Social Sharing

Extended Viewer

How Have Tradable-Bond Indexes Helped Investors Position in the Credit Market?

Dec 13, 2024

MSCI MarketAxess Tradable Corporate Bond Indexes are constructed with their constituents’ relative liquidity in mind. This characteristic makes these indexes and their derivatives a suitable set of tools to implement different strategies across credit markets. For example, investors can use the ETFs and index funds tracking such tradable-bond indexes to replicate the underlying market-risk profile while benefiting from the higher liquidity of the underlying basket in the primary and secondary markets. Derivatives linked to tradable-bond indexes — e.g., index futures — can also be employed by portfolio managers to address challenges in fast implementation of credit strategies for managing an investment book and hedging.

Indexes of the most liquid bonds

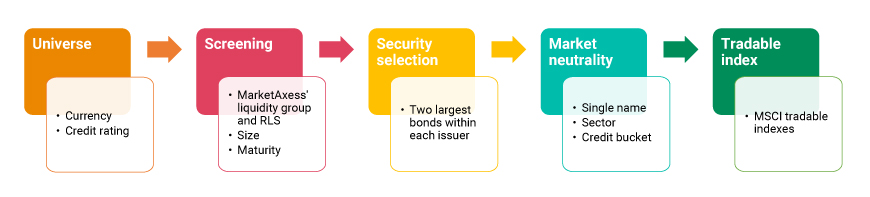

MSCI MarketAxess Tradable Corporate Bond Indexes consist of the most liquid subset of investment-grade (IG) and high-yield (HY) corporate bonds. Maintaining sector and credit-bucket allocations consistent with the underlying benchmark, these indexes allow investors to track the market while positioning in more-liquid securities. These characteristics may make tradable indexes, including MSCI MarketAxess Tradable Corporate Bond Indexes and their derivatives, suitable underlying in creation of investment and hedging instruments for credit-market investors.

MSCI MarketAxess indexes of tradable corporate bonds

Download report

Research authors

- Afsaneh Mastouri, Executive Director, MSCI Research

Related content

MSCI MarketAxess Tradable Corporate Bond Indexes Methodology

The MSCI MarketAxess Tradable Corporate Bond Indexes are designed to measure the performance of a selection of relatively liquid fixed income securities from the universe of corporate bonds defined by the underlying MSCI Corporate Bond Indexes.

Read the methodologyLiquidity Risk Monitor Reports

The MSCI Liquidity Risk Monitor is a quarterly report that demonstrates the development of several liquidity risk indicators over the previous 12 months.

Explore moreComparing Apples to Apples in Bond-Fund Liquidity

The SEC has proposed changes to standards for classifying the liquidity of fixed-income instruments held by open-end funds. The new approach may not pick up differences between funds and may not signal worsening liquidity amid market stress, however.

Read the blog post