Sector Indexes hero banner

Sector Indexes

Expanding investors’ toolkit

Social Sharing

Sector Indexes Intro

Why do Sectors matter?

For decades, institutional investors have incorporated sector views in their investing strategy. Our research shows that many sectors have exhibited unique characteristics and return profiles regardless of their geographic location. In addition to their diversification potential, sector-based strategies may enable investors to target market segments that are aligned with their allocation views.

MSCI has developed a wide range of sector and industry indexes, across regions and countries, to support sector allocation decisions and to allow institutional investors to incorporate tactical views into their portfolios.

How did MSCI create a Sector classification framework?

Sectors are groups of stocks that share common characteristics in terms of the products or services they provide, but also in terms of business models and how they generate revenue. Sector classifications are non-overlapping so a company can only be assigned to one sector, allowing for a complete building block approach to an investment universe.

A broader sector categorization can then be further divided into sub-sectors or industries, which provides investors with additional information about the business models and activities of specific companies.

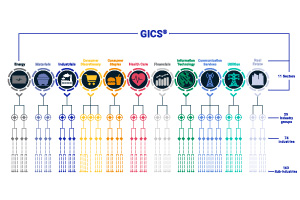

The Global Industry Classification Standard (GICS®)In 1999, MSCI and S&P Dow Jones Indices jointly developed the Global Industry Classification Standard (GICS), which continues to evolve today. This classification standard is an efficient tool that is designed to capture the depth, breadth and evolution of industry sectors and markets. It uses revenues as a key factor in determining a firm’s principal business activity.

|

Market Sectors over time

Interactive Assets

Select a date range:

Source: MSCI, as at December 2022.

Performance data net USD. Performance is measured from end of year until end of next year. For example, by selecting 2011-2012, it will calculate performance between December 31st, 2011 and December 31st, 2012, i.e. the performance for 2012.

The Real Estate sector was only established in 2016. Prior to 2016, data for the Real Estate sector was included in the Financials sector.

MSCI Sector Index Offering: Multi-Faceted and Extensive

Sector Index offering: multi-faceted and extensive

At the core of MSCI’s sector index offering lies the Global Industry Classification Standard (GICS®) that is applied consistently across regions, countries and asset types. Investors may select from a wide range of sector indexes designed to represent the performance of a variety of opportunity sets.

Our range of Sector Indexes

Our range of Sector indexes

Regional and Country Sector Indexes

The full GICS® framework encompasses 11 sectors, 25 industry groups, 74 industries and 163 sub-industries. The availability of industry and sub-industry indexes depends on the breadth and composition of country or regional economies.

If a specific sector or industry is not available in a specific market, investors can consider other regions or countries. It also can lead them to look deeper into their domestic market by including small caps.

Real Assets Indexes

These indexes target five categories of real assets: commodities, agriculture, timber, infrastructure, and real estate. These indexes are constructed by aggregating select GICS® sub-industries.

Cyclical/Defensive Indexes

MSCI’s Cyclical and Defensive Sectors Indexes are designed to track the performance of the opportunity set of global cyclical and defensive companies across various GICS® sectors.

To classify sectors as cyclical or defensive, we analyzed how each sector performed in expansion and contraction periods within the business cycle.

内嵌的应用

Related Indexes

- MSCI World Communication Services Index

- MSCI World Consumer Discretionary Index

- MSCI World Consumer Staples Index

- MSCI World Energy Index

- MSCI World Financials Index

- MSCI World Healthcare

- MSCI World Industrials Index

- MSCI World Information Technology Index

- MSCI World Materials Index

- MSCI World Real Estate Index

- MSCI World Utilities Index

- MSCI EM Communication Services Index

- MSCI Emerging Markets Consumer Discretionary Index

- MSCI Emerging Markets Consumer Staples Index

- MSCI Emerging Markets Energy Index

- MSCI Emerging Markets Financials Index

- MSCI Emerging Markets Healthcare Index

- MSCI Emerging Markets Industrials Index

- MSCI Emerging Markets Information Technology Index

- MSCI Emerging Markets Materials Index

- MSCI Emerging Markets Real Estate Index

- MSCI Emerging Markets Utilities Index

Related Indexes

Sector Indexes Featured Content

Featured content

The Regional Breakdown of Market Sectors Over Time

This infographic shows how the composition of the global stock market by sector and region has changed substantially from 2012 to 2022.

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Sector Performance and Concentration

How has sector concentration in equities changed over the past two decades? View our interactive global sector map.

Sector Indexes Related Content

Related content

Indexes

From foundational broad market to customized outcome indexes, our time-tested, globally consistent solutions power indexed strategies and products for investors.

Learn moreHarvesting Sector Beta through Broad Sector Indices

Many investors recognize that a broader mix of stocks, including both developed and emerging markets, and large, mid and small cap ("all cap") segments have provided return, risk, and diversification benefits compared with narrower portfolios.

Access reportSector Performance Across Business Cycles

We examine the co-movement of sector returns with business cycles in a global context, using long run historical data between 1976 and 2009.

Read moreSector investing in China

As the Chinese equity market has evolved, investors have faced new choices.

Read the blog