Social Sharing

Extended Viewer

Private Real Estate Valuation and Sale Price Comparison 2021

Jul 19, 2022

For mainstream financial asset classes, investment-performance measurement is based on transaction prices. In contrast, direct real estate is well known for being an illiquid and heterogeneous asset class, making the establishment of purely price-based indexes problematic.

Within these limits, valuation-based indexes aim to track actual agreed transaction prices as closely as possible. Therefore, it is of critical importance that users of these indexes can gauge how closely this goal has been achieved. For this reason, MSCI computes and discloses fair indicators comparing valuations and prices for assets that have come to the open market and transacted.

The latest annual report found that, in 2021:

- Sale sample increased during the post-COVID-19 recovery

- Weighted average absolute difference and weighted average difference between valuation and sale price increased higher than the 10-year average

- High sector deviation in average sale premium/discount was sustained

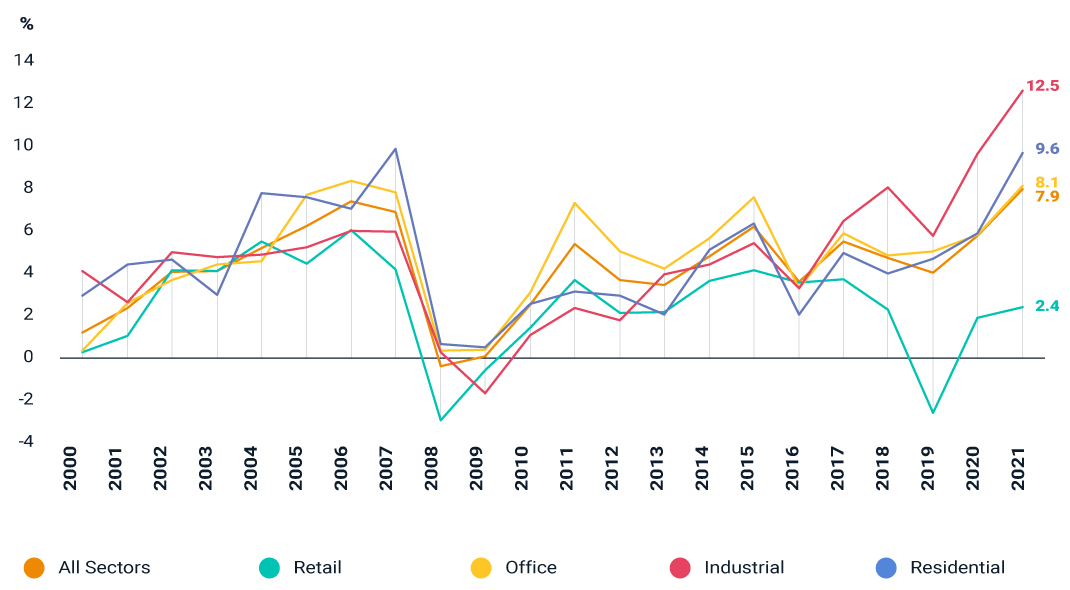

Weighted average difference by sector

Download Report

Research authors

- G Hariharan

- Vinay Kakka, Associate, MSCI Research

- Girish Walvekar, Vice President, MSCI Research

Related Content

Real Estate Market Size 2021/22

Investors may well have expected a decline in real estate pricing and an increase in distressed opportunities due to the economic impact of 2020’s global lockdowns. But the hit to pricing was mostly negligible, and the flood of distressed assets never came.

Explore MoreWhat Drove 2021 Real Estate Returns?

Industrial properties’ returns were strong in 2021. But within industrial, individual-asset performance was highly varied and widened the dispersion of returns.

Read More