- Spiking interest rates in 2022 pushed the prices of agency mortgage-backed securities lower, into discount space, complicated by various macroeconomic uncertainties.

- Investors now face base-speed risk with longer horizon. The lack of historical data has led MBS modeling and risk into uncharted territory with extrapolation.

- Armed with a historically calibrated model, investors can dynamically assess the information embedded in market dynamics. We also demonstrate the stress analysis with four risk scenarios as the agency-MBS themes for 2023.

Interest rates spiked sharply in 2022 as the Federal Reserve started quantitative tightening (QT), pushing the prices of most agency mortgage-backed securities (MBS) lower, into discount territory, where the bond price is below par and borrowers in the underlying mortgages lack a refinancing incentive. Prepayment speeds have slowed to a historical low, and the market entered uncharted territory, with limited historical data as guidance. A historically calibrated model can help gauge the baseline risk and dynamically assess the information embedded in market dynamics, which may deviate from historical extrapolation.

Looking back at 2022 to help assess 2023

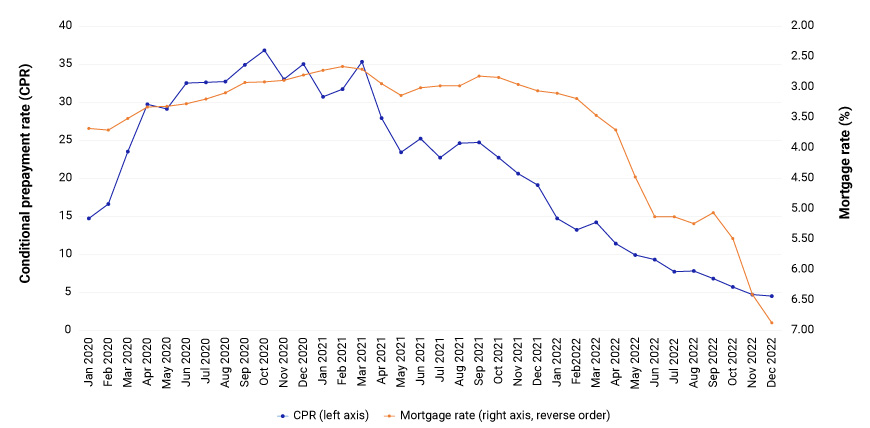

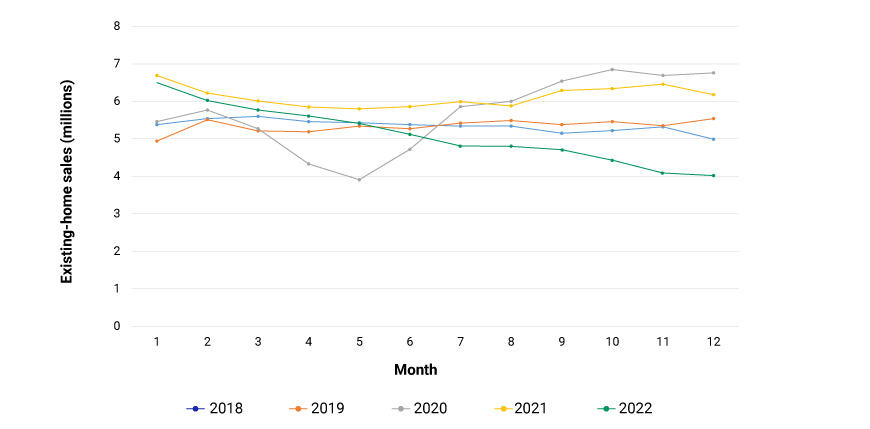

The effects of the Federal Reserve’s kicking off rate hikes and implementing QT at the beginning of 2022 was quickly felt throughout the markets: The 10-year Treasury ended the year at 3.88%, 236 basis points (bps) higher than at the beginning of the year. Mortgage rates increased even more, with a 378-bp jump, pushing the 30-year mortgage rate to near 7%. Consequently, the aggregate conditional prepayment rate (CPR) for 30-year mortgages dropped below 5, and existing home sales slumped significantly in the second half of the year — about 26% lower than the trailing-20-year average.

As mortgage rates rose, prepayment activity plunged

Source: Fannie Mae, Freddie Mac, Recursion

Existing-home sales slumped below the 20-year average

Source: National Association of Realtors

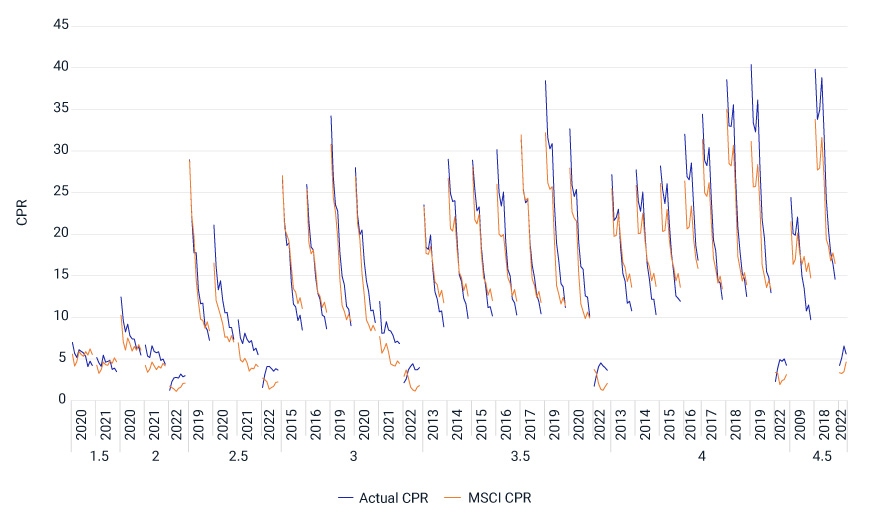

The challenge of modeling prepayment speeds

Prepayment speeds for agency MBS slowed drastically across all cohorts in 2022. MSCI’s MBS-prepayment model was able to track the actual speeds down into the discount space with an error margin of 1 CPR. Historically, the prepayment model’s accuracy has been mostly dominated by the refinance component. The base prepayment speeds, such as those driven by housing turnover, emerged as the dominant components by the end of 2022. It’s a critical test to ensure the prepayment model is appropriate through this transition phase with clear differentiation, as shown in the MSCI rank-based error tracking.

The MSCI prepayment model tracked the actual slowdown across major cohorts

Data on Fannie Mae 30-year MBS. Source: Fannie Mae, Recursion, MSCI Agency MBS Model Suite

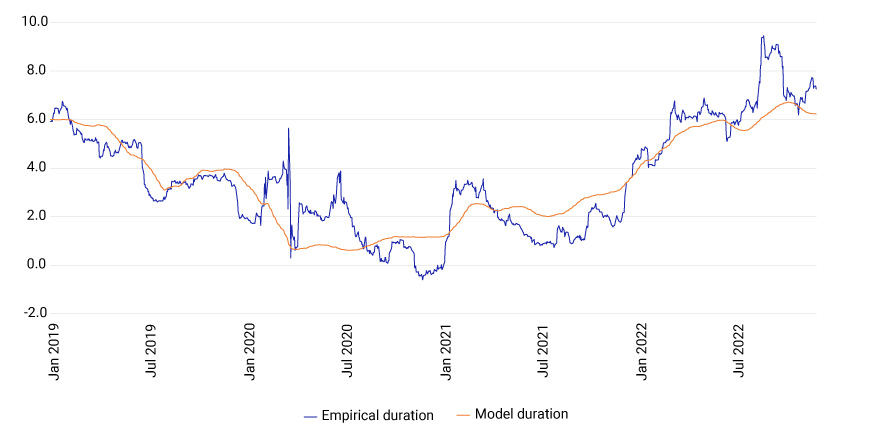

Longer empirical durations: An effect of quantitative tightening

Since the second half of 2022, empirical durations have been significantly longer than MSCI’s model-based option-adjusted duration (OAD). Given the drastic slowdown of existing-home sales and cash-out activities, some investors may raise concern that the model’s base-speed assumptions are too fast, which could contribute to OAD being too short. MSCI prepayment-error tracking shows the model slowed down in sync with the realized prepayment, with potentially 1 CPR of overshooting in the past three months.

Even if we dial the model 1 CPR slower, it is far from enough to account for the model and empirical-duration gap for the past six months. Instead, the more likely explanation is the QT. As QT tension built up and convexity volatility, such as one-month x 10-year swaption volatility, spiked to nearly 160 bps in the middle of 2022, the duration gap widened significantly.

We analyzed this phenomenon in a previous blog post that covered various historical periods. As the QT uncertainty and convexity volatility moderated recently, with one-month x 10-year swaption volatility dropping to 135 bps, the duration gap narrowed. The market currently implies the MSCI model’s projection for base speeds is in line with market expectation.

A reality check for our model’s MBS durations

Data on 30-year uniform MBS with a 3% coupon. Source: MSCI Agency MBS Model Suite, MSCI Two-Factor Interest Rate Model

Lack of historical data is a challenge for modeling 2023 prepayment

Prepayment in agency MBS relies heavily on historical data. There is very little prepayment-performance data drawn from periods when interest rates were high and most MBS were trading in the discount space. This is especially difficult as the current macroeconomic environment is complicated by a potential recession, uncertain inflation and a possible correction in housing prices. Assessing risk scenarios will inevitably involve extrapolating from limited historical data fitting.

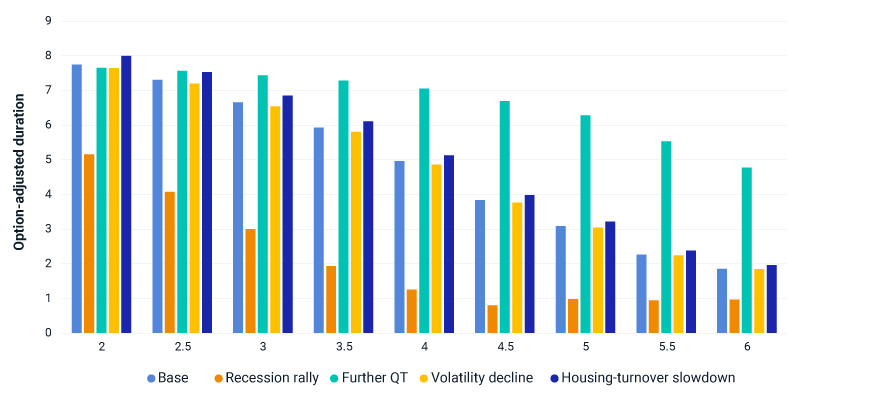

We ran four risk scenarios as potential agency-MBS themes for 2023. Investors may wish to run further and more granular analysis throughout 2023, navigating the uncharted territory.

- Recession rally: With a hypothetical 200-bp rally, duration could shorten significantly, especially for higher-coupon and newer originations. A rate rally could also alleviate the negative effect of high interest rates’ pressure on home sales, shortening the duration of out-of-money bonds.

- Further QT: If market tolerance and the economy in general hold up, the Fed could accelerate QT. We assume a 200-bp rate rise for this scenario. Bonds may extend significantly, especially those with higher coupons. The impact on lower coupons may be relatively small.

- Volatility decline: Currently volatility is about 40 bps higher than the previous average. Volatility could decline if the economy transitions smoothly to a new norm of high rates. The impact on durations could be mild. OAS could pick up 20 to 40 bps across the coupon stack, with 4s and 4.5s leading the advantage due to a higher drop in option cost.

- Housing-turnover slowdown: Although it’s hard to identify a bottom for housing turnover, it’s possible that existing-home sales may slow further in 2023 and beyond. In the event of a 40% slowdown for the next two years and reversion to normal in another year, OAS for lower coupons could fall by 5 bps and rise by about 4 bps for higher coupons, even though the duration impact is rather small, according to the MSCI Agency MBS Model Suite.

How option-adjusted durations could evolve under our scenarios

Data on 30-year agency uniform MBS from the to-be-announced market. Source: MSCI Agency MBS Model Suite, MSCI Two-factor Interest Rate Model

Navigating unknown waters

In summary, lack of historical prepayment-performance data led the market for agency MBS into the uncharted territory of this unprecedented discount environment. A historically calibrated MBS model, validated through the transition period in 2022, could help investors consider various stress scenarios and assess information embedded in market dynamics — and not rely solely on historical data.

Further Reading

MSCI Agency MBS Model Performance Review 2022

Managing Against MBS Indexes: A Duration Perspective

MSCI Agency Fixed Rate MBS Prepayment Model Version 2.0

A ‘Normal’ Choice of Interest-Rate Model for MBS