Social Sharing

Extended Viewer

Unpacking COP28 Commitments to Renewable Energy and Energy Efficiency

Mar 4, 2024

At the United Nations Climate Change Conference (COP28) in Dubai in December 2023, 198 nations agreed on the world’s first global stocktake — a comprehensive assessment of global emissions reduction progress. The stocktake noted that more efforts are required to achieve the goals of the Paris Agreement and called on these nations to triple renewable-energy capacity and double energy-efficiency improvements by 2030.

In this paper, we outline opportunities by assessing the quality of renewable-energy and energy-efficiency technology patents held by constituents of the MSCI ACWI Investable Market Index (IMI). This analysis may help investors identify sectors and issuers that could be well positioned to leverage growth opportunities in these zero- and low-emitting technologies. In addition, we explore the current fuel mix and capacity targets of constituents of the utilities sector1 in the MSCI ACWI IMI to identify companies that have committed to increasing renewable-energy capacity by 2030. Our analysis of low-carbon patents, fuel mix and renewable-energy targets may help investors measure their portfolio exposure to opportunities in low-carbon technology.

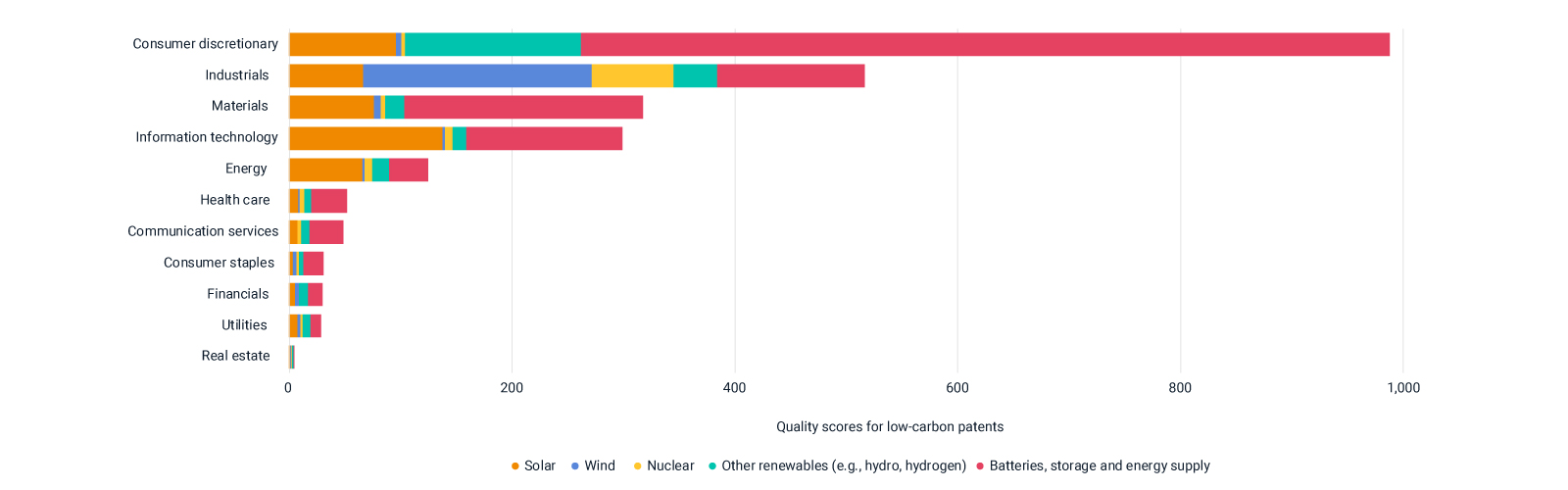

Analysis of renewable-energy- and energy-storage-patent quality

Notes: We analyzed the quality scores of low-carbon patents for constituents of the MSCI ACWI IMI across GICS sectors. We calculated the market-cap-weighted average of their low-carbon-patent scores. Data as of Jan. 5, 2024. Source: MSCI ESG Research

1. Sectors are defined according to the Global Industry Classification Standard (GICS®). GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Download Report

Research authors

- Kenji Watanabe, Vice President, MSCI Research

- Anthony Chan, Vice President, MSCI Research

- Kuldeep Yadav, Vice President, MSCI Research

- Siyao He, Senior Associate, MSCI Research

- Sylvain Vanston, Executive Director, MSCI Research

Related content

COP28: Key Takeaways for Investors from the Global Climate Summit

COP28 concluded with an agreement for countries to transition away from fossil fuels, marking a historic pivot away from the primary sources of energy that have powered society for nearly 200 years.

Read the reportCOP28: The Beginning of the End for Fossil Fuels?

While the media focused on the battle over the wording of the final agreement, there was actually a lot of progress that flew further under the radar, but may have a greater impact on investors.

Listen to the podcastThe Climate Transition Is Increasingly About Opportunity

Climate-friendly policies and regulations and the massive reallocation of capital needed in the coming years to ensure a successful shift to a net-zero economy should continue to expand the range of opportunities for both companies and investors.

Read the report