Factor indexes hero image

Factor indexes intro

A leader in factor indexing

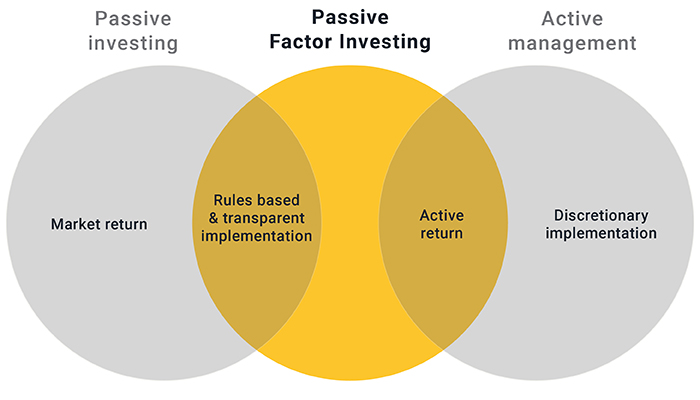

MSCI Factor Indexes are designed to capture the return of factors which have historically demonstrated excess market returns over the long run. These rules-based, transparent indexes target stocks with favorable factor characteristics – as backed by robust academic findings and empirical results – and are designed for simple implementation, replicability, and use for both traditional passive and active mandates.

Click on any of the factor icons below to learn more about the MSCI single factors:

|

|

|

|

|

|

Learn more about factors – view the MSCI Factor Investing Webinar Series.

Learn more about MSCI Factor ESG Indexes

Are factors too complicated?

Contact Us Button (Contact Sales)

Factor indexes

In addition to Single Factor Indexes we offer MSCI Multiple-Factor Indexes, which aim to give institutional investors a foundation for implementing multi-factor strategies transparently and efficiently. There are two key ways to gain multi-factor exposure:

- MSCI Diversified Multiple-Factor Indexes: Target outperformance while maintaining a risk profile similar to the parent index, using factor optimization.

- MSCI Factor Mix Indexes: Designed to represent the performance of equity in multiple factors, while benefiting from diversification and flexibility. The MSCI Factor Mix A-Series, MSCI Factor Mix A-Series Capped and MSCI Quality Mix (E-Series) are part of MSCI Factor Mix Indexes.

Applications

Our Factor Indexes can be used to support:

- Asset allocation: Adding a factor return component to portfolio strategies.

- Performance measurement and attribution: Benchmarks factor-driven performance of specific investment strategies, as well as defining factor-based stock universes.

- Research: A trusted source of data for sell-side research.

- Investment product development: May be licensed for use as the basis for structured products and other index-linked investment vehicles, such as ETFs and ETNs.

Additional Factor Indexes

- MSCI Diversified Multiple-Factor Indexes

- MSCI Factor Mix A-Series Indexes

- MSCI Dividend Masters Indexes

- MSCI Equal Weighted Indexes

- MSCI Factor Indexes

- MSCI High Dividend Yield

- MSCI Single Factor ESG Reduced Carbon Target Indexes

- MSCI Minimum Volatility Indexes

- MSCI Risk Weighted Indexes

- MSCI Select Value Momentum Blend Indexes

- MSCI Top 50 Dividend Indexes

- Índices MSCI Mexico Select Momentum Capped & Mexico Select Risk Weighted

- MSCI Dividend Points Indexes

ADDITIONAL INSIGHTS AND RESEARCH

Research

Factor Investing Basics

- Foundations of Factor Investing

Full Paper | Research Spotlight

Factor Investing

- Can Alpha be Captured by Risk Premia?

- Harvesting Risk Premia for Large Scale Portfolios

- Harvesting Risk Premia with Strategy Indexes

- Incorporating Risk Premia Mandates in a Strategic Allocation-A Case Study

- Portfolio of Risk Premia: a new approach to diversification

- Applications of Systematic Indexes in the Investment Process

- Factor Indexes in Perspective: Insights from 40 Years of Data Part I

- Factor Indexes in Perspective: Insights from 40 Years of Data Part II

Single Factor Investing

- Finding Value: Understanding Factor Investing

- Flight to Quality: Understanding Factor Investing

- Harvesting Equity Yield: Understanding Factor Investing

- Riding on Momentum: Understanding Factor Investing

- Constructing Low Volatility Strategies: Understanding Factor Investing

- One Size Does Not Fit All: Understanding Factor Investing

Multi-Factor Investing

HTML Displayer Portlet

MSCI Equity Factor Models

MSCI Equity Factor Models

Leverage factors like sustainability, crowding and machine learning for building more resilient portfolios as market conditions change.

Are factors too complicated?

Awards 2021

Awards 2021

Equity Factor Index Provider of the Year at Professional Pensions Investment Awards 2021

Interested in our Insights on Factors?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning factor research, industry events, and latest products.