Social Sharing

Extended Viewer

Enhancements to MSCI’s Fund ESG Ratings

Mar 24, 2023

Institutional investors that have a fiduciary duty to consider significant investment risks now often analyze the ESG characteristics of their funds’ investment profiles. Assessments of funds’ ESG characteristics can be an important input to the fund selection process, but to be useful for decision-making, assessments need to provide meaningful differentiation and a meaningful reflection of funds’ ESG exposures.

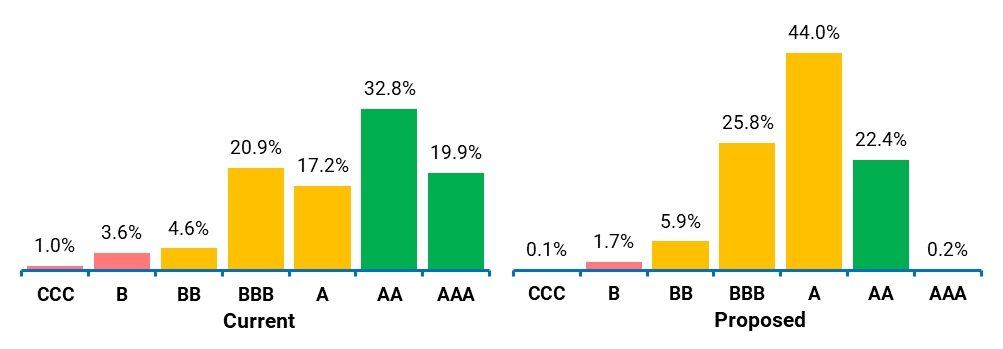

Changes to MSCI’s Fund ESG Ratings methodology aim to raise the requirements for a fund to be assessed as “AA” or “AAA” rated, improve stability in Fund ESG Ratings and add transparency through simpler attribution analysis. This means the distribution of the fund ratings will shift, and approximately 31,000 funds in our universe will see one-time downgrades as a result.

The methodology changes were driven by consultations with clients, based on market feedback and are not, as has been reported, linked to regulatory developments in the EU or elsewhere.

MSCI’s Fund ESG Ratings universe and methodology

Download report

Research authors

- Rumi Mahmood, Vice President, MSCI Sustainability Institute

Related content

MSCI ESG Ratings

ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks.

Learn moreUnderstanding MSCI’s Climate Metrics

With no “one fits all” solution, to help investors identify the most suitable climate metrics, we take an in-depth look at MSCI ESG Research’s climate metrics in terms of what they measure, how they are calculated and their potential use cases.

Read moreESG and Climate Funds in Focus

MSCI offers a focus on these funds to help investors understand the latest ESG trends and characteristics across more than 53,000 mutual funds and ETFs in our coverage universe.

Explore more