Extended Viewer

Were Small Caps Immune to Concentration?

A few weeks ago, we looked at the historical and current concentration of a range of regional indexes and noted there had been an increase in concentration across the globe. But what about small-cap indexes, specifically?

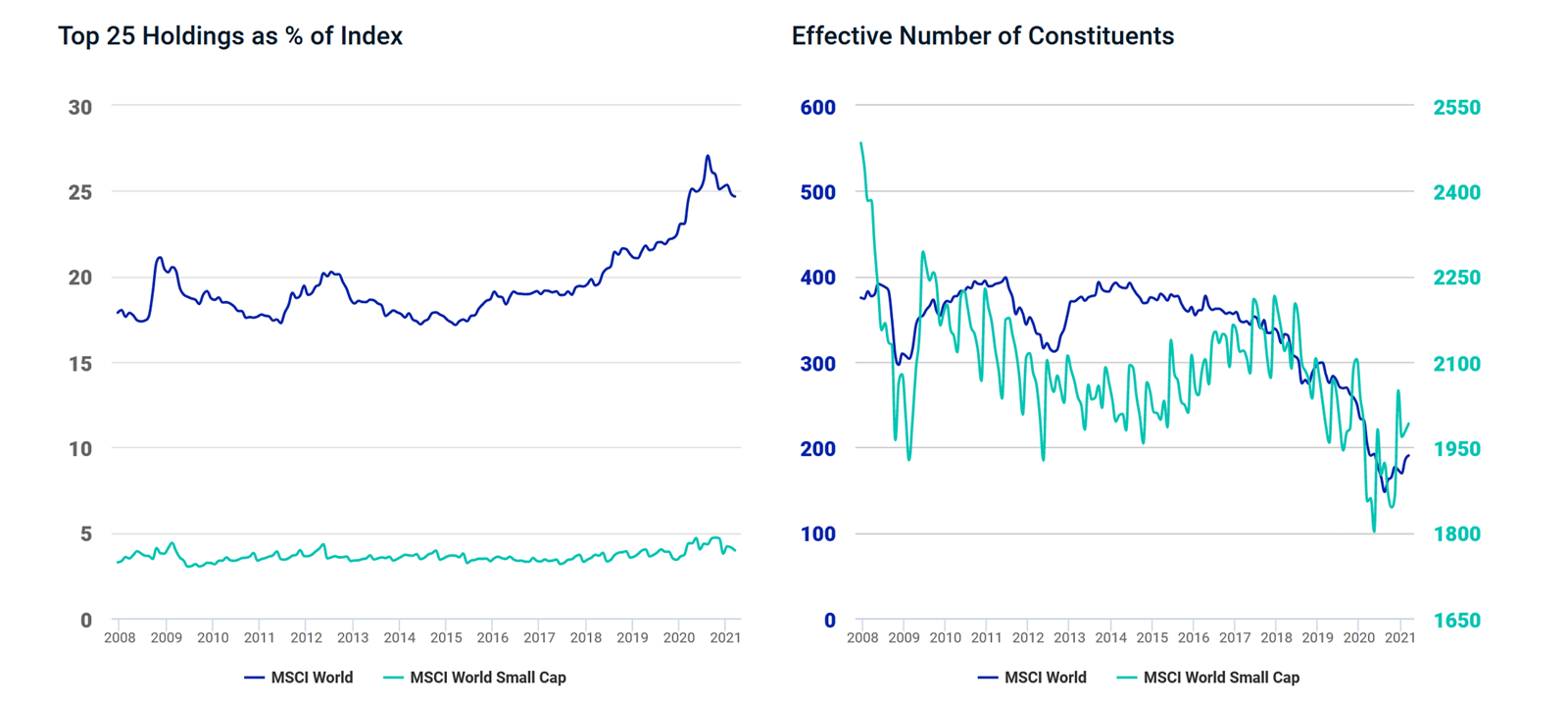

Looking again at the percentage of the largest companies in the index and the effective number of stocks, this time for the MSCI World and MSCI World Small Cap Indexes, we can see in the charts below that both measures indicated a higher level of concentration for MSCI World compared to MSCI Small Cap. As a recap, the effective number of stocks indicates how many stocks are “effectively” driving an index vs. the total number of index constituents. The bigger the difference between the effective number and the number of index constituents, the more concentrated the index.

For the period in review, the MSCI World Small Cap Index had an average of 3,464 constituents, while the effective number was 1,744 (just over half of the average). The MSCI World Index, on the other hand, had an average of 1,646 constituents and an effective number of 319.

Regardless of location, when an index is more concentrated, its performance and risk will be dominated by a smaller number of names.

Were Small Caps Immune to Concentration?

Related Content

Global Investing Trends to Watch

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Explore MoreRisk and Volatility in Small Caps

We recently looked at small caps through the lens of historical performance during economic recovery. To complement that analysis, we look at total risk or volatility.

Learn MoreSmall Caps’ revenue exposure and the global recovery

The volume of world merchandise trade fell by 5.3% in 2020, while travel services were down by 63%, according to estimates by the World Trade Organization (WTO).

Read More