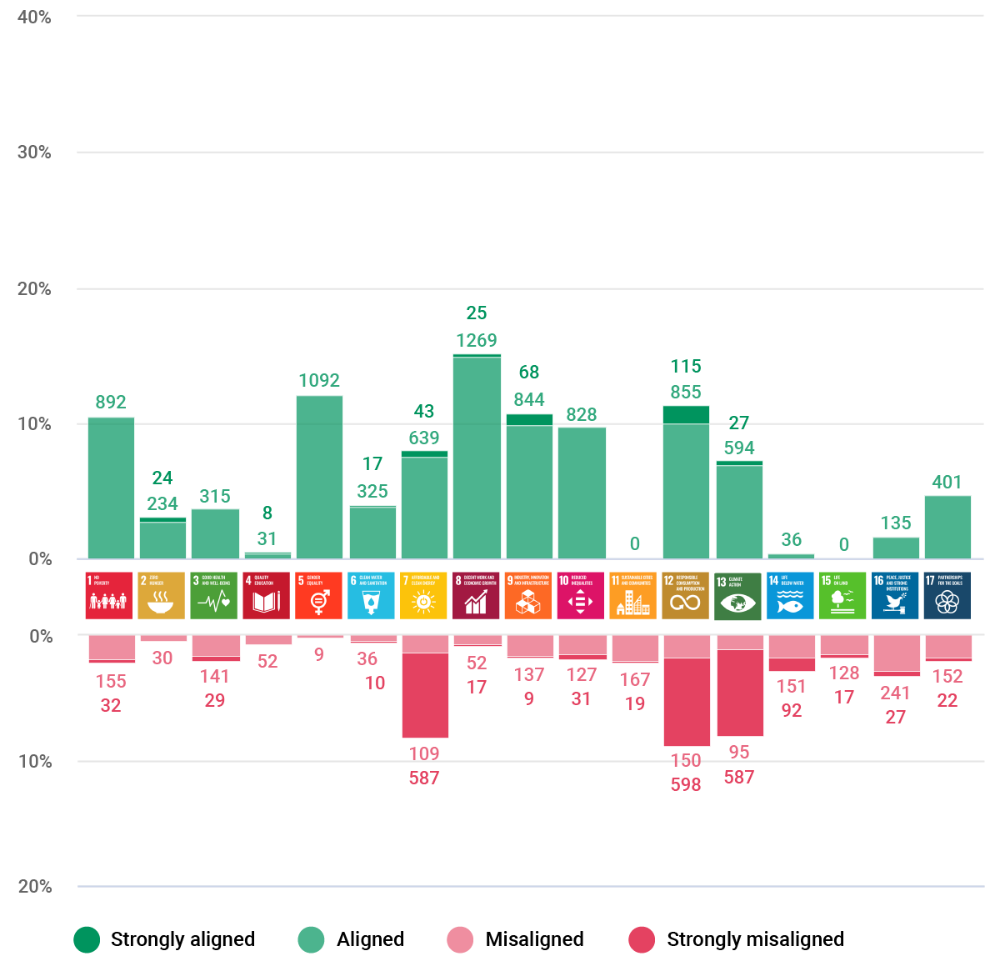

Our research found that incorporating both positive and adverse impacts into a standardized assessment makes it possible to compare companies and help make sense of what could seem like conflicting information. Using the MSCI SDG Alignment dataset, we looked at how products, services and activities of 8,550 issuers, including 7,306 MSCI ACWI Investable Market Index (IMI) constituents, aligned across the individual goals. The results ranged from strongly aligned to strongly misaligned, with many firms in the middle (“neutral/mixed”).

Have Companies Made Progress Toward Meeting SDGs?

The chart displays distribution of companies’ assessment by SDG for a set of 8,550 companies, as of Aug. 11, 2020.

Source: MSCI ESG Research LLC.

Where Companies Are Most Aligned and Misaligned

Of the 17 SDGs the global community aims to achieve, climate mitigation (Goal 13), clean energy solutions (Goal 7) and sustainable consumption and production (Goal 12) are among the most commonly cited by companies.3 Yet these three goals saw the highest degree of misalignment (more than 8% out of 8,550 issuers were assessed as misaligned or strongly misaligned) compared to other SDGs.

The slow progress toward addressing these three SDGs was most apparent for the energy and utilities sectors.4 The energy sector continued to develop low-carbon solutions and advance the use of alternative energy, but only three energy companies — the biofuels companies VERBIO Vereinigte BioEnergie AG, Renewable Energy Group and REX American Resources Corp. — earned more than half their revenue from clean energy. However, 91% of the energy sector continues to rely on fossil fuels as a core source of revenue, suggesting strong present-day misalignment on all three SDGs (Goals 7, 12 and 13).

The alignment gap looked less drastic for the utilities sector. Just over 18% of the 425 utilities companies we assessed promoted the transition to clean and affordable energy through greening their fuel mix, with 7% exclusively involved in renewable power generation. In addition, 40% continued to primarily rely on fossil fuels for power generation (though this included natural gas, considered a “transition” fuel by some).

Goal 8, which targets economic advancement, employment and decent work conditions, saw the highest degree of support and alignment: 15% of the 8,550 companies we assessed in the beginning of August 2020 supported inclusive employment, advancement of professional growth or offered economic-empowerment solutions. Due primarily to their involvement in controversies related to adherence to labor standards, only 8% of U.S. firms aligned with this SDG compared to 15% for Australia and New Zealand, 17% for Europe and 19% for Asia. Companies domiciled in Europe also tended to be more aligned with the goals tied to gender equality and women’s empowerment (Goal 5) and reducing inequality (Goal 10) compared to companies in other regions.

Majority in the Middle

Though MSCI ESG Research does not assess a company’s overall alignment with the SDGs, we can draw some overall conclusions based on the extent each company is aligned or misaligned with the 17 goals:

- Across all SDGs, we found that nearly four in 10 (37.8%) of the 8,550 companies we assessed had a greater number of alignments than misalignments. However, a larger share of developed-market companies (60.9%) were aligned with more SDGs. This finding may suggest that companies in highly industrialized nations face greater pressure to mitigate their effect on the environment and society, and report on those efforts, compared to their counterparts in developing economies.

- The majority (55%) had neutral or mixed alignment across the goals, generally because their products or operations were not especially relevant to the advancement of specific individual goals (e.g., Goal 4 on access to quality education).

- At the extremes, 0.8% of companies were strongly misaligned with at least three SDGs, while 0.2% of companies were strongly aligned with at least three of them. The outliers — strongly aligned or strongly misaligned — exhibited roughly the same rates in both developed and emerging markets.

10 Years and counting

From institutional investors’ perspective, effective evaluation of SDGs still has a long way to go. The path starts with having clear, transparent and consistent information. That way, investors can better assess the merits of claims put forth by portfolio companies, whether overstated or understated. With the target deadline for achieving the SDGs only a decade away, starting on the standardization of that assessment now is critical.

1 Transforming our World: the 2030 Agenda for Sustainable Development.” United Nations Department of Economic and Social Affairs, Oct. 21, 2015.

2 “United Nations Secretary General’s Roadmap for Financing the 2030 Agenda for Sustainable Development, 2019-2021.” United Nations Secretary General, July 18, 2019.

“World Investment Report 2019.” United Nations Conference on Trade and Development.

3 Scott, L., and McGill, A. 2019. “Creating a Strategy for a Better World.” PwC.

Who Cares about the United Nations Sustainable Development Goals?” MSCI Blog, April 6, 2020.

4 Based on the Global Industry Classification Standard (GICS®), the global industry classification standard jointly developed by MSCI and Standard & Poor’s.

Further Reading

Who cares about the UN Sustainable Development Goals?

Aligning portfolios with UN Sustainable Development Goals

The SDGs and Sustainable Impact: A Practical Guide for Investors